China Growth - Curb Your Enthusiasm?

06 March 2023

Read Time 2 MIN

China Rebound

China’s growth expectations for 2023 are now the highest in 12 months (5.3%), but further upgrades might be less forthcoming after the surprisingly conservative growth target (around 5%) set up by the National People’s Congress (NPC) over the weekend. As regards the policy framework to achieve the target, some aspects look comparable to the last year’s numbers (the adjusted budget deficit, local government special bond quota – also with adjustments). The NPC reemphasized support for domestic demand, the housing sector, and private companies. But it’s clear that authorities do not want to overstimulate the economy – anything related to the pandemic-related rise in leverage perhaps?

EM Growth

China’s growth rebounding to 5%+ this year is still good news for many emerging markets (EM), which are arguably less correlated with risks like higher U.S. policy rates. And this includes positive growth spillovers, which we expect to be reflected in the updated GDP forecasts published by the IMF around the Spring Meetings in April. In the meantime, the consensus projections keep improving. The share of positive growth revisions in the Bloomberg consensus survey (101 countries) rose to 30% from 8% in December, and the share of large growth downgrades dropped from 50% to 7% over the same period. The composite EM PMI (Purchasing Managers Index) is now well in expansion zone, and the PMI momentum in most EMs showed improvement in the past 3 months – potentially positive signals for carry trades and sovereign spreads.

EM Disinflation

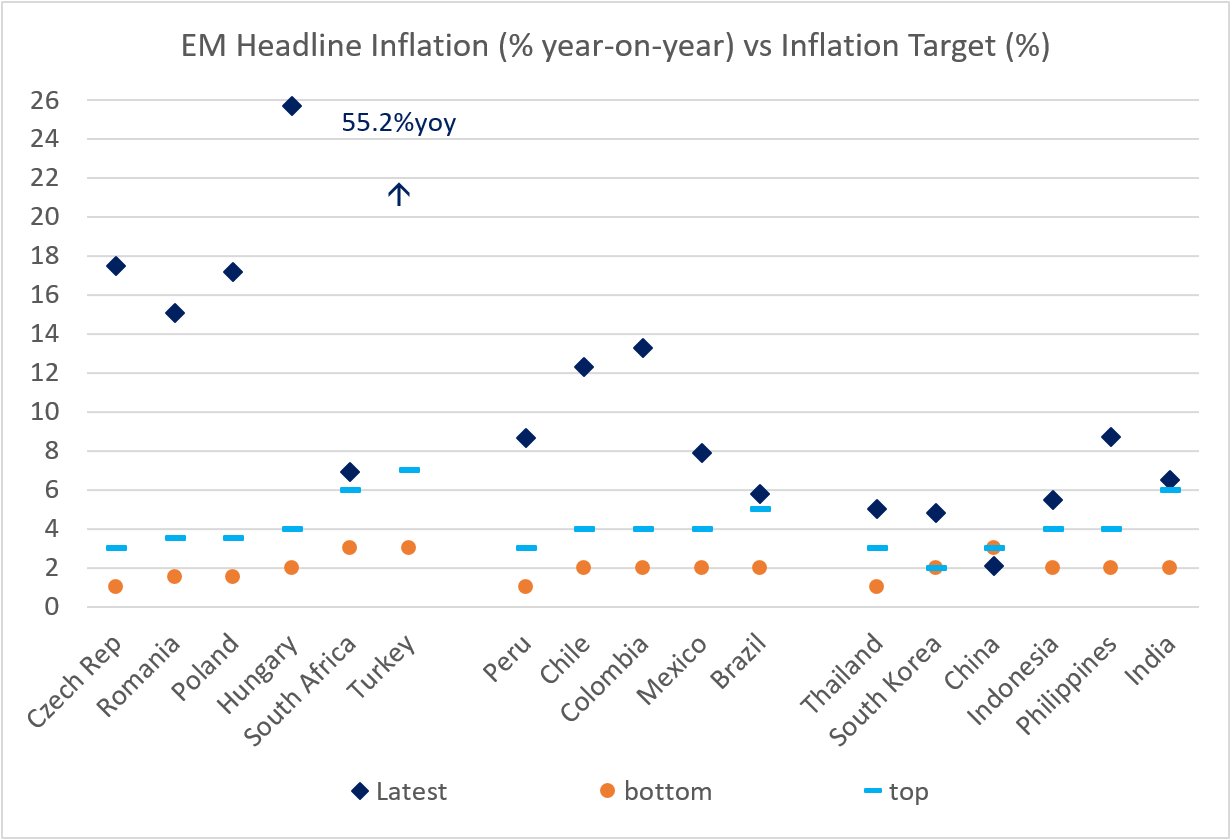

Chinese authorities’ measured approach to policy stimulus might also lower a risk of “runaway” inflation pressures that plagued China’s EM peers in the past year and a half – albeit we remain vigilant. China is currently the only major EM, where headline inflation is below the target (see chart below). However, “revenge” spending could be a powerful inflation driver, pushing peak core inflation higher and making it stickier than expected – even in EM’s disinflation poster kids, like Brazil. This week brings a big inflation data dump in EM, including Mexico, Brazil, the Philippines, Thailand, Hungary – and China. Are we going to get another “underwhelming” China’s surprise? Stay tuned!

Chart at a Glance: EM Inflation Still Far From Official Targets – Except in China

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.