Market Sees Few EM Rate Cuts – Why?

03 March 2023

Read Time 2 MIN

Hawkish Fed

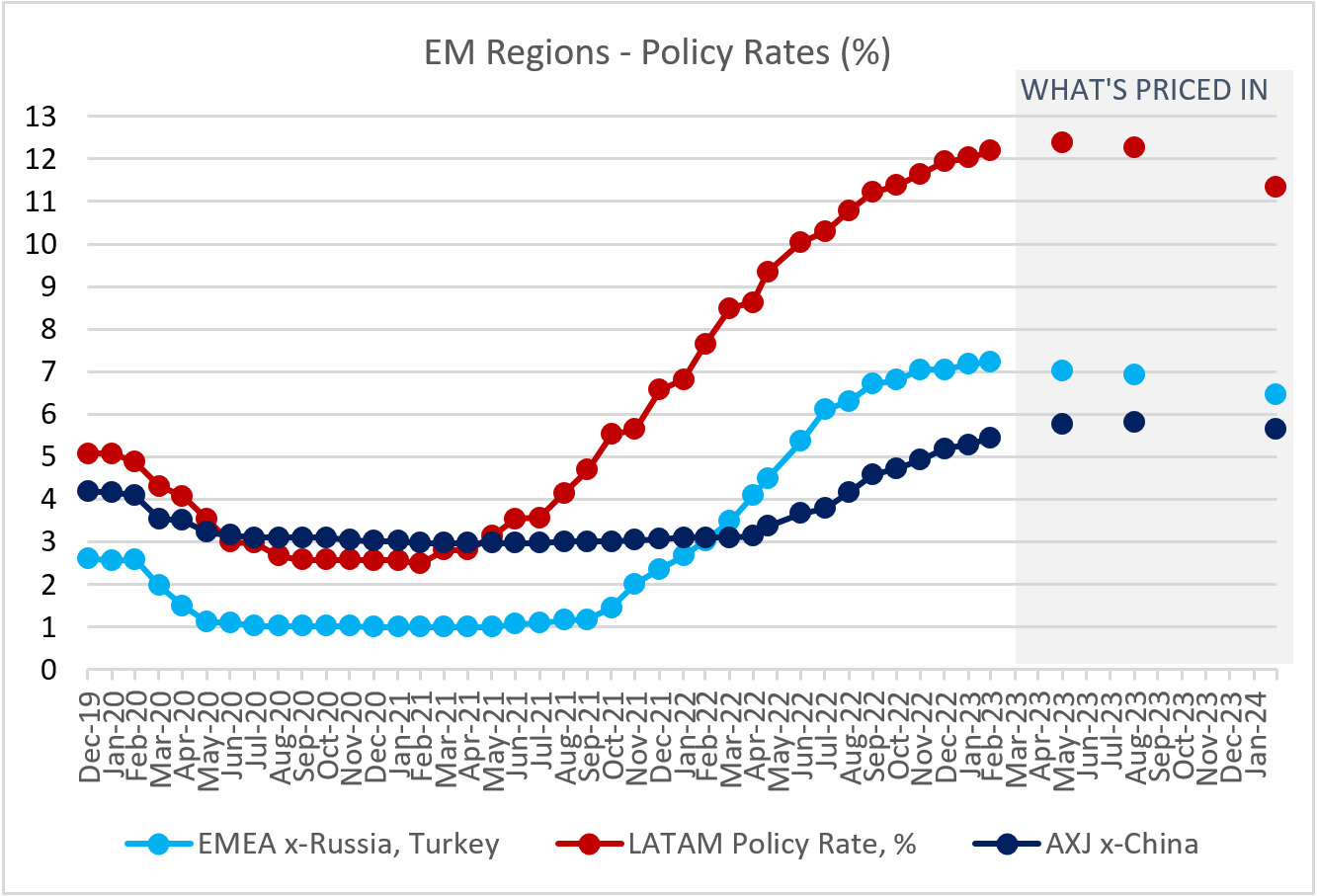

Headline inflation had peaked in most emerging markets (EM) by now, but the market expectations for EM rate cuts over the next 12 months look quite “stingy” in most regions (see chart below). Further, some analysts are now talking about the need for “insurance” rate hikes in some EMs. These include South Korea (the local swap curve prices in +40bps more), India (the market sees another 52bps in the current cycle) and South Africa (50bps more or so). Two major LATAM economies are also on the list – Mexico (+60bps more) and Colombia (+75bps more). An easy explanation is that EMs feel obliged to follow the U.S. Federal Reserve (Fed) – a more robust 2023 growth outlook and a series of upside inflation surprises pushed the U.S. peak rate forecast to 5.4-5.5% recently. Well, this might be the case in Mexico (a “nearshoring” argument), but we think local factors play a more important role elsewhere.

Brazil Fiscal Outlook

Brazil is EM’s poster kid for successful disinflation (from 12.13% year-on-year to 5.77% in nine months). However, the fiscal policy uncertainty and new administration’s attempts to “convince” the central bank to lower the policy rate (in order to prop up growth) put the market (and the central bank) on the defensive. As of this morning, the local swap curve priced in only 95bps of rate cuts during the rest of the year. It is important to keep an eye on the new fiscal framework – the draft is expected to be finalized over the weekend – and what it means for the spending cap. The consensus sees the budget deficit widening from 4.7% of GDP in 2022 to 7.8% of GDP this year. But if the new framework looks credible, the market should see more room for policy easing before the year-end.

EM Policy Easing

One (local) reason behind various EM central banks’ caution is that underlying price pressures are often more persistent than headline, and core disinflation can take more time (a reflection of tight labor markets, for example). Central banks are also mindful of subsidy withdrawals, which is a good sign for the fiscal outlook but could result in “bumpy” disinflation progress. We do not see major problems with EM central banks’ cautious stance – especially if the growth outlook continues to improve at the margin. This combo provides a supportive backdrop for carry trades – additional Fed rate hikes notwithstanding – and leaves room for rates compression if disinflation progresses as expected (or faster). Stay tuned!

Chart at a Glance: EM Rate Cuts – Not Much Priced In

Source: VanEck Research; Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.