China’s Trade Surplus… To the Moon!

08 August 2022

Read Time 2 MIN

Summary

China’s large trade surpluses are growth- and currency-positive – all other things equal, of course.

China’s External Surpluses

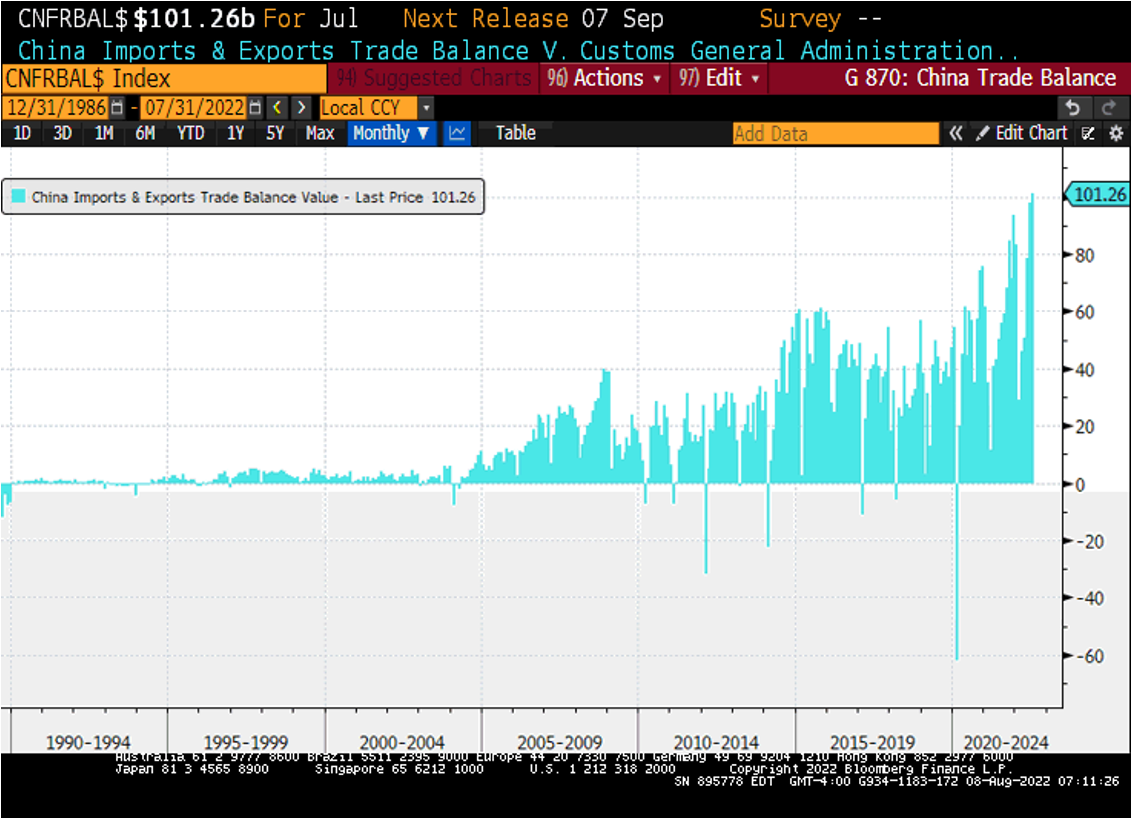

China’s trade surplus topped USD100B in July – a historic record for a month (see chart below). What are the main takeaways? First, such a large trade surplus is growth-positive at the margin – an important consideration when other growth drivers (such as household consumption) are still soft, and the consensus growth forecast for 2022 has been cut below 4%. The contribution of net exports to China’s real GDP growth surged above 20% in 2020-21 – not a negligible amount. And this also suggests that authorities will continue to be super-conservative with any additional policy stimulus (on top of the infrastructure plan), focusing on specific sectors and specific issues (real estate). As regards the stimulus timeline, we would expect to see a lot of frontloading – forthcoming credit and money aggregates for July should provide more color (and evidence that this is indeed the case).

Global Growth Outlook

The second takeaway from China’s foreign trade numbers is that exports growth remains solid (up by 18% year-on-year), suggesting that the global supply chain disruptions might be easing (especially in Europe and Asia) and that the global growth backdrop might not be as dismal as news headlines suggest (I saw a couple of “Schroedinger’s recession” comments in my inbox this morning). Indeed, the latest labor report in the U.S. was quite upbeat, strengthened the market’s conviction about another large rate hike in September – the Fed Funds Futures currently price in +69.6bps vs. +56.6bps on August 1.

China’s Currency Depreciation

The last takeaway is that larger trade surpluses can translate into large(r) current account surpluses, which is one of the key fundamental drivers for the currency. Granted, there are other equally important factors – interest rate differentials (5-year yield differential between China’s government bonds and U.S. Treasuries is still negative and close to the widest – negative – point in years), foreign direct investments (down in Q2), portfolio inflows (we do not have the actual Q2 number yet, but most likely outflows – just as they were in Q1). But larger current account surpluses can partially compensate for these negatives, reducing the depreciation pressure on the renminbi and stabilizing the currency. Stay tuned!

Chart at a Glance: China Trade Surplus – Historic High Gets Higher

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.