Will These Tech Stock Valuations Last?

10 February 2020

Read Time 3 MIN

Despite the coronavirus concerns that have hit commodity markets and, in turn, energy and basic materials stocks, U.S. tech stocks have posted strong returns to start the year. This continues their impressive streak from 2019. But are the current tech valuations sustainable?

In a recent market note, Brian Colello, Director of Technology, Media and Telecom Equity Research at Morningstar, noted that the median tech stock was 11% overvalued as of January 30. This was one of the highest price/fair value ratios since 2007, according to Colello. Certain sub-industries within tech are more overvalued than others, but a strong fourth quarter and January have erased some discounts to fair value, particularly in semiconductor stocks, which Morningstar viewed as undervalued through much of 2019.

Software companies Microsoft (MSFT) and ServiceNow (NOW), both VanEck Vectors Morningstar Wide Moat ETF (MOAT) holdings, have had their fair value estimate raised in recent weeks following strong quarterly results. Other companies that appeared attractive in 2019 have rallied, leaving the tech sector one to keep an eye on as the impact of the coronavirus on markets becomes known. Colello noted that some tech companies have provided wider bands of revenue guidance, but there is no clear-cut impact to upcoming earnings at this point.

MOAT’s underlying index, Morningstar Wide Moat Focus Index (“Moat Index”), remains underweight tech stocks due to its focus on valuations. Its underexposure benefited the strategy during the trade war-induced selloff in the fourth quarter of 2018. The Moat Index currently maintains overweights to the application software and semiconductor sub-industries within tech. Morningstar will reassess company valuations in March.

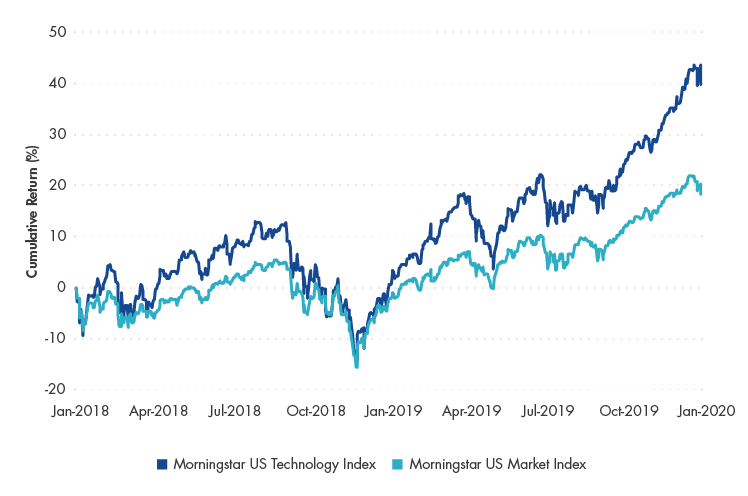

Tech Stocks Have Taken Off Since June

Source: Morningstar. Data 1/31/2018 – 1/31/2020. Past performance is no guarantee of future results. For illustrative purposes only.

Healthcare Stocks in Focus: No Major Overhaul Expected

The top sector overweight in the Moat Index remains healthcare, despite a slight decrease in weighting over the last few quarters. Despite solid sector fundamentals, U.S. healthcare stocks underperformed the U.S. market through 2019, driven largely by political rhetoric feeding fears around potential healthcare policy changes.

Damien Conover, Director of Healthcare Equity Research at Morningstar, noted in January that their healthcare coverage universe was slightly overvalued, with the median price/fair value estimate at a 5% premium to fair value. He added that these elevated valuations are being driven by certain sub-industries, such as devices and diagnostics, where some investors are turning in order to maintain some healthcare exposure while avoiding areas more impacted by policy uncertainty, such as pharmaceuticals. One fallout from the potential structural and policy changes in healthcare was the 2019 downgrade of many companies involved in pharmaceutical distribution.

Conover noted that pockets of undervalued stocks within the sector exist. Drug and biotech industries present the most potential in this regard, due to market fears over potential policy limits on drug pricing power. Morningstar views these fears as overblown. According to Morningstar, growth in net drug prices (the price paid after discounts) has decelerated to below inflation, leaving Morningstar to view drug pricing as less of a problem. Therefore, even though some form of U.S. policy reform is probable, Morningstar does not believe a major overhaul is likely.

MOAT offers exposure to the pharmaceutical and biotech industries by holding wide moat stocks Bristol-Myers Squibb (BMY), Pfizer (PFE), Merk & Co (MRK), Biogen (BIIB), Gilead Sciences (GILD) and Amgen (AMGN).

Related Insights

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Insights

31 December 2024