Investment Outlook: Time to Hedge Against Central Bank Uncertainty?

07 October 2019

Read Time 5 MIN

October 07, 2019

October 07, 2019

Investment Outlook: Time to Hedge Against Central Bank Uncertainty?

CEO Jan van Eck discusses his investment outlook for the remainder of the year and into 2020. Following the surge in negative-yielding debt, we believe investors should consider how they hedge against central bank uncertainty and avoid being too conservative in fixed income. Watch Video

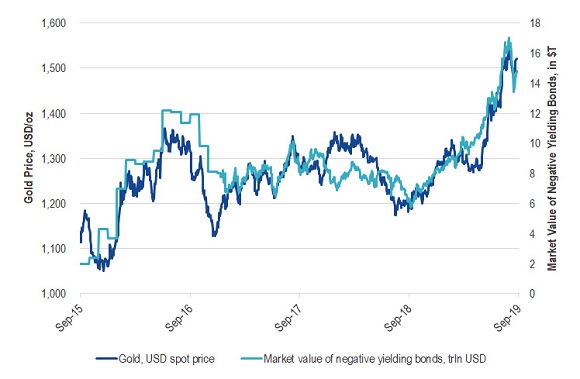

Negative Interest Rates Fuel Gold Breakout

The biggest event in the markets this past summer was the surge in negative-yielding debt to $14 trillion.1 Already, this has led to some excitement in alternative assets, with gold breaking through a very strong technical six-year mark around the same time. I think this is the time for investors to look at how they hedge against central bank uncertainty through the end of this year and into 2020.

The first dimension supporting gold is just that low rates make gold look attractive. High interest rate environments tend to be tough for gold as gold does not pay any yield, but against negative interest rates, gold looks much more attractive.

Negative Yielding Bonds and Gold

Source: Bloomberg. Data as of September 23, 2019.

The second dimension supporting gold is the concern about whether central banks have lost their power to stimulate the economy. Despite moves by the European Central Bank to stimulate the European economy over the past several years, Europe continues to slow down and is probably the weakest region in the world. If Europe is caught in a trap and central banks have lost their power, then concern about huge debt levels may drive investors to gold. Interestingly, other central banks, like Russia and China, have been big buyers of gold recently. Maybe they are worried, too.

Are the Strong Inflows to Bond Funds Driven by Fear or Greed?

My biggest concern is that investors are becoming excessively conservative in their fixed income portfolios, driven by fears of the trade war and global recession. As I mentioned in my last outlook, many investors have been too focused on short-term and high quality fixed income. The tendency is for investors—if they fear that lower interest rates may mean a global recession is coming—to go to short-term bonds and money market funds. However, this gives them very low yields, and I think this approach is a mistake in the current environment. In my view, slow but steady growth in China suggests that we are not headed for a global recession, so I am not sure that there should be any concern about a normal credit allocation.

China has continued to be relatively constrained on the monetary policy front, and we believe the central bank does not intend to flood the system with cheap credit. While this may lead to lower growth, we believe the growth will be both more stable and of higher quality. Ultimately, I think that’s good for fixed income investors. For more insights on China, see our regular updates on China’s economic growth.

Emerging markets debt is one asset class that I think became more appealing this summer. Last year, it offered attractive yields and valuations, and towards the end of 2018, presented an opportunity to diversify against U.S. stocks. We now actually have several positive stories to highlight. Brazil, a major leader in South America, has been implementing pro-growth reforms, and India, surprisingly, has just announced big corporate tax cuts, which I believe are going to be very stimulative for its economy. In addition to the value story we saw in emerging markets debt heading into 2019, I think that now we are also seeing positive and exciting economic reforms that have the potential to fuel this asset class.

Ignore Politics in Your Portfolio

The trade war between the U.S. and China was in the headlines this summer and will probably continue to be in the headlines. My strong feeling in response to that is: ignore politics in your portfolio.

One long-standing truth I learned when I came into the industry over two decades ago was that you cannot anticipate political events. We learned that lesson over and over this summer. What President Donald Trump is going to tweet around the trade war is unpredictable. Everyone in the market was surprised by how the election in Argentina turned out. And then there was the military attack on the Saudi Arabian oil facility. I don’t believe that investors can guide their portfolios around these political events.

Happy investing!

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.