Is Your Rate Hike “Club” Cool or Not?

13 July 2022

Read Time 2 MIN

Higher Inflation, More Rate Hikes in the U.S.

The “+75bps club” is all the rage now – especially after today’s inflation print in the U.S. (above-consensus 9.1% year-on-year) reaffirmed the market expectation of a 75bps hike in July. But being a member of the “+50bps club” can be cool as well – with some conditions, though. South Korea’s decision to step up the pace of tightening to 50bps was universally lauded as a credible policy move in response to persistent price pressures (annual headline inflation accelerated to 6% in June – high but not “runaway” high). In the developed markets (DM) world, New Zealand maintained the pace of tightening with another 50bps rate increase. And back in emerging markets (EM), Brazil is expected to do the same (+50bps) in August, as inflation is showing signs of plateauing/peaking. The local swap curve, however, added extra 25bps for the rest of the year following a series of hawkish comments from the central bank.

When a 50bps Rate Hike Is Not Enough

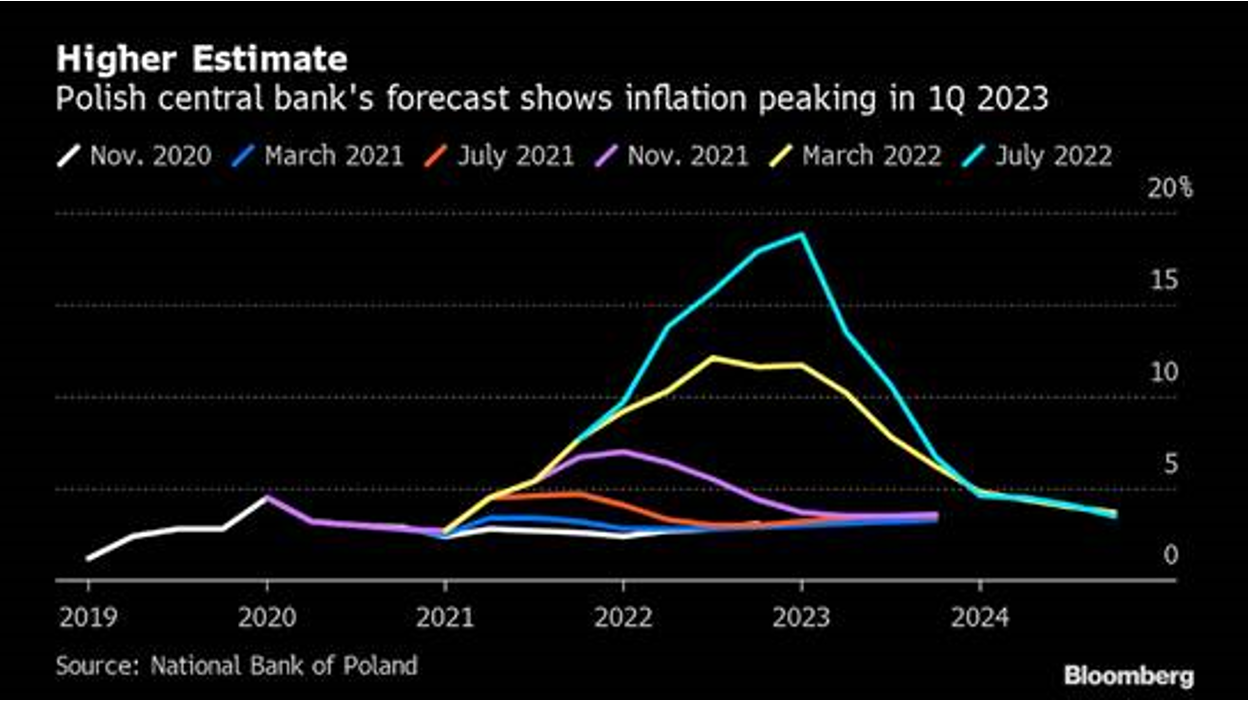

The consensus still sees a 50bps rate hike in Chile later today, but the market might be disappointed if this actually happens – the weaker currency (the Chilean peso breached an important 1,000/U.S. dollar level this week), concerns about tax reform/copper prices, and double-digit inflation argue for a larger +75/+100bps policy move. Poland is another not-so-cool member of the “50bps club”. The latest rate hike was smaller than expected, and the updated central bank inflation projections raise even more questions about its response function. The chart below screams “inflation capitulation”, but Governor Adam Glapinski is still talking about the tightening cycle’s peak. Poland’s new – delayed – inflation peak of around 18% is not that far from the latest 17.2% year-on-year inflation print in the Czech Republic. It is 2.2% higher than the central bank’s forecast and light years away from the 1-3% inflation target. Meanwhile, Czech interest rate swaps price in no additional tightening in 3m after June’s super-sized “goodbye” hike.

China Growth and Policy Easing

Some emerging markets are in a class of their own – like China. China is definitely not tightening – the question is how much more additional easing it needs to do, given that domestic activity started to show signs of life. It is true that imports looked very weak in June (up by mere 1% year-on-year), but this number reflects shipments before the easing of some COVID restrictions. The same logic might apply to June’s industrial production, retails sales and investments that should be released tomorrow. China’s activity should look better in August, but would this be enough to narrow the gap between the 4.1% 2022 growth forecast and the official growth target of about 5.5%? Stay tuned!

Chart at a Glance: EMEA Inflation – (Much) Higher and Later Peak in Poland

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.