How Much Policy Room Is Left?

18 October 2022

Read Time 2 MIN

China Fiscal Stimulus

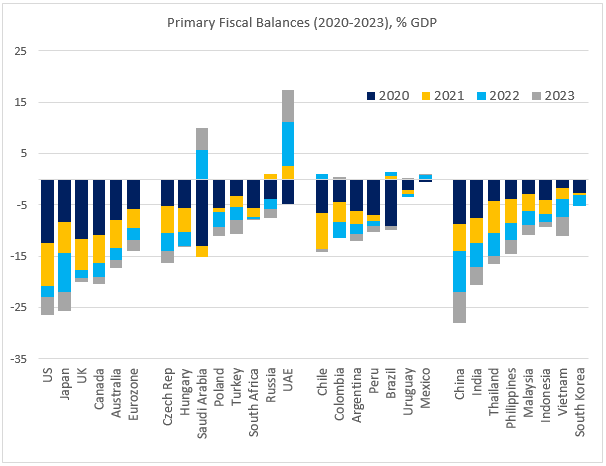

Today is a pretty “light” day data-wise, which might explain why there is so much focus on a delay in China’s activity and foreign trade numbers – presumably due to the timing of the 20th Communist Party Congress. Anyway, while leaders and officials are busy thinking about the country’s development path for the next few years, the IMF’s Fiscal Monitor raises more immediate questions about the extent of China’s fiscal stimulus during the pandemic, and how much policy room China may still have in this area going forward. China’s stimulus might have been targeted – as opposed to the “wall of liquidity” approach in major developed markets (DM) – but these small measures can still add up. The IMF projections shows that China will run the largest primary deficit (as % of GDP) among major emerging and developed markets both in 2022 and 2023 (see chart below). China is also among a handful of economies where primary deficit is set to widen in 2022 – and this widening (again, as % of GDP) is the second largest after Russia (which is financing the war in Ukraine).

China Growth Slowdown

China has so far been reluctant to use monetary policy space – the rate cuts were tiny and the 1-year medium-term lending facility rate was kept on hold last week. Further, China’s interbank rates are already quite low, so it is not clear whether additional rate cuts would make a difference. Finally, China’s falling interest rates worsen the differential with the U.S. – the 5-year differential is now very negative (-171bps) – putting additional pressure on the currency, and creating more policy challenges for the central bank. As regards domestic activity, the strongest headwinds are related to housing sector instability and the zero-COVID approach, and we hope to get more clarity on these issues once the party congress is over.

Global Rate Hikes

China is not the only economy, where market participants question the available policy space – the recent policy U-turns in the U.K. is a fascinating (and scary) example. Major central banks, however, continue to sound hawkish – recession concerns notwithstanding – supporting the market expectations of large rate hikes in the next month or two. Swap curves price in the terminal rates of about 5% in the U.S. and the U.K., and above 3% in the Eurozone. In emerging markets (EM), this week’s focus will be on Turkey – which is expected to cut the policy rate once again (to 11%, with inflation climbing to 83.5%), testing the market’s patience and authorities’ ability to rely on macroprudential measures in the run up to the elections. Stay tuned!

Chart at a Glance: Fiscal Deficits During and After Pandemic

Source: IMF Fiscal Monitor, October 2022.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.