EM Bonds - Place Your Bets

13 April 2023

Read Time 2 MIN

EM Bonds Performance

The latest IMF projections show that the growth differential between emerging and developed economies should improve noticeably in favor of EMs in 2023 - an additional factor supporting the outlook for the asset class this year. However, EM is not a monolith, and while the market looks with amazement at super-tight sovereign spreads of “EM Graduates,” some lower-income EMs appear more distressed. As the debt restructuring drumbeat is getting stronger, many participants were unhappy about the slow progress in the common framework, especially as regards China’s role and the involvement of private creditors. China might be in a unique position to push things ahead. Still, the recent change of leadership and some institutional features inside China can make it more difficult to follow in the Paris Club's footsteps. Geopolitical tensions involving China create an extra layer of uncertainty that can lead to further delays.

EM Structural Reforms

These issues define a broader context for discussions about structural reforms in EM, including fiscal adjustment. Everybody agrees that exceptional fiscal support during the pandemic was fully justified. Still, now governments have to balance disinflation and financial stability with the need to continue protecting the most vulnerable, especially in low-income countries. Some participants pointed out that aggressive fiscal consolidation in countries with high debt levels might have an offsetting negative impact on GDP, delaying their progress in meeting the UN’s sustainable development goals.

Turkey Elections

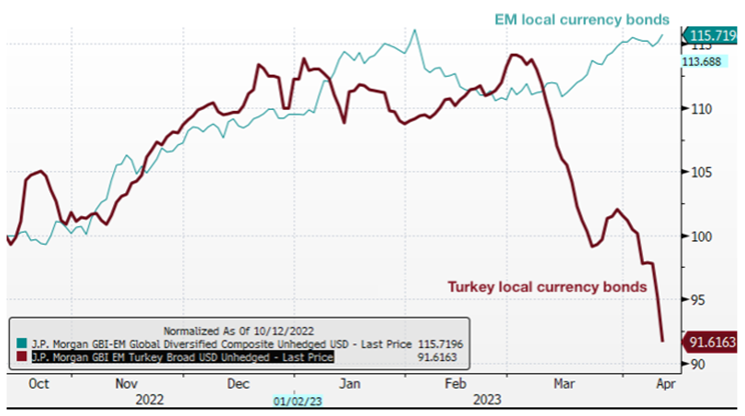

One country that has attracted a lot of attention this year is Turkey. Turkey is heading for the elections in exactly one month. The local bond rout (see chart below) signals that the market prices in (1) a normalization of the policy rate after the elections, and (2) the central bank having less firepower to support the local bond market, given the need to defend the exchange rate. Investors expect a lot of noise and volatility immediately after the elections, while the new team is put in place and some macro-prudential regulations potentially lifted. Deputy Portfolio Manager David Austerweil visited Turkey recently. He believes that the elections will majorly impact the debt market and that long-dated low-dollar price sovereign bonds look the most attractive given the balance of risks. Stay tuned!

Chart at a Glance: Turkey Pre-Election Signals - Things Need To Change*

Source: Bloomberg LP

*J.P. Morgan GBI-EM Global Diversified Composite Unhedged USD Index – Comprehensive emerging market debt benchmark that track local currency bonds issued by Emerging market governments, denominated in U.S. dollars without any currency hedging.

**J.P. Morgan GBI-EM Turkey Broad USD Unhedged Index – Tracks the performance of a diversified range of local currency government bonds issued by Turkey, denominated in U.S. dollars without any currency hedging.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.