VanEck Mid-February 2025 Bitcoin ChainCheck

20 February 2025

Read Time 10+ MIN

Please note that VanEck has exposure to bitcoin.

Three key takeaways for mid-January – mid-February:

- Washington Reverse Course on Crypto: The U.S. government is pivoting toward a more pro-crypto stance, with new legislative efforts, SEC regulatory shifts, and Bitcoin reserve discussions at the White House reinforcing Bitcoin’s legitimacy.

- State Bitcoin Treasuries Gain Momentum, 'Frontrunning’ the Fed: State legislators are rapidly proposing strategic Bitcoin reserves, positioning themselves ahead of federal discussions on a Strategic Bitcoin Reserve (SBR). To quantify the potential impact, we published the Bitcoin Reserve Tool, which helps model Bitcoin’s potential role in U.S. monetary policy.

- Miners Expand Capacity, Accelerate AI/HPC Pivot: The 13 miners we cover are on track for a 42% CAGR in energized capacity, with increasing commitments to AI/HPC expansion. As AI energy demand surges, large-scale miners are positioning themselves as emerging AI/HPC infrastructure providers.

- Bitcoin Price Action

- Bitcoin Treasury Adoption

- Bitcoin Miners

- Bitcoin’s Network Activity, Adoption, and Fees

- Bitcoin ChainCheck Monthly Dashboard

Chart of the Month

Relative Unrealized Profit (RUP) Indicators Have Cooled In 2025, Suggesting an Accumulation Opportunity

Source: Glassnode as of 02/18/2025. Not intended as a recommendation to buy or sell any securities mentioned herein. Past performance is no guarantee of future results.

Context: In our November ChainCheck, we analyzed the relationship between Bitcoin’s Relative Unrealized Profits (RUP) and forward-looking returns. RUP measures the proportion of Bitcoin’s market cap represented by unrealized gains—profits that exist on paper but have not yet been realized through selling.

Insight: Historically, Bitcoin’s strongest short- to medium-term returns (7-day to 180-day) have occurred when RUP’s 30-day moving average (30 DMA) ranged between 0.60 and 0.70—high but not yet overheated. Today, RUP sits at ~0.55, having never exceeded 0.62 since November. Given the short-lived duration of this indicator so far this cycle, we believe today’s reading suggests another accumulation opportunity before a potential market cycle top.

Bitcoin’s Price Action

Market sentiment: Bitcoin is once again in a period of low volatility, with price trading sideways (-2 %) month-over-month. Despite Bitcoin’s price trading sideways, Bitcoin dominance is up 6% month-over-month as altcoins continue to bleed, firmly negating the budding alt season we highlighted in December. This disconnect between Bitcoin and altcoins has led to a dismal market sentiment; while the bullish U.S. regulatory backdrop has allowed Bitcoin to sustain its prices near all-time highs, altcoins have suffered from continued dispersion, most notably as meme coin mania continues. The most recent escalation of this “memecoin” carnage was through the fake Argentine cryptocurrency LIBRA, which was falsely touted by President Javier Milei’s social media.

While damaging, we believe this sort of rampant market behavior invariably highlights Bitcoin’s distinguished position among cryptocurrencies.

Like our call in September, we believe this period of low volatility will end with a Bitcoin breakout to the upside. We also expect altcoin season to resume, reversing Bitcoin’s recent dominance uptrend. However, this will be a token-picker’s market. With far more altcoins available in 2025 than in prior cycles (2016–2017, 2020–2021), we do not expect a rising tide to lift all boats equally.

In anticipation of an upside catalyst, we examine the latest policy developments.

Policy Updates: President Trump appears determined to fulfill his campaign promise to make the U.S. “the Crypto Capital of the World,” taking aggressive steps to reverse the federal government’s prior anti-crypto stance. This is playing out across several legislative, judicial, and executive actions. The House Committee on Financial Services recently held a hearing on "Operation Choke Point 2.0: The Biden Administration’s Efforts to Put Crypto in the Crosshairs," investigating allegations that crypto businesses and individuals were systematically debanked starting in 2021. If confirmed, these actions may have contributed to the collapse of crypto-friendly banks such as Signature Bank and Silvergate.

In late January, SEC Acting Chairman Mark Uyeda announced the formation of a Crypto Task Force to establish a clear regulatory framework for digital assets. Led by SEC Commissioner Hester Peirce, the Task Force signals a shift away from enforcement-first regulation. Its key objectives include defining the security status of digital assets, establishing temporary relief for token issuers, and addressing custody, clearing, and cross-border crypto regulation. As part of this shift, over 50 SEC lawyers and staff have reportedly been reassigned from crypto enforcement actions.

‘Stargate’, a $500 billion AI infrastructure initiative, was also announced in late January. Stargate is led by Softbank’s Chairman Masayoshi Son—who previously pledged $100 billion in AI investment—and has doubled down under Trump’s deregulatory, pro-energy, pro-crypto, pro-AI administration. SoftBank is joined by OpenAI, Oracle, and MGX in the initiative. While not directly tied to digital assets, our research suggests Stargate could provide Bitcoin miners with capital to expand into AI and HPC. Given Bitcoin miners' expertise in securing large-scale power agreements, they could emerge as key players in this AI-driven energy expansion.

SoftBank seems to think so. Later that month, it invested $50 million in Cipher Mining (CIFR), acquiring 10.4 million shares to support CIFR’s HPC data center expansion. This move reinforces the growing recognition of Bitcoin miners as emerging AI/HPC infrastructure providers.

On February 4, White House ‘Crypto Czar’ David Sacks held a joint press conference with congressional leaders, outlining a bipartisan roadmap for digital asset legislation. Congress is advancing several key bills:

- Stablecoins: The GENIUS Act (Guiding and Establishing National Innovation in U.S. Stablecoins Act), introduced by Senator Hagerty, defines stablecoins as USD-pegged digital assets, establishes issuance procedures, licensing, and reserve requirements, and designates the Federal Reserve and OCC as primary regulators. Meanwhile, Rep. French Hill's draft Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act is even more bullish. It permits state-qualified issuers without imposing a market cap limit, allowing for broader competition in the U.S. stablecoin market.

- Market Structure: Lawmakers plan to reintroduce FIT21, which would clarify the CFTC’s jurisdiction over digital commodities and grant the SEC oversight of blockchain-based securities.

During the press conference, Sacks stated, “[A] Bitcoin reserve will be one of the first things we are going to look at.”

As the federal government pivots toward a more crypto-friendly stance, individual U.S. states are also accelerating their own Bitcoin strategies. A growing number are moving ahead of Washington by introducing legislation to treat Bitcoin as a Strategic Reserve Asset—a trend we explore next.

Bitcoin Treasury Adoption Updates

State-Level Initiatives

| U.S. State Bitcoin & Digital Asset Reserves | |||||||||

| Title | Introduced | Type | Status | Funding Source(s) | Est. Funding Source Size ($) | Potential Investment (%) | Est. Potential Investment ($) | Est. # Bitcoin | |

| Arizona | Senate Bill 1025, 'Arizona Strategic Bitcoin Reserve 24 Act' |

16-Dec-24 | Both Reserve & Pension | Chamber 1 | State Treasurer Public Fund, Retirement System | 87,394,974,218 | 10 | 8,739,497,422 | 91,657 |

| Florida | Strategic Bitcoin Reserve | 3-Dec-24 | Both Reserve & Pension | Introduced | Pension Fund, Budget Surplus | 302,200,000,000 | 1 | 3,022,000,000 | 31,694 |

| Pennsylvania | House Bill No. 2664 | 19-Nov-24 | Reserve | Failed/Dead | Unexpended, unencumbered, or uncommitted funds in the General Fund, Budget Stabilization Reserve Fund, Any other investment fund managed directly by State Treasurer | 23,586,024,543 | 10 | 2,358,602,454 | 24,736 |

| Oklahoma | House Bill 1203 (HB 1203) | 15-Jan-25 | Both Reserve & Pension | Committee 1 | State General Fund, Revenue Stabilization Fund, Constitutional Reserve (Rainy Day) Fund | 14,664,000,000 | 10 | 1,466,400,000 | 15,379 |

| Massachusetts | Senate Docket, No. 422 | Jan-25 | Reserve | Introduced | Commonwealth Stabilization ("Rainy Day") Fund | 8,831,000,000 | 10 | 883,100,000 | 9,262 |

| Wyoming | House Bill 201 (HB 201) | 17-Jan-25 | Reserve | Failed/Dead | General Fund and Permanent Wyoming Mineral Trust Fund | 27,100,000,000 | 3 | 813,000,000 | 8,526 |

| Ohio | House Bill No. 18 | 23-Jan-25 | Reserve | Committee 1 | General Revenue Fund Interim Funds, Budget Stabilization Fund, Deferred Prizes Trust Fund | 4,590,000,000 | 10 | 459,000,000 | 4,814 |

| Ohio | Senate Bill No. 57 | 29-Jan-25 | Reserve | Committee 1 | State entities' Bitcoin payments, donations, criminal forfeitures, interim funds | n/a | n/a | n/a | n/a |

| New Hampshire | HB 302 | 10-Jan-25 | Reserve | Committee 1 | General Fund, Revenue Stabilization Funds, others as authorized by legislature | 2,116,317,421 | 10 | 211,631,742 | 2,220 |

| Utah | House Bill 230 | 15-Jan-25 | Reserve | Committee 2 | State Disaster Recovery Restricted Account, General Fund Budget Reserve Account, Income Tax Fund Budget Reserve Account, Medicaid Growth Reduction and Budget Stabilization Account | 1,401,800,000 | 10 | 140,180,000 | 1,470 |

| Texas | Senate Bill 778 (SB 778) | 16-Jan-25 | Reserve | Committee 1 | Unencumbered and unobligated GRF blance per biennium | 18,290,000,000 | 1 | 182,900,000 | 1,918 |

| North Dakota | House Concurrent Resolution No. 3001 | 14-Jan-25 | Reserve | Introduced | State General Fund, Budget Stabilization Fund, Legacy Fund | 18,557,625,832 | unspecified | - | - |

| North Dakota | HB1184 | 7-Jan-25 | Reserve | Failed/Dead | Certain State Funds | n/a | n/a | n/a | n/a |

| Iowa | Inflation Protection Act | 6-Feb-25 | Reserve | Introduced | General Fund, Cash Reserve Fund, Economic Emergency Fund | 5,472,000,000 | 5 | 273,600,000 | 2,869 |

| Illinois | Strategic Bitcoin Reserve Act | 29-Jan-25 | Reserve | Committee 1 | Gifts, Grants, Donations | n/a | n/a | n/a | n/a |

| Kentucky | HB 376 | 6-Feb-25 | Reserve | Committee 1 | Excess State Treasury Cash | unclear | 10% | - | - |

| Missouri | HB 1217 Bitcoin Strategic Reserve Fund | 6-Feb-25 | Reserve | Introduced | Gifts, Grants, Donations | n/a | n/a | n/a | n/a |

| Missouri | SB614 - Treasurer Investment Provisions | 23-Jan-25 | Reserve | Introduced | State Treasurer | 17,082,467,808 | 10 | 1,708,246,781 | 17,916 |

| Maryland | HB1389 - Strategic Bitcoin Reserve Act of Maryland | 21-Jan-25 | Reserve | Committee 1 | Seized gambling-related money, state budget fund appropriations, donations, grants | n/a | n/a | n/a | n/a |

| New Mexico | Strategic Bitcoin Reserve Act (SB 275) | 4-Feb-25 | Reserve | Committee 1 | Land Grant Permanent Fund, Severance Tax Permanent Fund, Tobacoo Settlement Permanent Fund, other state funds deemed appropriate by investment council | 42,098,000,000 | 5 | 2,104,900,000 | 22,076 |

| South Dakota | House Bill 1202 | 30-Jan-25 | Both Reserve & Pension | Committee 1 | State public funds approved by the State Investment Council | 16,678,800,000 | 10 | 1,667,880,000 | 17,492 |

| Montana | House Bill No. 429 - "Inflation Protection Act of 2025" | 8-Feb-25 | Reserve | Committee 1 | Montana General Fund - up to $50 million initially, | 4,176,970,000 | n/a | 50,000,000 | 524 |

| North Carolina | HB 92 - NC Digital Assets Investments Act | 10-Feb-25 | Both Reserve & Pension | Introduced | General Fund, Highway Fund, Teachers' and Sate Employees' Retirement System, other special state funds | 26,291,046,000 | 10 | 2,629,104,600 | 27,573 |

| West Virginia | Senate Bill 465 | 14-Feb-25 | Both Reserve & Pension | Introduced | Public Funds Overseen by Board of Treasury Investments | 11,000,000,000 | 10 | 1,100,000,000 | 11,536 |

| Michigan | HB4087 | 13-Feb-25 | Reserve | Committee 1 | The General Fund, The Countercyclical Budget and Economic Stabilization Fund | 3,982,618,000 | 10 | 398,261,800 | 4,147 |

| Total: | 25,036,702,345 | 262,547 | |||||||

Source: State Legislatures, Bitcoinlaws.io as of 02/17/2025. Not intended as a recommendation to buy or sell any securities mentioned herein. Past performance is no guarantee of future results. Please see important disclosures regarding hypothetical performance at the end of this blog.

This month, we published a summary table of our database tracking the U.S. States’ legislative initiatives to invest in Bitcoin and other digital assets. After reading each piece of legislation, we identified the sources of funding and estimated their sizes by looking up their most recently available financials. Based on the legislation’s limitations (e.g., up to 10% of the General Fund), we estimated the potential investment size in U.S. dollars, which we then converted to Bitcoin. For simplicity, we excluded other cryptocurrencies, though several bills theoretically allow for investment in other digital assets contingent on certain factors such as market cap.

At current market prices of ~$95,350 per Bitcoin, we estimated that currently the pending legislative initiatives could see these U.S. states purchase a total for 262,577 BTC, worth ~$25 billion. This figure is both optimistic and conservative. The probability of each of these proposals passing is low, as three bills from Pennsylvania, Wyoming, and North Dakota have already failed. Further, our estimates are based on the upper bounds of each bill, which means purchasing as much Bitcoin as each bill allows. On the other hand, however, several bills do not provide clear guidance to estimate the amount of Bitcoin they could acquire. Thus, we allocated zero Bitcoin purchases to them. We also emphasize that while some of these bills include allocations to Bitcoin in certain state retirement funds, this list excludes pension-only allocations already made in states like Michigan and Wisconsin.

Regardless of the near-term likelihood of these bills passing and making significant allocations towards the digital asset class, this exercise illustrates the shift in sentiment between U.S. public policy and digital assets. These developments were previously unthinkable under prior administrations, given their hostility towards crypto entrepreneurs, banks, etc., as demonstrated by the systemic debanking now being uncovered in the Operation Chokepoint 2.0 investigations. As of February 17th, 32 pieces of state Bitcoin & digital asset legislation have been submitted—24 of them strategic reserves—suggesting the urgency of this matter perceived by state lawmakers.

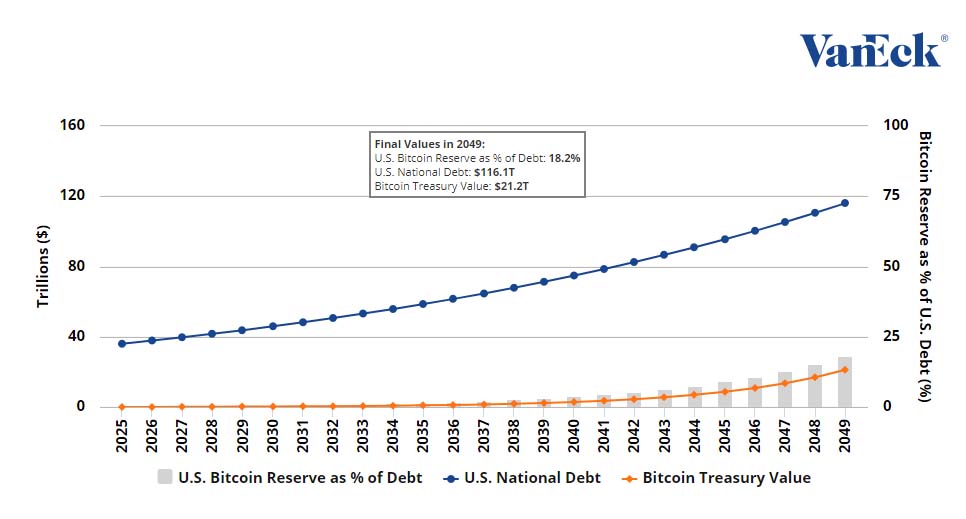

At The Federal Level: A U.S. Strategic Bitcoin Reserve Could Help Offset National Debt

Source: VanEck Research as of 02/17/2025. The information, valuation scenarios, and price targets presented on any Bitcoin in this blog are not intended as financial advice, a recommendation to buy or sell Bitcoin, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance of Bitcoin scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

As states move ahead with Bitcoin reserves, they are effectively ‘frontrunning’ the federal government's emerging policy signals for a Strategic Bitcoin Reserve (SBR). While no formal U.S. Treasury initiative exists yet, the debate is gaining momentum.

To explore this further, we’ve developed the U.S. Debt to Bitcoin Reserve Tool, which is now available on our website. This interactive model lets users adjust U.S. debt growth rates, Bitcoin acquisition prices, BTC price growth, and reserve size to visualize how a national Bitcoin reserve could impact U.S. debt.

With state adoption accelerating, this tool offers a data-driven framework for evaluating Bitcoin’s potential role in U.S. monetary policy. This idea, once speculative, is now increasingly entering the policy debate.

Bitcoin Miners

Publicly Traded Bitcoin Miners Will Energize an Estimated 4+ GW Per Year Through 2027

Source: Company Public Filings as of 02/14/2025. Not intended as a recommendation to buy or sell any securities mentioned herein. Past performance is no guarantee of future results.

Scaling Electrical Capacity

We conducted a comprehensive mapping of the 13 public Bitcoin miners in our coverage: BITF, BTBT, BTDR, CIFR, CLSK, CORZ, GLXY, HIVE, HUT, IREN, MARA, RIOT, and WULF. We estimate that these miners collectively operate 7.1GW of energized capacity, with plans to expand to 11.7GW by the end of 2025, 15.9GW by 2026, and 20.4GW by 2027. This projection represents a 42% compound annual growth rate over three years. Beyond 2028, they have an additional 7.3GW pipeline, which we view as a conservative estimate, given the competitive nature of power procurement in Bitcoin mining and the more secretive nature of long-term growth pipelines.

Assuming the expansion through 2027 would require a modernized (15 J/TH efficiency) fleet of Bitmain Antminer S21 Pros at $5,000 each and $450,000 per MW of supporting infrastructure, we estimate the total cost of this growth would be $24.8 billion in capex.

However, we think miners are unlikely to commit all this capacity to Bitcoin. Securing new electrical capacity is a core competency for miners—one that is becoming even more valuable in the era of power-intensive AI computing. According to Goldman Sachs, AI currently consumes ~7.7GW of global data center power usage (14%), a figure expected to grow to ~22.7GW (27%) by 2027. Similarly, based on our review of their site pipelines, we think the Bitcoin miners we cover will pivot at least 20%-30% of their electrical capacity to supporting AI/HPC workloads.

Miners' AI/HPC Pivot Accelerates

The shift toward AI and high-performance computing (HPC) is gaining momentum among Bitcoin miners. Following CoreWeave’s 700MW AI/HPC deal in 2024, multiple miners are now actively exploring AI-driven revenue streams:

- Bitfarms (BITF): Engaged two AI/HPC consultants to assess feasibility across all North American sites.

- Bitdeer (BTDR): Following completion of its AI/HPC datacenter consulting engagement, cited ongoing discussions with AI/HPC development partners.

- Cipher Mining (CIFR): In late January, SoftBank invested $50 million in Cipher Mining, acquiring 10.4 million shares to support HPC data center expansion.

- Riot (RIOT): Announced additions to its Board of Directors bringing AI/HPC conversion, data center, and real estate expertise, in addition to retaining AI/HPC investment banking expertise.

- HIVE Digital Technologies (HIVE): Appointed Craig Tavares as President and COO of Buzz HPC to lead the company’s growth in HPC and GPU cloud services.

- Iris Energy (IREN): Announced a 75MW liquid-cooled AI/HPC data center in Childress, TX (H2 2025) and an additional 600MW expansion at Sweetwater, bringing total site capacity to 2GW—potentially making it one of the largest sites in North America that may become AI/HPC-eligible.

One industry expert explained the scarcity of such large-scale sites like IREN’s, stating, "I can count on two hands the number of people who have 1,000MW [at one site] today." Such campuses are ideal for AI training, providing the dense compute clusters needed for cutting-edge model development, faster iteration, and sustained workloads at scale. This underscores the strategic advantage of miners with large portfolios of scalable energy assets as AI demand surges.

Implications for Bitcoin Miners

Bitcoin Network Transaction Fees Have Failed to Keep Pace with Price

Source: Company Public Filings as of 02/15/2025.

The pivot toward AI/HPC is increasingly critical as Bitcoin’s fee revenue model remains unreliable. While network congestion associated with speculative markets can drive temporary spikes in transaction fees, sustained on-chain revenue growth remains elusive. Meanwhile, the rise of off-chain solutions (ETFs, futures markets, L2s, centralized exchanges) could further reduce miners' long-term fee income.

With Bitcoin’s block rewards halving every four years, BTC’s price must double just for miners to maintain their revenues. This structural challenge further highlights why AI/HPC is an attractive diversification play.

We believe the most successful Bitcoin miners will be those that:

- Use mining to subsidize grid expansion in remote and overlooked energy markets.

- Diversify into AI/HPC by leveraging their existing power portfolios and pipelines for higher-margin services, unlocking new financing vehicles.

- Monetize operational expertise through innovations such as liquid cooling systems, chip design, and mining co-location technologies.

Bitcoin’s Network Activity, Adoption, and Fees

Daily Transactions: Transaction activity declined modestly, down 10% MoM.

Ordinals Inscriptions: Ordinals transactions are down 6% month-over-month (MoM), losing momentum after the Q4 surge in activity. Like NFTs on other blockchains, we view Ordinals as on-chain collectibles—essentially luxury or Veblen goods—whose demand tends to rise and fall with Bitcoin’s price performance. This cyclical pattern suggests that while inscriptions may cool during periods of consolidation, they could reaccelerate in the next bull phase, particularly with continued advances in marketplace and gallery user experiences.

Total Transfer Volume: Transfer volume is down 28% MoM; we believe low volatility is once again the culprit. One month ago, transfer volumes were high as Bitcoin prices bounced off a low of $89k on January 13th and rapidly approached new highs above $109k by January 20th.

Average Transaction Fees: Costing an average of $1.40, Bitcoin fees are down 23% MoM, reflecting the reduced demand from transactions, transfer volume, and ordinals activity.

Global Power Consumption & Mining Difficulty: Global power consumption grew 3% to reach 157 TWh, and mining difficulty rose 8% MoM to 114 terahashes (T), both hitting all-time highs. This reflects a robust and growing network as miners scale operations to meet rising Bitcoin demand.

Total Crypto Equities Market Cap: Down 1% MoM, crypto equities mirrored Bitcoin’s low volatility and minimal price changes MoM.

Transfer Volume from Miners to Exchanges: Miners are transferring ~$7.4M per day to exchanges, up 35% MoM. These levels reflect the 94th percentile of all-time history, though they are still less than half of the levels seen throughout most of H1’21. We think that transfer volumes from miners to exchanges are a good proxy for Bitcoin’s adoption as a monetary asset, as higher levels reflect a market capable of absorbing new, higher-cost supply as mining difficulty increases.

Futures Sentiment: Annualized Bitcoin futures declined 30% MoM, reflecting a shift from last month’s bullish sentiment to a more neutral. At the 51st percentile of historical levels, funding rates suggest market indecision rather than outright bearishness.

Bitcoin Monthly Dashboard

| As of February 17th, 2025 | 7-day avg | 30 day change1 (%) | 365 day change (%) | Last 7 days Percentile vs all-time history(%) |

| Bitcoin Price | $ 96,789 | -2 | 88 | 99 |

| Daily Active Addresses | 712,597 | -8 | -17 | 63 |

| Daily New Addresses | 295,924 | -9 | -20 | 53 |

| Daily Transactions | 341,131 | -10 | 4 | 87 |

| Daily Inscriptions | 84,506 | -6 | 4 | 52 |

| Total Transfer Volume (USD) | $ 54,314,005,476 | -28 | 18 | 85 |

| % Supply Active, last 180 days | 26% | 4 | 49 | 46 |

| % Supply Dormant for 3+ Years | 45% | 0 | 3 | 95 |

| Avg Fees (USD) | $ 1.40 | -23 | -78 | 66 |

| Avg Fees (BTC) | 0.00001 | -22 | -89 | 9 |

| Percent of BTC Addresses in profit | 93% | -4 | -1 | 79 |

| Unrealized profit/loss ratio | 0.55 | -5 | -1 | 76 |

| Global Power Consumption (TWh) | 157 | 3 | 38 | 100 |

| Total Daily BTC Miner Revenues (USD) | $ 44,388,508 | 0 | -8 | 92 |

| Total Crypto Equities' Market Cap* (USD) (MM) | $ 218,393 | -1 | 122 | 89 |

| Transfer volume from Miners to Exchanges (USD) | $ 7,448,714 | 35 | 0 | 94 |

| Bitcoin Dominance | 57% | 6 | 15 | 89 |

| Bitcoin Futures Annualized Basis | 8% | -30 | -36 | 51 |

| Mining Difficulty (T) | 114 | 3 | 40 | 100 |

* DAPP market cap as a proxy, as of Feb 17th, 2025

1 30 day change & 365 day change are relative to the 7-day avg, not absolute

| Regional Trading | MoM Change (%) | YoY Change (%) |

| Asia Hours Price Change MoM ($) | 3 | 2 |

| US hours Price Change MoM ($) | -3 | 3 |

| EU hours Price Change MoM ($) | 4 | 3 |

Source: Glassnode, VanEck research as of 02/17/25. Past performance is no guarantee of future results.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.