VanEck Crypto Monthly Recap for February 2025

05 March 2025

Read Time 10+ MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Brutal month. Bitcoin tanked (-28%) from its January peak of $109K, bottoming at $78.2K before bouncing to $84K (-17.5% MTD). Ethereum (-33%) and other alts fared much worse. Nasdaq slid (-4%), it’s worst month since April 2024. Despite the improving regulatory backdrop in the US and a positive sentiment shift amongst investment institutions, the MarketVector Smart Contract Leaders Index (MVSCLE) was down a painful (-34%) since the last day of January. Some of the biggest losing smart contract platform (SCP) tokens on the month include Starknet’s STRK (-39%), Solana’s SOL (-37%), and Avalanche’s AVAX (- 36%). On the other end, some of the tokens that held the line against the price rinse include Sonic’ S (+21%), Tron’s TRX (-9%), and Binance’s BNB (-13%). The worst performing sector for tokens was Memecoins (-41%) followed closely by Oracles (-36%) and Gaming (-35%).

Bitcoin corrections in bull markets aren’t new. 2017 saw multiple (-30-40%) dips. Even in 2021, BTC cratered 55% before ripping to all-time highs. This selloff fits the pattern.

What happened?

- Macro: Trump’s proposed 25% tariffs on Canada, Mexico, China, and the EU spooked markets. Consumer confidence slumped near multi-decade lows. The services sector (ISM) contracted for the first time in over two years.

- Carry trade collapse: The annualized next-month BTC futures premium hit 52-week lows as leverage unwound. Bitcoin ETPs had their worst week of net outflows ever, totaling $3.3B, as hedge funds closed Bitcoin trades, and many went short.

-

Crypto-specific: Bybit hacked for $1.5B in ETH, shaking trust in CEXs and smart contract platforms.

Bitcoin reserve bills flopped. Four U.S. states failed to pass Bitcoin reserve legislation. Key Oklahoma vote coming soon.

Stablecoin legislation gets a revamp. A new House draft bill removes many federal restrictions from last year’s version, restoring state rights and cutting bureaucracy—a major win for stablecoin issuers.

VanEck-backed Agora stablecoin surpassed $100M in AUM after launching on Solana, its 6th chain, making $AUSD one of the fastest-growing dollar stablecoins.

Figure launched the first retail yield-bearing stablecoin, bringing traditional financial yield mechanisms into crypto-native dollars.

- Regulatory U-turn: SEC abruptly dropped cases against Coinbase, Uniswap, Robinhood, Binance, and others. Two years of “war on crypto” suddenly vanished.

-

Institutional money still moving in: BlackRock raises the ante. The world’s biggest asset manager added 1-2% Bitcoin exposure to its $150B model portfolios, putting BTC in front of thousands of RIAs and wealth managers.

MicroStrategy broke into the preferred equity stack. MSTR sold $700M of 8% perpetual preferred stock, managed by Morgan Stanley, Citi, and Goldman Sachs, at 80 cents on the dollar. The issue rallied to 99 cents before ending the month at 92.4 cents.

In-kind Bitcoin ETP redemptions coming? Nasdaq filed a rule change on Jan 24, 2025, to enable in-kind creations/redemptions for BlackRock’s bitcoin ETP. The SEC has a 45-day review window, meaning approval could come as soon as March 10, 2025. This would allow U.S. broker-dealers to handle Bitcoin directly—a game changer for market structure.

VanEck-backed SegMint became the #2 NFT project by volume on Abstract blockchain as utility expanded thanks to an innovative real-world quest the team launched alongside Portals.

-

Governments making moves: Abu Dhabi’s Mubadala sovereign fund took a $436.9M stake in BlackRock’s Bitcoin ETP—first known SWF allocation to BTC.

Czech central bank governor pushed to evaluate Bitcoin as a reserve asset, possibly allocating up to 5% of its €140B reserves to BTC.

Wisconsin doubles down on Bitcoin ETP. The State of Wisconsin Investment Board increased its Bitcoin ETP holdings to over 6M shares (~$321M position).

U.S. signals Bitcoin policy shift. As we went to print, Donald Trump posted on social media that he will establish a U.S. Crypto Strategic Reserve, promising to include BTC, ETH, XRP, ADA, and SOL, signaling a dramatic shift in U.S. digital asset policy.

- Bitcoin’s correlation with the Nasdaq: The correlation ratio has drifted lower to 0.27 from its 2022 peak of 0.8, suggesting that Bitcoin’s price action is increasingly moving to its own rhythm rather than being dictated by traditional equities.

February was ugly, but if history is any guide, deep corrections in bull markets shake out weak hands before the next leg up.

Price Returns

| February (%) | 1-year (%) | |

| S&P 500 Index | -2 | 16 |

| Nasdaq Index | -4 | 18 |

| Bitcoin | -18 | 47 |

| MarketVector Global Digital Assets Equity Index | -23 | 18 |

| Coinbase | -27 | 4 |

| Ethereum | -33 | -32 |

| MarketVector Smart Contract Leaders Index | -34 | -18 |

| MarketVector Infrastructure Application Leaders Index | -39 | 54 |

| MarketVector Meme Coin Index | -40 | NA |

| MarketVector Decentralized Finance Leaders Index | -40 | -43 |

Source: Bloomberg as of 2/28/2025. Index performance is not representative of strategy performance. It is not possible to invest directly in an index. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Crypto Fundamental’s Sour

The cryptocurrency market saw a sharp decline in Smart Contract Platform (SCP) activity as memecoin trading collapsed (-80% month-to-month), driven by accusations of insider trading and fraud. January saw controversial launches of $TRUMP and $MELANIA, followed by February’s launch of $LIBRA, a token likely linked to Argentinian President Javier Milei. $LIBRA briefly reached a $4B valuation before crashing over 98%, with insiders profiting heavily. This has fueled concerns that memecoin markets are manipulated by influencers and traders engaging in pump-and-dump schemes. Onchain gas usage for memecoin trading dropped significantly, down (-73%) on Ethereum and (-65%) on Solana month-to-month.

MarketVector Smart Contract Leaders Index (MVSCLE) Below Pre-Election Levels

Source: Market Vectors as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein. The MarketVector Smart Contract Leaders Index (MVSCLE) is designed to track the performance of the largest and most liquid smart contract assets, and is an investable subset of MarketVector Smart Contract Index.

Just as investors were moving past memecoin losses, the market took another hit with the partial hack of Bybit, the third-largest crypto exchange by volume. The attack, the largest in crypto history, resulted in the theft of $1.5B in ETH or about 6% of Bybit’s assets. Authorities have linked the hack to the Lazarus Group, a North Korean state-sponsored cybercriminal organization. The attack’s sophistication, along with concerns about security vulnerabilities in Gnosis’ crypto safeguarding software, has left the industry on high alert.

Stablecoin Volume Increased (+63%) for Base in February

Source: Artemis XYZ as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Across all blockchains, key metrics of economic activity were down in February including daily averages in Revenue (-48%), DEX Volume (-27%), Stablecoin Transfer Volume (-16%), and Active Addresses (-7%). In fact, if we remove Base from our calculation of Stablecoin Transfer Volumes, who has shown some recent aberrant surges in stablecoin activity, transfer volumes are down (-42%) month-to-month. Additionally, the relative share of crypto trading that occurs on blockchain DEXes versus centralized exchanges fell from its all-time high of 20.2% in January to 19.2% in February. Activity in some sectors of the on-chain economy declined more than others, as measured by blockchain revenues generated. For example, revenues from DeFi activity on Ethereum slumped (-80%) and Solana DeFi activity dropped by (-65%).

Ethereum-Tectonics

Average Gas Price in Gwei (1-9 ETH) is down (-88%) YoY

Source: Etherscan as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Ethereum has struggled in the current crypto cycle, both in terms of usage and asset valuation. This decline is largely due to the erosion of the core factors that once made Ethereum valuable. Most significantly, Ethereum is no longer the central hub for onchain crypto trading or related revenue-generating activities like trading finance and wallet-to-wallet transfers.

One major reason for this shift is Ethereum’s own strategy of encouraging users to move off its Mainnet to Layer 2 (L2) blockchains by expanding and lowering the cost of available blockspace. Additionally, other blockchains have emerged as more efficient and cost-effective alternatives. Due to the mechanics of EIP-1559, a linear decline in Ethereum’s usage leads to an exponential drop in gas prices. With demand shifting to L2s and competing blockchains, Ethereum’s gas prices have fallen (-88%), and its revenue has dropped (-93%) over the past year. Currently, the cost of Ethereum blockspace, measured in ETH per gas unit, is at its lowest since mid-2024 in both ETH and dollar terms.

A direct consequence of this reduced demand is that ETH is no longer deflationary. Since ETH is burned as part of transaction fees, lower usage means less ETH is being burned. With crypto activity moving elsewhere, Ethereum's valuation has declined due to reduced expectations for its economic future. Ethereum’s share of blockchain revenue has dropped from 55% in February 2024 to 24% in February 2025. Furthermore, because Ethereum cannot handle high transaction volumes efficiently, major projects are moving to their own blockchains. These include Uniswap, which accounted for 11% of Ethereum’s revenue, Ondo, an RWA platform managing ~$1B in assets, and Ethereum Name Service. Ethereum now faces competition from more advanced blockchains with significantly greater processing power and substantial financial and intellectual resources. Without lowering transaction costs, Ethereum’s previous fee structure may have accelerated its decline due to the rise of low-cost alternatives.

Another issue is Ethereum’s divided vision. It aims to maximize decentralization, serve as a financial infrastructure, and establish ETH as a store-of-value asset. However, many argue that these goals conflict with each other both technically and philosophically. Competing blockchains tend to focus on just one goal: Solana prioritizes transaction execution while Bitcoin focuses on store-of-value. Many argue that this singularity of vision contributed to outperformance against Ethereum. While Ethereum is widely considered the most decentralized blockchain, it is unclear whether this alone justifies ETH’s ~$300B valuation. Recent decisions, such as increasing the gas limit and reducing the validator count in the upcoming Pectra upgrade, suggest Ethereum is already compromising on its decentralization goals.

Ethereum Mainnet Share of Decentralized Exchange (DEX) Volumes

Source: Artemis XYZ as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Despite ETH’s anemic price action and economic activity clustering on other blockchains, Ethereum’s community has been slow to acknowledge its challenges and even more lethargic in adequately addressing them. This has divided the Ethereum community, leading to infighting and even exodus by some disgruntled members. However, Ethereum’s community is shifting focus to address its challenges and the most impactful has been changing Ethereum’s execution layer to recapture lost economic activity. In early February, Ethereum’s validators increased their capacities to process Ethereum transactions. Ethereum throughput was increased in February by validators who increased gas limits (+20%) moving from 30M -> 36M. Recognizing that this raise is competitively inadequate against current blockchains (Max Recorded TPS: Ethereum ~63 vs Solana ~4,000) and future chains (TPS: Solana w/Firedancer 100,000+), Ethereum’s leader Vitalik Buterin has called for further 10x increase in gas capacity. Increases in gas capacity arguably make Ethereum less decentralized because of the additional resources needed to run Ethereum’s software, due to the gas increase, effectively. For Ethereum to remain competitive going forward, it may need to compromise more on decentralization to favor scaling its Mainnet.

Even with L2s, Ethereum Throughput Lags Others

Source: Chainspect as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Ethereum is improving its own blockchain and enhancing the environment for its Layer 2 (L2) blockchains, which act as low-cost extensions that utilize Ethereum’s blockspace. In February, the Ethereum Foundation introduced a software upgrade called “Intents,” designed to improve how L2s interact with each other. This upgrade will provide a smoother transaction experience for users when bridging and making transactions across multiple Ethereum L2 chains.

One of the biggest criticisms of Ethereum is its reliance on bridges, which users must use to move assets between chains. Bridges are often slow, expensive, and have been responsible for billions of dollars in security breaches. They charge high fees and require long wait times, sometimes minutes or hours, for asset transfers. With the introduction of Intents, users may no longer need to rely on bridges, reducing both security risks and transaction delays.

Many Ethereum users anticipate the upcoming "Pectra" upgrade, which is set to launch in March. Pectra is a major update that will bring significant improvements to Ethereum and promises to accomplish the following:

- Increase Ethereum’s L2 blob capacity from 3/6 -> 6/12 (EIP-7742)

- Increase the Maximum Validator Stake Size from 32 => 2,048 ETH (EIP-7251)

- Improve the Staking Experience (EIP-6110, EIP-7002)

- Debut Account Abstraction (EIP-7702)

The most significant upgrade in Pectra is the increase in blob space, which will improve Ethereum’s Layer 2 (L2) transaction processing capacity. Ethereum L2s operate on their own chains but submit compressed data, called "Blobs," to Ethereum for validation. These Blobs are stored in Ethereum’s dedicated "Blob Space." Currently, Ethereum targets 3 and can process up to 6 blobs (each 125KB) every 12 seconds. With Pectra (EIP-7742), this capacity will double to 6-12 Blobs per cycle, allowing L2s to submit more transactions. This expansion could lower transaction costs for users as increased throughput eases congestion.

Another key upgrade is the increase in the maximum validator stake from 32 ETH to 2,048 ETH (EIP-7251). This change will enable large validator entities to consolidate stakes, reducing the total number of validators. Fewer validators mean lower messaging overhead, which could allow Ethereum to process larger blocks of transactions. Additionally, Ethereum could further increase transaction capacity by reducing the time between blocks (blocktime). For example, if blocktime is reduced from 12 seconds to 6 seconds, Ethereum could process twice as many transactions.

Other updates in Pectra focus on improving staking security and efficiency. Currently, validator deposits are managed through a bridge between Ethereum’s consensus and execution layers, requiring validators to vote on deposit data, which can cause delays and potential failures. Pectra (EIP-6110) will move these deposits directly to the execution layer, cutting processing times from 12 hours to 13 minutes while improving security. Additionally, smart contracts will gain the ability to handle validator withdrawals (EIP-7002), giving staking pool operators like Lido more flexibility and allowing users to withdraw their funds without relying solely on the staking operators.

Finally, Pectra will introduce account abstraction (EIP-7702), which enhances how Ethereum handles user accounts and smart contract interactions. This feature aims to make Ethereum transactions more flexible and user-friendly by improving the efficiency of smart contract-based wallets.

More Solana Drama

Solana Decentralized Exchange (DEX) Volumes briefly exceeded Ethereum Ecosystem's

Source: Artemis XYZ as of 2/28/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Solana has been the standout performer in the current crypto market cycle, with its token price rising (+191%), on-chain revenues (excluding MEV) surging (+700%), and stablecoin supply increasing (+291%) in 2024. This success is largely due to Solana’s low transaction costs (Solana Avg ~$0.05 vs Ethereum Avg $1.27) and its ability to handle a high volume of trades. As a result, Solana has become a key hub for on-chain trading, attracting major crypto projects to build on its network.

One of the biggest drivers of Solana’s growth has been memecoin trading, which accounts for approximately 80% of its revenues. The most successful platform for memecoin launches, Pump.fun, operates on Solana. Pump.fun allows users to quickly and cheaply create and trade memecoins, charging a 1% fee on trading volume. Pump.fun has generated more than $577M in fees in just over a year, making it one of the most profitable applications in crypto history. However, memecoin trading is controversial due to concerns over insider manipulation. Some insiders create and market memecoins solely to drive up prices before dumping them on retail investors. Additionally, sophisticated automated traders often “snipe” well-anticipated memecoin launches, buying tokens before retail traders have a chance. This is similar to the high-frequency trading issues highlighted in Michael Lewis’s book *Flash Boys*.

In February, Solana suffered significant losses due to a collapse in memecoin trading. The impact was severe, with stablecoin transfers—the backbone of on-chain trading—plummeting (-80%) from January levels. Solana’s price decline reflected this drop in fundamental activity. Key trading metrics also saw sharp declines: DEX volumes fell (-55%), fees collected dropped (-63%), and MEV activity decreased (-63%).

Despite this downturn, Solana has several upcoming protocol upgrades, known as SIMDs, to improve its technical capabilities and economic framework. These changes could help stabilize and enhance Solana’s position in the crypto ecosystem moving forward.

Priority Fees are the Highest Share of Solana Revenues

Source: Blockworks as of 3/3/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Solana recently implemented SIMD 096 on February 12, which changed its fee burn policy to direct 100% of priority fees to validators. Previously, 50% of these fees were burned, while the other half was shared between validators and their stakers. This change benefits stakers by increasing their rewards while discouraging offchain deals between traders and validators. Previously, validators were incentivized to engage in private trading agreements to bypass on-chain fees. With all priority fees now going to validators, they have a stronger economic reason to ensure trading occurs on-chain.

Another proposal, SIMD 0123, is awaiting a vote and would create an in-protocol mechanism to distribute Solana’s priority fees to validator stakers. Currently, validators must share voting rewards and MEV fees with stakers, but they are not required to remit priority fees, which account for 40% of all Solana fees. In practice, some validators send a portion of priority fees to stakers, but most keep the majority. If SIMD 0123 passes, validators will have to distribute these fees to stakers based on an onchain verifiable commission rate. This would shift more revenue to stakers while reducing validator earnings.

The most impactful proposal under consideration is SIMD 0228, which aims to adjust Solana’s inflation rate based on the percentage of SOL staked. Currently, about 63.4% of the total SOL supply is staked, and Solana's inflation rate stands at 4.7%, decreasing 15% annually until it reaches a floor of 1.5%.

Under SIMD 0228, inflation would decrease as staking participation increases, reducing dilution and lowering selling pressure from stakers who treat staking rewards as income. Conversely, if staking participation drops, inflation would rise to incentivize more staking and maintain network security.

For example:

- If 63% of SOL is staked, inflation would adjust to 0.93%.

- If 65% of SOL is staked, inflation would be approximately 0.87%.

- If 50% of SOL is staked, inflation would be approximately 1.32%.

This mechanism aims to balance token issuance with staking demand, helping to sustain network security while minimizing unnecessary dilution. The vote on SIMD 0228 is scheduled for epoch 753, starting on March 6, 2025.

These three proposals have generated significant controversy due to their expected impact on validator revenues. Some estimates suggest validator earnings could decrease by as much as 95%, making operations unsustainable for smaller validators. Running a Solana validator requires covering fixed costs, including voting fees of approximately 1.1 SOL per day ($58,000 per year) and hardware expenses of about $6,000 per year. Currently, Solana has 1,323 validators, but only 458 have enough stake (more than 100,000 SOL) to surpass the basic profitability threshold. If smaller validators shut down, the network may become more centralized around large institutional entities such as Coinbase and Binance. Some community members propose reducing the cost of voting as a potential solution to help validators remain financially viable. But foundationally, it is difficult to assess what the correct number of validators is to sustain a decentralized network, and we leave such decisions to the market.

While these changes may reduce staking rewards, we believe lowering inflation is a worthy goal that strengthens Solana’s long-term sustainability. Maintaining a predictable and low inflation rate can support SOL’s value by reducing dilution and sell pressure. We support the team’s willingness to experiment with different economic models and adjust course if necessary to balance incentives and network health over time.

Bybit Hack

Largest Hack Ever: Bybit Losses Are >2x Previous Record Heists

Source: DeFiLlama, Elliptic as of 2/25/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Backstory

On February 21, 2025, Dubai-based cryptocurrency exchange Bybit suffered a massive security breach, resulting in the largest crypto heist in history. Approximately 401,000 ETH was stolen, valued at over $1.4B. Initial investigations suggest a combination of social engineering and infrastructure compromise enabled the exploit, not technical vulnerabilities in the software, which differs from some crypto attacks that exploit coding flaws.

The culprit? On-chain analytics from Chainalysis reveal that laundered proceeds have been consolidated into addresses linked to previous attacks by North Korea’s Lazarus Group, an entity commonly believed to be state-sponsored by the DPRK government. Chainalysis reports Lazarus Group stole $660.5M across 20 incidents in 2023 and $1.34B across 47 incidents in 2024, with the Bybit heist alone surpassing the 2024 total.

How it Happened

Bybit stored some of its funds in a widely used crypto security tool called Safe(Wallet), which requires multiple approvals (multi-signature) to move funds. This is similar to banks requiring multiple authorizations for large transactions. Hackers exploited a weakness in Safe (Wallet)’s backend infrastructure, allowing them to secretly alter transactions as they were being processed.

Instead of directly hacking Bybit’s wallets, the attackers gained access to Safe{Wallet}’s cloud storage system (AWS S3), where important software files were stored. According to Safe itself, this was accomplished by compromising a Safe employee’s computer. Using the hacked computer, the attackers modified a critical script that processed transactions, inserting hidden code that changed transaction details in real-time. This allowed them to replace Bybit’s legitimate security checks with a fraudulent version, making it appear as if the transactions were approved normally.

Because the fraudulent code was embedded in Safe (Wallet)’s legitimate website, Bybit’s security team and signers unknowingly approved legitimate-looking transactions that had been secretly altered on the backend. The attack was designed to activate only for specific accounts, such as Bybit’s, allowing the hackers to divert funds without triggering alarms.

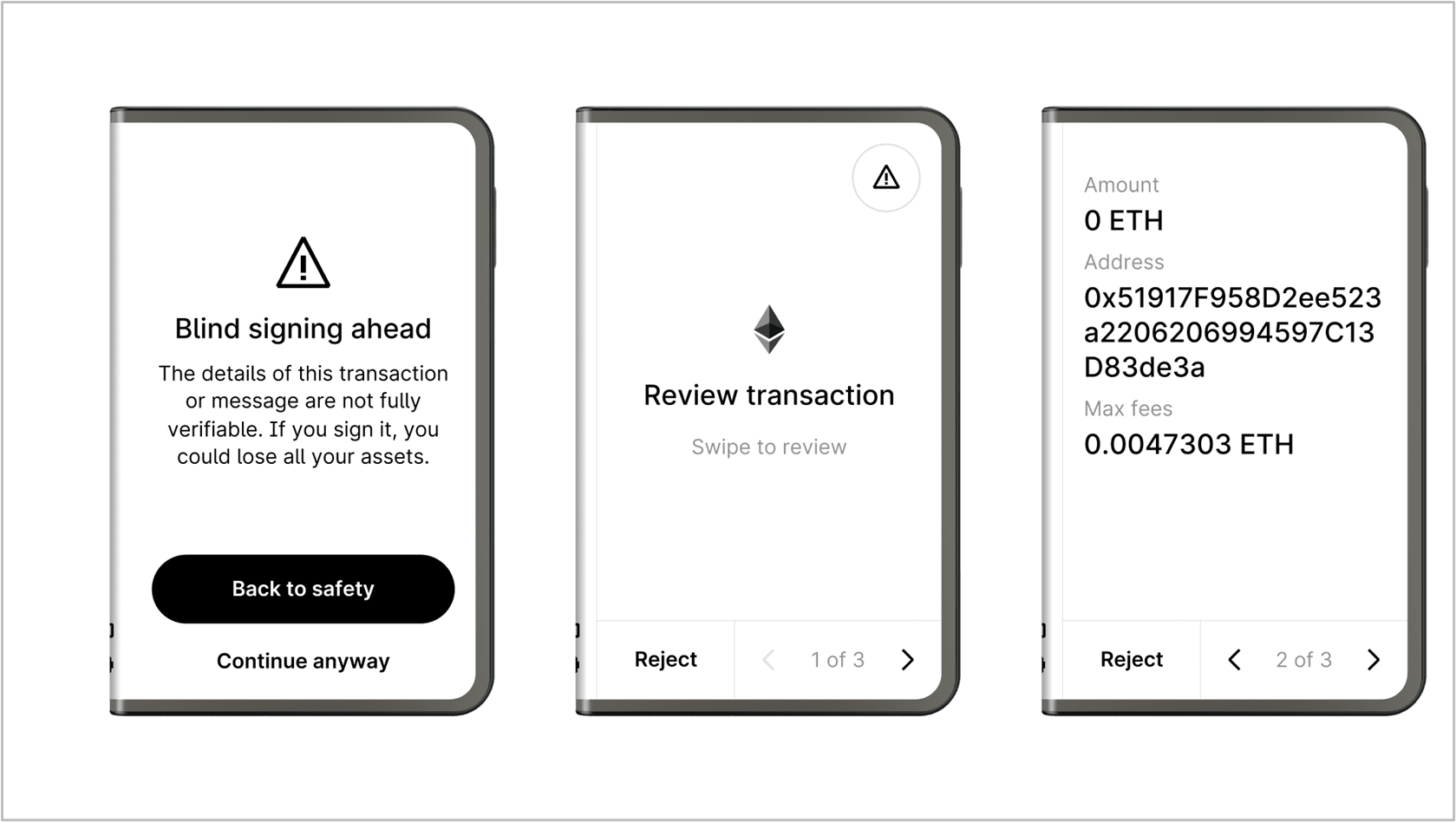

It is crucial to understand how blind signing contributed to this exploit. During the attack, Bybit’s signers used Safe(Wallet)’s web interface, which falsely displayed the intended transaction addresses and URL but masked the true, signing details to hide the malicious changes. This reliance on the web frontend led to blind signing—approving transactions without seeing their real content—because hardware wallets like Ledger couldn’t fully display Safe (Wallet)’s transaction details, forcing signers to depend on the compromised interface instead of secure devices. This vulnerability bypassed a key security benefit of hardware wallets: their air-gapped design, which keeps them offline and immune to online hacking, ultimately enabling the hackers’ deception.

Source: Ledger as of 02/26/2025. Not intended as a recommendation to buy or sell any securities named herein.

Had the signers been able to verify human-readable transaction details on their Ledger devices, instead of blindly approving hexadecimal data, this exploit likely would have been prevented.

Execution and Fallout

Once the malicious contract was approved, the attackers leveraged hidden backdoor functions, specifically sweepETH and sweepERC20, to drain Bybit’s cold wallet. The stolen assets were then distributed across multiple wallets, a tactic associated with sophisticated threat actors such as North Korea’s Lazarus Group.

Following the hack, Bybit temporarily halted certain wallet operations, including suspending Safe{Wallet} smart wallet functions to ensure platform security, as confirmed by the exchange. This led to significant operational disruptions, with users withdrawing approximately $5.5B in a single day, primarily from institutional accounts, causing delays in fund transfers. Bybit quickly replenished its reserves, securing nearly 447,000 ETH through emergency loans and large deposits from firms like Galaxy Digital and Wintermute, and maintained withdrawals open, but the incident rattled investor confidence, prompting a sharp drop in Ethereum and broader crypto market prices.

To restore trust, Bybit accelerated plans to enhance its security infrastructure, moving the majority of funds out of Safe (Wallet) cold wallets and evaluating alternative custody solutions, such as potentially requiring secure devices for transaction verification. Regulatory scrutiny has intensified, with the Singapore government and the U.S. FBI taking the issue seriously, investigating North Korea’s Lazarus Group’s role. The hack has also spurred a market-wide sell-off, with Bitcoin and Ethereum prices falling significantly, and some users shifting funds to self-custody, reflecting heightened concerns about centralized exchanges’ security.

However, Bybit has since engaged forensic investigators and has assured customers that funds remain secure, implying that the losses were from corporate reserves rather than user funds.

Further analysis found that the malicious JavaScript modifications were timestamped February 19, 2025, indicating that the attackers had infiltrated Safe(Wallet)’s infrastructure days before executing the attack.

This breach highlights the risks of multi-signature wallets that depend on third-party systems and reinforces concerns among crypto advocates about centralized exchanges like Bybit. It also strengthens the case for safeguards such as local multisig applications (instead of Safe{Wallet}’s web interface) and adopting open-source tools like pcaversaccio’s safe-tx-hash-util script. By leveraging ERC-712 standards, such tools enable users to verify transaction details, reducing the risk of relying on blind signing.

February’s Notable Performer – Sonic (S) (+21%)

Sonic & Berachain Led Trading Volumes Among Sub-$5B L1s in February

Source: DeFiLlama as of 02/2/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Sonic (S), the rebranded evolution of Fantom, outperformed the broader altcoin market in February, gaining 21% MoM after experiencing a ~70% peak-to-trough drawdown in January from its December highs. The token’s decline in December and January was driven by investor uncertainty following its transition from Fantom (FTM) to Sonic (S), such as Binance’s delisting of FTM. However, February saw a recovery in sentiment, supported by rising DEX volumes, increasing onchain activity, and renewed investor interest—driven particularly, in our view, by an airdrop scheduled for June.

Fantom vs. Sonic

As Fantom, the network saw significant adoption during the 2021-2022 bull market, reaching over $10B in Total Value Locked (TVL) by October 2021. It’s Opera network, capable of 200 transactions per second (TPS) and sub-600ms finality, provided an early advantage over Ethereum’s 12 TPS and ~60-second finality at the time. Much of this growth was attributed to Andre Cronje, the founder of Yearn Finance, whose departure in February 2022—later linked to SEC-related pressures—marked a shift in momentum. Cronje’s exit marked a turning point for Fantom, as it lost a key figurehead and a leader known for driving the project's vision and innovation. As bear market conditions worsened, Layer-1 alternatives such as Solana and Avalanche and Ethereum’s Layer-2 ecosystem further challenged the network’s position, eroding its mindshare as a high-throughput ecosystem.

Sonic’s migration, completed in January 2025, was intended to reestablish its competitive standing. The upgrade introduced a new Layer-1 blockchain with increased scalability—which claims 10,000 TPS and sub-1-second finality—alongside a 1:1 token swap from FTM to S.

Sonic’s Differentiation in 2025

February’s rally signals renewed confidence in Sonic’s ecosystem expansion. TVL surpassed $1B on February 20th, increasing ~413% from $195M just one month prior. Similarly, weekly DEX trading volumes grew 459%, from $152M in mid-January to $850M in mid-February, stealing market share from other alt-L1s like Mantle and competing with the highly anticipated Berachain launch, which has seen similar DEX volumes.

Sonic’s unique developer incentives have likely contributed to this momentum. Its Fee Monetization (FeeM) program allows approved applications to earn up to 90% of their users' transaction fees, creating a new revenue model for developers. Unlike traditional Layer-1 fee structures that primarily reward validators, Sonic’s FeeM model is inspired by Web2 ad-revenue systems (e.g., YouTube), enabling app developers to more directly share in the upside from the network adoption they bring

To attract retail demand, Sonic is conducting a 190.5M S token airdrop (~$132M at current prices), driving increased participation. Anticipation of free tokens has likely fueled February’s buying pressure as users position for eligibility. To discourage short-term speculation, only 25% of the airdrop is immediately claimable to discourage short-term speculation, while the remaining 75% vests over 270 days. Early claims incur steep, linearly decreasing penalties—90% after 30 days, 80% after 60 days, tapering to 0% at full vesting.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

Related Insights

DISCLOSURES

Index Definitions

S&P 500 Index: is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Nasdaq 100 Index: is comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

MarketVector Centralized Exchanges Index: designed to track the performance of assets classified as 'Centralized Exchanges'.

MarketVector Decentralized Finance Leaders Index: designed to track the performance of the largest and most liquid decentralized financial assets, and is an investable subset of MarketVector Decentralized Finance Index.

MarketVector Media & Entertainment Leaders Index: designed to track the performance of the largest and most liquid media & entertainment assets, and is an investable subset of MarketVector Media & Entertainment Index.

MarketVector Smart Contract Leaders Index: designed to track the performance of the largest and most liquid smart contract assets, and is an investable subset of MarketVector Smart Contract Index.

MarketVector Infrastructure Application Leaders Index: designed to track the performance of the largest and most liquid infrastructure application assets, and is an investable subset of MarketVector Infrastructure Application Index.

MarketVector Digital Assets 100 Large-Cap Index: market cap-weighted index which tracks the performance of the 20 largest digital assets in The MarketVector Digital Assets 100 Index.

MarketVector Digital Assets 100 Small-Cap Index: market cap-weighted index which tracks the performance of the 50 smallest digital assets in The MarketVector Digital Assets 100 Index.

MarketVector Meme Coin Index: modified market cap-weighted index which tracks the performance of the 6 largest meme coins. Meme coin refers to crypto assets often named after characters, individuals, animals, artworks, or other memetic elements. Initially supported by enthusiastic online traders and communities, these coins are intended for entertainment purposes.

Coin Definitions

- Bitcoin (BTC): A decentralized digital currency enabling peer-to-peer transactions without intermediaries or a central authority.

- Ethereum (ETH): A blockchain platform with smart contracts; its cryptocurrency Ether is second to Bitcoin in market capitalization.

- Solana (SOL): A high-performance blockchain with proof-of-stake and proof-of-history, powering decentralized applications via the SOL token.

- Tron (TRX): A blockchain platform focused on decentralizing content sharing and entertainment using the TRX cryptocurrency.

- Sui (SUI): A high-throughput, low-latency blockchain designed for scalability and powered by the SUI cryptocurrency.

- Ton (TON): A decentralized blockchain by Telegram optimized for scalability, featuring the TON token for transactions and dApps.

- BNB (BNB): The native cryptocurrency of Binance Chain, used for fees, staking, and applications in the ecosystem.

- Avalanche (AVAX): A high-speed, scalable blockchain platform using a unique consensus mechanism to support decentralized applications and custom blockchain networks.

- Cardano (ADA): A proof-of-stake blockchain platform designed for security and scalability, supporting smart contracts and decentralized applications.

- Sonic (S): The rebranded evolution of Fantom, a high-speed Layer-1 blockchain focused on scalability, decentralized applications and innovative fee structures.

- Ripple (XRP): A digital asset designed for payments and remittances, powering the Ripple network for fast and low-cost cross-border transactions.

- Fantom (FTM): A high-performance, scalable and secure smart contract platform designed for decentralized applications and digital assets, utilizing a Direct Acyclic Graph (DAG) consensus mechanism.

- Starknet (STRK): A Layer-2 zk-rollup network built on Ethereum, enhancing scalability through zero-knowledge proofs while maintaining decentralization and security.

Related Insights

03 February 2025