Will Strong Global Growth Lead to Disappointment?

27 November 2020

Our quarterly investment outlooks comprise our general observations on the market. Each quarter, we post a video with a short synopsis of one or two themes.

Overview

Despite a pandemic that has led large parts of the world to lockdown, global growth has been strong, which we previously noted in last quarter's investment outlook. We have seen this trend persist as we look at key indicators like global Purchasing Managers Indices (PMIs)—we are keeping a close eye on China’s PMIs and pace of recovery—and the price of copper, which is near four-year highs. Unemployment is also decreasing in the U.S., which is a very positive sign. The strong growth is not that surprising given the significant stimulus from fiscal spending and central banks lowering rates. In the later months of the summer, economies also started reopening from their lockdowns.

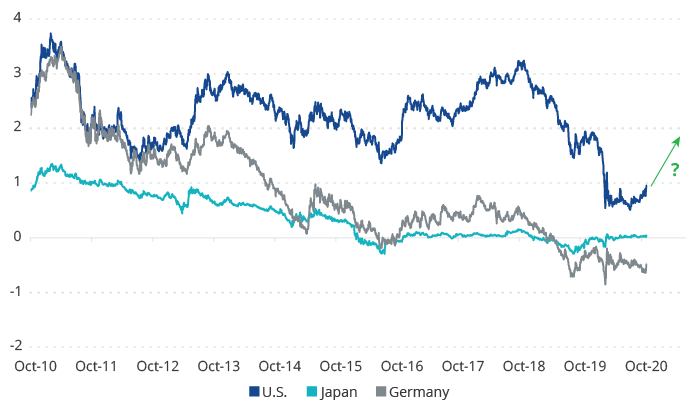

Will Global Growth Put Upward Pressure on Interest Rates?

Looking into 2021, my saying now is: “Prepare to be disappointed.” Not all forces are working in favor for financial markets. If global growth continues to be strong, it may push up 10-year interest rates. The increase may not be dramatic, but even a move up to 1.5-2% would not be great for stock and bond markets. It might not be too negative, but it won’t be positive. Put another way, there is a saying that “Not all that’s good for Wall Street is good for Main Street.” Well, the reverse can be true as well.

Continued Global Growth May Push Interest Rates Up

Source: Bloomberg. Data as of 10 November 2020. Past performance is not a guarantee of future results.

I think we have two scenarios to consider. First, this may be a goldilocks economy1, where we have lower-for-longer interest rates and financial assets continue to do fine. Second, if economic growth continues to strengthen heading into 2021 and puts upwards pressure on interest rates, then as I said, prepare to be disappointed.

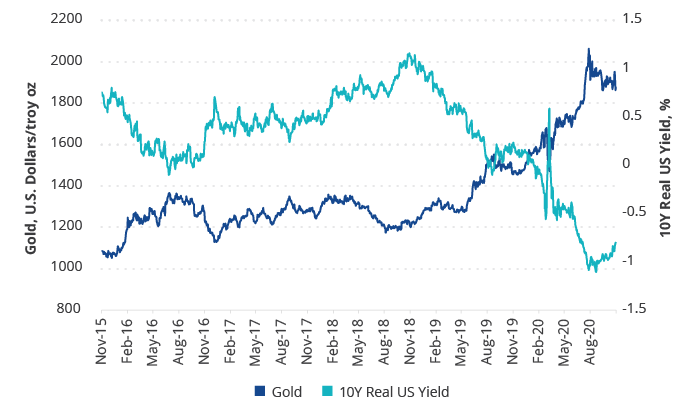

If nominal rates rise, we also have to look at what happens to real interest rates and what that means for gold. Nominal interest rates have come down, but because inflation is higher, real rates are negative. Negative real rates would be a dream scenario for gold.

If Nominal Rates Rise, Will Real Rates Rise, Hurting Gold?

Source: Bloomberg. Data as of 30 September 2020. Past performance is not a guarantee of future results. Chart is for illustrative purposes only.

What we need to watch for is if interest rates rise and inflation does not go up with it, that scenario will not be great for gold. A weaker dollar may help push inflation up and our overall bullish outlook on gold remains, but we do have this warning flag to raise. Additionally, there is a potential risk that long-term rates go up—but not until 2022 or 2023.

Still Believing in a Balanced Stock Market Portfolio

We pointed out this summer that growth stocks may be overheated. Since then, we have seen the stock market reorganize itself. Smaller cap stocks have been performing better, and value is having a bit of a day in the sun. And hot stock Tesla (TSLA) has not reached new highs, so far, from our summer outlook. Especially now, we believe investors should be seeking an equity exposure that’s not overly growth-oriented.

Higher interest rates could also benefit out-of-favor sectors like the financial sector. If global growth continues, then that may place upward pressure on oil prices as well and help lift the beleaguered energy sector. Both of these sectors may face some long-term challenges, but overall, equities should be fine.

How Investors Can Interpret the Election Results

Ahead of the election, our investment professionals shared their insights on the impact of the election on their respective asset classes and what investors can expect in the aftermath. Regardless of the results, we knew the Federal Reserve was going to try to keep rates lower for longer, and that is unlikely to change.

On fiscal policy, the Senate hawks that are worried about over-spending are likely to keep fiscal spending reigned in. That was one of the reasons a spending deal wasn’t reached before the election. If this is the case, then again, prepare to be disappointed. Some of the tailwinds for the stock market that were in place at the end of 2020 do not appear to be in place for 2021.

1A goldilocks economy is an economy that is not so hot that it causes inflation and not so cold that it causes a recession.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck Switzerland AG which has been appointed as distributor of VanEck products in Switzerland by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck Switzerland AG’s registered address is at Genferstrasse 21, 8002 Zürich, Switzerland.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Switzerland AG and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: First Independent Fund Services Ltd, Feldeggstrasse 12, 8008 Zurich, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Switzerland AG

Sign-up for our ETF newsletter

Related Insights

Related Insights

13 December 2024

06 August 2024

01 May 2024

12 February 2024