Fed Stimulus Clears Path for Gold Run

01 September 2020

The level of stimulus the Federal Reserve (Fed) has thrown at the economy this year is almost unprecedented and has investment consequences.

First, gold. Our outlook for gold has been bullish since the summer of 2019, and the case for gold investing has become more solid in recent weeks as gold rallied through its $1,800 per ounce technical resistance level and past its previous high of $1,921.

To help gauge how high gold could go, we looked at prior gold bull markets—which could be categorized as either inflationary or deflationary—as well as the persistence of negative real interest rates. Our base case now is that we are in a deflationary environment and, based on historical trends, gold’s price typically moves up two to three times in a deflationary cycle. This helped inform the $3,400 price target we have set for gold. (See prior gold bull markets here.)

Financial markets have also benefited from the Fed stimulus. And perhaps the surprise from this summer’s data is that the global economy is doing quite well, supporting the markets, despite the social distancing that we all feel in our personal lives. Important commodities like copper have regained pre-COVID highs. In addition, China’s industrial recovery is pointing to all-time highs in activity, even while the consumer activity is still below prior-year levels.

A Beneficiary: High Yield and Fallen Angel Bonds

In a recessionary environment, some bonds are going to default or be downgraded. Fixed income markets this year generally started recovering after the Fed announced plans to intervene. We have already seen a record amount of new fallen angel bond volume over $140B as of 31 July 20201—and expect more through the remainder of the year.

Similar to 2016, we have seen a lot of energy companies downgraded to become fallen angels, and the fallen angel strategy is buying those downgraded bonds. These new energy fallen angels are among the top contributors to performance of the fallen angel strategy so far this year. As long as the Fed remains supportive, we believe this strategy should continue to do well.

Fallen Angel High Yield Bonds vs. Broad High Yield Bond Market

31/12/2003 – 31/7/2020

Source: ICE Data Indices as of 31/7/2020. This chart is for illustrative purposes only. Broad High Yield Bond Market is represented by the ICE BofAML Global High Yield Index. Fallen Angel Global High Yield is represented by the ICE Global Fallen Angel High Yield 10% Constrained Index (HWCF). Index performance is not illustrative of fund performance. Indexes are unmanaged and are not securities in which an investment can be made. Current data may differ from data quoted. Past performance is no guarantee of future results. An investor cannot invest directly in an index. The results assume that no cash was added to or assets withdrawn from the index.

Risks to this Scenario

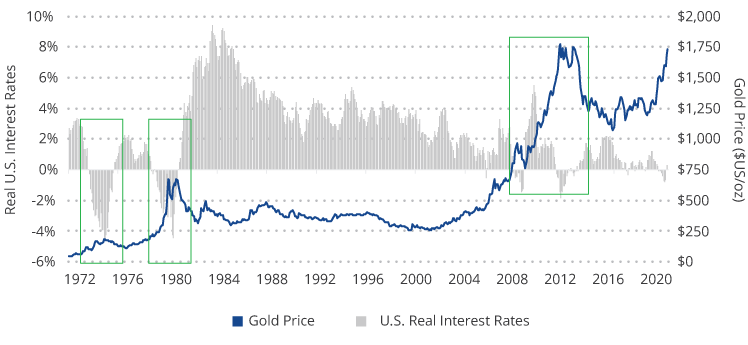

One risk to gold and bonds is if there were to be an unforeseen rise in interest rates in the U.S. This could come from a burst of inflation driven by supply chain issues or money supply growth, for example. This is not our “base case”, but it is possible. As we can see from the chart below, higher real interest rates are not good for gold.

Gold Price vs. Real Interest Rates

Source: VanEck, FactSet, Bloomberg. Data as of May 2020. Past performance is no guarantee of future results.

Another concern for the market is that the return to full employment may be bumpy. An incredible number of people have been laid off in the U.S. and, regardless of GDP numbers, people are unlikely to return to work at the same levels as the start of the year. Concern may be high enough for policy makers to take additional steps that may impact the financial recovery.

2020 Elections: Focus on Policies, not Politics

In our view, it is hard to invest according to politics, but it is important to look at the underlying policies and see if they are going to change. Regardless of who is elected in November, we don’t anticipate a big shift in Fed policy. As far as tax policy, we think there would have to be quite a degree of confidence in the economic recovery before any possible fiscal shock in terms of a big tax increase. In our view, investors should ignore all the political noise and make sure there is going to be a policy change before shifting their assets.

1Source: FactSet, ICE Data Indices, LLC and Morningstar.

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter

Related Insights

Related Insights

13 août 2024

06 août 2024

01 mai 2024

08 décembre 2023

06 août 2024

01 mai 2024

08 décembre 2023

10 octobre 2023