Chinas Wachstum wieder auf Kurs

09 April 2021

China leistet einen wesentlichen Beitrag zum globalen Wachstum, und seine wirtschaftliche Aktivität wirkt sich meist erheblich auf die Weltwirtschaft aus. Um zu verstehen, wo sich die chinesische Wirtschaft in ihrem Wachstumszyklus befindet, heben wir im Folgenden einige Schlüsseldiagramme hervor, die auch den Kontext für die Auswirkungen des Coronavirus liefern. Für Länder, die nach der COVID-19-Epidemie begonnen haben, sich wieder zu öffnen, bleibt China ein richtungweisender wirtschaftlicher Indikator.

Chinas jüngste Konjunkturdaten sollten alle verbleibenden Zweifel an der Erholung nach der Pandemie ausräumen. Die März-Zahlen sahen wirklich gut aus. Ja, dies war zum Teil auf die Saisonalität des chinesischen Neujahrs zurückzuführen, aber der Einbruch, der mit dem Wiederauftreten des Virus im Winter verbunden war, scheint vorbei zu sein. Das Ende der Lockdowns gab dem Einkaufsmanagerindex für das verarbeitende Gewerbe (PMI)1zusätzlichen Auftrieb - er stieg stärker als erwartet auf 51,9 - und insbesondere auch dem Dienstleistungs-PMI, der auf 56,3 anstieg. Letzteres war ein willkommenes Zeichen dafür, dass die Erholung ausgewogener wird.

Wichtige Indikatoren für die chinesische Konjunktur: PMIs

Quelle: Bloomberg. Stand der Daten: 31.3.2021. Die Wertentwicklung in der Vergangenheit ist keine Garantie für künftige Ergebnisse. Die Grafik dient nur zu Illustrationszwecken.

Auch die Details sahen beruhigend aus, darunter Auftragseingänge, Beschäftigung und neue Exportaufträge. Der PMI für kleine Unternehmen war wieder in der Expansionszone, obwohl die staatlichen Stellen hier nichts für selbstverständlich halten und bestimmte Arten von Steuererleichterungen für kleine und mittlere Unternehmen (KMU) bis zum Ende des Jahres ausweiten. Dies ist aus unserer Sicht ein kluger Schachzug, da die Finanzierungskosten für private Unternehmen trotz einiger Verbesserungen in den letzten Monaten immer noch schmerzhaft hoch sind.

Zum Verständnis des Kreditzyklus:

Quelle: UBS. Stand der Daten: 23.3.2021. Die Wertentwicklung in der Vergangenheit ist keine Garantie für künftige Ergebnisse. Die Grafik dient nur zu Illustrationszwecken. Die Messung der Spreads erfolgt relativ zur durchschnittlichen Rendite von Anleihen der China Development Bank mit einer Laufzeit von 1, 3, 5 und 10 Jahren.

Der allgemeine Branchenkonsens erwartet nun, dass die chinesische Wirtschaft in diesem Jahr real um 8,5% wächst.2 Das ist deutlich optimistischer als das offizielle Ziel von mehr als 6%.3 Was ist von dieser Differenz zu halten?

Die offensichtlichste Schlussfolgerung ist, dass die Behörden den politischen Stimulus weiter zurücknehmen werden. Die Fortsetzung der Steuererleichterungen für KMUs lässt jedoch vermuten, dass der Rückzug ebenso zielgerichtet erfolgen wird wie der Konjunkturimpuls selbst, ohne zu viele scharfe Wendungen.

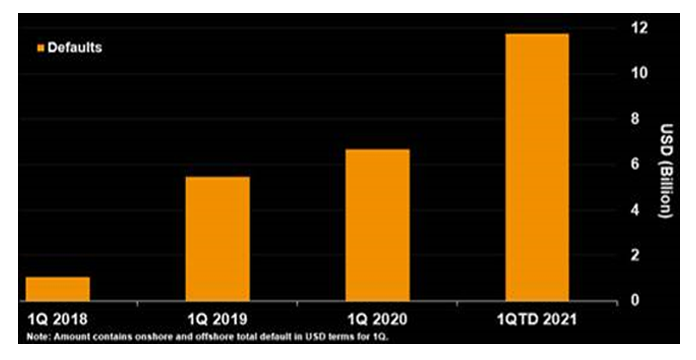

Ein stärker als erwartetes Wachstum kann die Behörden weiter ermutigen, die Regulierung in einigen Bereichen zu verschärfen (z. B. bei Umwelt- und Ökologiefragen und überhitzten Sektoren wie dem Immobiliensektor) und das Moral-Hazard-Risiko zu verringern, indem mehr Unternehmensausfälle, auch von staatseigenen Betrieben, zugelassen werden. Chinas Q1-Statistik für Unternehmensausfälle ist in dieser Hinsicht recht aufschlussreich, da die Ausfälle trotz des wirtschaftlichen Gegenwinds durch den Winterausbruch von COVID weiter zunahmen. Wir sind uns bewusst, dass Unternehmensausfälle mit höheren Kreditrisiken verbunden sein können, aber sie können auch ein Zeichen für ein reiferes System sein, das einzelne Wirtschaftsakteure nicht ewig verhätscheln will.

Unternehmensausfälle in China nahmen im 1. Quartal weiter zu

Quelle: Bloomberg LP

1Der Einkaufsmanagerindex (PMI) ist ein Konjunkturindikator auf der Grundlage monatlicher Befragungen von Unternehmen im Privatsektor. Ein Wert über 50 deutet auf Wachstum hin, ein Wert unter 50 signalisiert eine Kontraktion. Unseres Erachtens sind PMIs ein besserer Indikator für die Gesundheit der chinesischen Wirtschaft als das Niveau des Bruttoinlandsprodukts (BIP), das politisiert ist und ohnehin ein Kompositum darstellt. Die PMIs für das verarbeitende und das nicht verarbeitende Gewerbe (d. h. den Dienstleistungssektor) wurden getrennt, um ein besseres Verständnis der einzelnen Sektoren der Volkswirtschaft zu ermöglichen. Derzeit glauben wir, dass der PMI des verarbeitenden Gewerbes die Kennzahl ist, die man im Hinblick auf den Konjunkturzyklus beobachten sollte.

2Quelle: Bloomberg

3Quelle: https://www.wsj.com/articles/china-sets-2021-gdp-growth-target-at-over-6-11614907661

Wichtige Hinweise

Ausschließlich zu Informations- und/oder Werbezwecken.

Diese Informationen stammen von VanEck (Europe) GmbH, die von der nach niederländischem Recht gegründeten und bei der niederländischen Finanzmarktaufsicht (AFM) registrierten Verwaltungsgesellschaft VanEck Asset Management B.V. zum Vertrieb der VanEck-Produkte in Europa bestellt wurde. Die VanEck (Europe) GmbH mit eingetragenem Sitz unter der Anschrift Kreuznacher Str. 30, 60486 Frankfurt, Deutschland, ist ein von der Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) beaufsichtigter Finanzdienstleister. Die Angaben sind nur dazu bestimmt, Anlegern allgemeine und vorläufige Informationen zu bieten, und sollten nicht als Anlage-, Rechts- oder Steuerberatung ausgelegt werden. Die VanEck (Europe) GmbH und ihre verbundenen und Tochterunternehmen (gemeinsam „VanEck“) übernehmen keine Haftung in Bezug auf Investitions-, Veräußerungs- oder Retentionsentscheidungen, die der Investor aufgrund dieser Informationen trifft. Die zum Ausdruck gebrachten Ansichten und Meinungen sind die des Autors bzw. der Autoren, aber nicht notwendigerweise die von VanEck. Die Meinungen sind zum Zeitpunkt der Veröffentlichung aktuell und können sich mit den Marktbedingungen ändern. Bestimmte enthaltene Aussagen können Hochrechnungen, Prognosen und andere zukunftsorientierte Aussagen darstellen, die keine tatsächlichen Ergebnisse widerspiegeln. Es wird angenommen, dass die von Dritten bereitgestellten Informationen zuverlässig sind. Diese Informationen wurden weder von unabhängigen Stellen auf ihre Korrektheit oder Vollständigkeit hin geprüft noch können sie garantiert werden. Alle genannten Indizes sind Kennzahlen für übliche Marktsektoren und Wertentwicklungen. Es ist nicht möglich, direkt in einen Index zu investieren.

Alle Angaben zur Wertentwicklung beziehen sich auf die Vergangenheit und sind keine Garantie für zukünftige Ergebnisse. Anlagen sind mit Risiken verbunden, die auch einen möglichen Verlust des eingesetzten Kapitals einschließen können. Sie müssen den Verkaufsprospekt und die KID lesen, bevor Sie eine Anlage tätigen.

Ohne ausdrückliche schriftliche Genehmigung von VanEck ist es nicht gestattet, Inhalte dieser Publikation in jedweder Form zu vervielfältigen oder in einer anderen Publikation auf sie zu verweisen.

© VanEck (Europe) GmbH

Jetzt zum Newsletter anmelden

Verwandte Einblicke

Related Insights

06 August 2024

01 Mai 2024

13 Dezember 2024

06 August 2024

01 Mai 2024

08 Dezember 2023