Moat Index Review: Value Is In, Facebook Is Out

29 September 2020

The Morningstar® Wide Moat Focus IndexSM (the “Index”) completed its quarterly review on Friday, 18 September 2020. The first quarter and second quarter reviews saw more significant changes to the index, as its process of identifying attractively priced wide moat companies was more noteworthy during and following the market turbulence of earlier this year. Notable in this quarter’s review is the continuation of several of the key trends of the year. Here are our main takeaways from the latest rebalance.

Unfriended: Facebook Removed from Moat Index

The Index’s shift from big tech formally began in June and took one step further last week as Facebook (FB) was removed from the Index. Facebook’s stock price premium to Morningstar’s assessment of its fair value signaled an opportunity to lock in gains relative to other opportunities in the wide moat universe.

Facebook has notably been an index member off and on since its IPO in May 2012 and has a track record of supporting Index returns during those periods. With the volatility big tech has faced in recent weeks, time will tell if Facebook rejoins the Index in the future. For now, the only big tech names in the Index remain Amazon (AMZN) and Microsoft (MSFT), which together account for just over 2% weighting at present. This compares to a combined weighting of more than 22% in the S&P 500 Index for Facebook, Apple, Amazon, Netflix, Google and Microsoft. The steady increase in stock prices for many of these stocks recently is bringing them at or above fair value, according to Morningstar, and there simply remain too many other attractively valued opportunities in the U.S. wide moat universe.

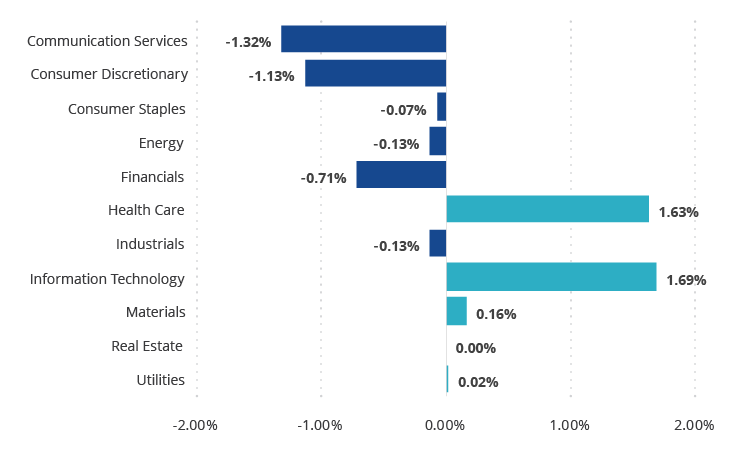

Modest Sector Shifts

Despite the removal of Facebook, the tech sector saw a slight increase in weight following the September review. Health care, a long-time overweight, also saw a slight increase in its exposure, while those gains resulted in similar reductions to communications services, consumer discretionary and financials.

Five Sectors Account for Minor Repositioning of Moat Index

As of 21 September 2020

Source: Morningstar. Changes in sector weightings from 18/9/2020 to 21/9/2020 displayed above.

The decreases in consumer discretionary and communications services are logical to see as they are two of the top performing sectors in the U.S. market in 2020. Tech is far and away the top performing sector in the market this year, yet interestingly, the Index’s tech exposure increased modestly. This is due mainly to an increase in semiconductor exposure, which has underperformed the broader tech sector this year. Applied Materials (AMAT) saw its position increased during the review and new entrant Lam Research Corp. (LRCX) was added following a recent economic moat rating upgrade from narrow to wide moat earlier this year. Cost advantages and intangible assets drive LRCX’s wide economic moat, according to Morningstar. Its research and development cost advantages over smaller peers and intangible assets related to equipment design from service contracts and customer collaboration leave LRCX well-positioned relative to competition in the chip manufacturing industry. It is an industry leader in the dry etch process and a prominent player in the deposition segment. Both of these processes combined are critical to chip fabricating.

Nike (NKE) and Facebook (FB) drove the consumer discretionary and communication services sector weighting lower as they both became too rich to remain in the Index. Over and underweights relative to the S&P 500 Index that have been in place for much of the year remain.

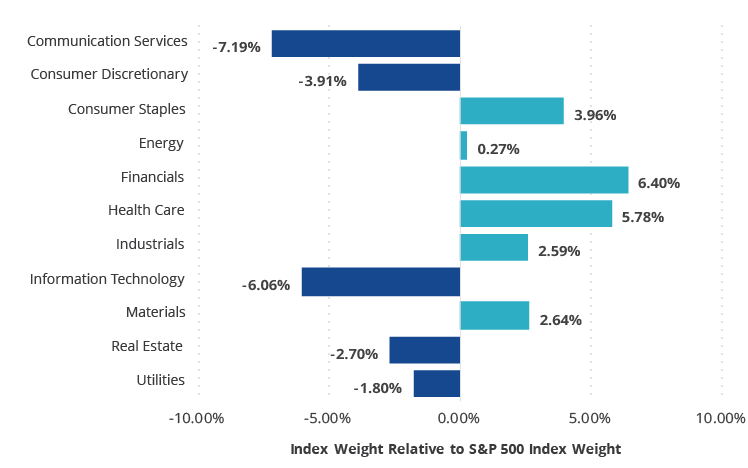

Financials and Health Care Remain Top Overweights in Moat Index

As of 21 September 2020

Source: Morningstar.

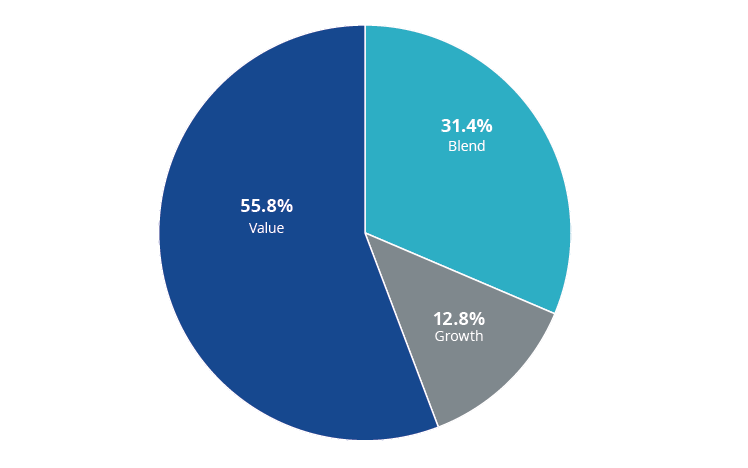

Moat Index Style: Value Over Growth

The Index’s style exposure to growth companies remains low relative to historical averages. At times in the past when growth exposure has decreased, much of that decrease was offset by “core” or “blend” exposure, which are companies that exhibit characteristics of both value and growth. Now the Index is skewed more heavily to value companies and has one of its highest exposures to value historically.

Value Exposure in Moat Index at All Time Highs

Morningstar Wide Moat Focus Index as of 9/21/2020

Source: Morningstar.

The last time the Index had anywhere near this level of exposure to value companies was in mid-2018, shortly before the so-called “tech wreck” that coincided with the breakdown of U.S./China trade negotiations in the fourth quarter and subsequent market selloff led by tech stocks. Prior to 2018, the Index has never had as much as 50% exposure to value companies.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck Switzerland AG which has been appointed as distributor of VanEck products in Switzerland by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck Switzerland AG’s registered address is at Genferstrasse 21, 8002 Zürich, Switzerland.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Switzerland AG and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: First Independent Fund Services Ltd, Feldeggstrasse 12, 8008 Zurich, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Switzerland AG

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

14 February 2025

20 January 2025

15 January 2025

17 December 2024