High Yield Shines Among EM Corporate Bonds

25 June 2019

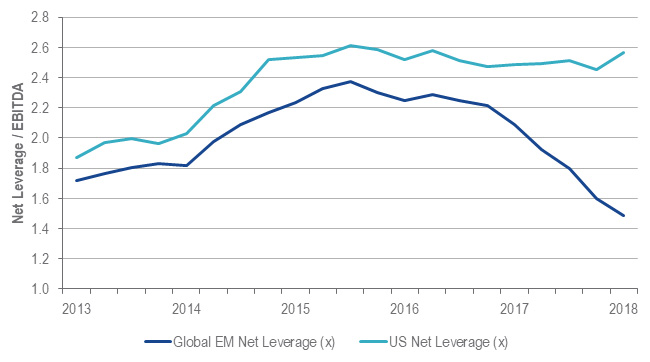

Relative to the U.S., emerging markets corporate bond markets are exhibiting healthier and improving credit metrics. This is illustrated by the dramatic decline in net leverage over the past three years, compared to U.S. levels that have not shown the same improvement.

Emerging Markets vs U.S. Net Leverage

Source: Bank of America Merrill Lynch. Data as of May 2019.

This decline has been driven by lower debt levels and higher revenue growth, particularly in the high yield segment of the market. High yield total debt has declined 5% versus one year ago, with Latin America and EMEA posting the highest declines.1 Total debt among Asian high yield issuers showed a small increase of 3% and EBITDA growth among those issuers in 2018 was the strongest versus other regions, although all regions posted increases.2

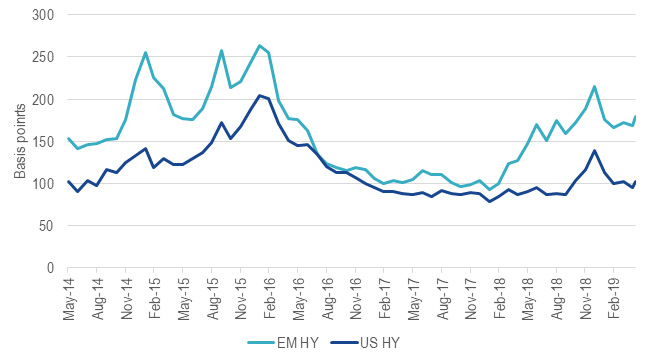

For emerging markets high yield bond investors, the ultimate question is whether there is adequate compensation for the risk being taken, both on an absolute basis and relative to other asset classes. The recent widening in credit spreads in conjunction with improved fundamentals has resulted in what we believe is a potentially attractive risk/reward tradeoff in emerging markets high yield corporate bonds.

Spread per Turn of Net Leverage

Source: Bank of America Merrill Lynch. Data as of May 2019.

DISCLOSURE

1Source: Bank of America Merrill Lynch.

2Source: Bank of America Merrill Lynch.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck Switzerland AG which has been appointed as distributor of VanEck products in Switzerland by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck Switzerland AG’s registered address is at Genferstrasse 21, 8002 Zürich, Switzerland.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Switzerland AG and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: First Independent Fund Services Ltd, Feldeggstrasse 12, 8008 Zurich, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Switzerland AG

Sign-up for our ETF newsletter

Related Insights

Related Insights

08 January 2025

06 August 2024

23 July 2024

05 July 2024

29 May 2024