Ethereum Staking 101

16 May 2024

Read Time 5+ MIN

Regarding our recent announcement regarding Staking on Ethereum with the VanEck Ethereum ETN, you may be wondering what is “Staking” and how can a regulated financial product such as the VanEck Ethereum ETN participate in the security of the Ethereum network? In order to address these questions, we will cover various topics on staking, starting with a brief refresher on Ethereum and why we need decentralized consensus in the first place.

Bitcoin, Ethereum, and many other cryptocurrencies operate on a decentralized system, where no single entity can alter the ledger without the consensus of the majority. This removal of intermediaries empowers participants to collectively uphold the ledger's integrity. But how is this ledger protected from tampering? Bitcoin achieves this through Proof of Work, where miners must solve complex puzzles to create blocks, preventing falsification through verifiable proof. In essence, the cost of double spending outweighs any potential gain. Ethereum, on the other hand, has transitioned from Proof of Work to Proof of Stake. This system incentivizes validators to uphold the ledger's integrity by staking capital, which they risk losing if caught cheating. This shift from electricity-based to capital-based security ensures the network's stability while rewarding positive contributions. In simpler terms, Ethereum's validators safeguard the network's operations, akin to service providers, with staking rewards reflecting their role. So, who are these validators?Ethereum’s Top 10 Staking Service Providers

|

Name |

Type |

Ethereum Staked (Ξ) |

# of Validators |

Market Share |

Ethereum Earned (Ξ) |

|

Lido |

Liquid Staking |

9,341,660 |

292k |

28.60% |

537k |

|

Coinbase |

CEXs |

4,421,538 |

138k |

13.50% |

292k |

|

ether.fi |

Liquid Restaking |

1,184,800 |

37k |

3.60% |

5k |

|

Kiln |

Staking Pools |

1,120,288 |

35k |

3.40% |

24k |

|

Binance |

CEXs |

1,072,960 |

34k |

3.30% |

148k |

|

Renzo |

Liquid Restaking |

1,006,080 |

31k |

3.10% |

3k |

|

Figment |

Staking Pools |

841,344 |

26k |

2.60% |

44k |

|

Rocket Pool |

Liquid Staking |

789,916 |

25k |

2.40% |

37k |

|

Kraken |

CEXs |

767,553 |

24k |

2.30% |

138k |

|

Staked.us |

Staking Pools |

617,212 |

19k |

1.90% |

66k |

Source: Dune, data as of 09/05/2024. Historical performance is no guarantee for future results. This should not be interpreted as advice for specific service providers. Additionally, some service providers are such as Lido are outsourcing the actual node management to other providers.

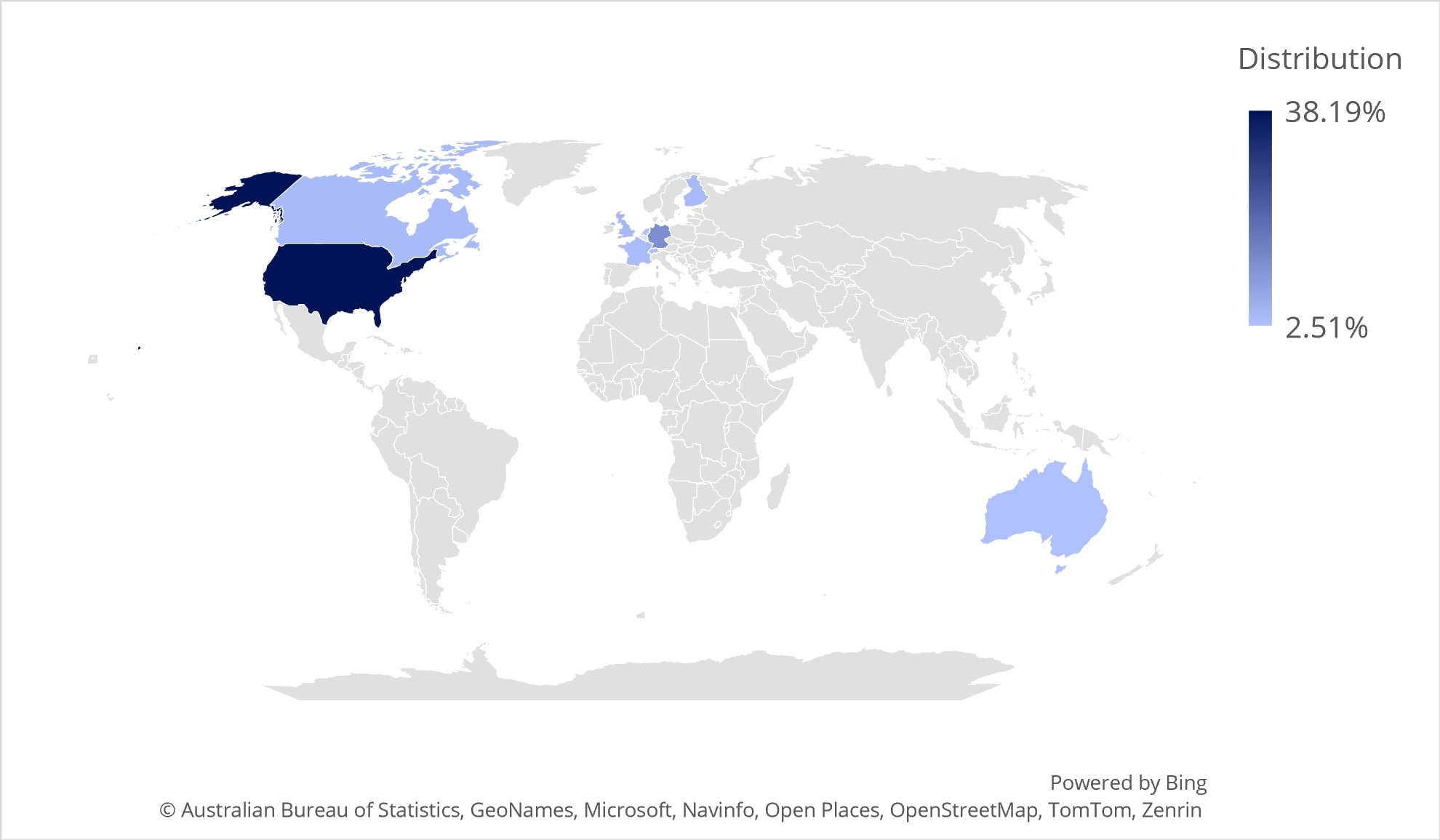

A common misconception is that staking and even mining (in Bitcoin) is done by mostly by companies in countries like China and Russia. This is far from the truth, the approximate geographical distribution for professional staking entities is more like the following (excluding “Other countries” which accounts for 21.64%):

Geographical Distribution of Staking Entities

Source: Rated.network, data as of 09/05/2024.

What are staking rewards?

Now, delving a bit deeper into the technical aspects of staking is essential for a thorough understanding of the technology. It's worth noting that the specific mechanisms of staking vary across different protocols. For Ethereum, the process unfolds as follows: A prospective validator deposits a minimum of 32 ETH (or multiples thereof) into the Ethereum Staking contract, alongside pertinent data including the public keys of the validator and withdrawal address. Upon successful validation of the deposit by the network, the validator joins the Entry Queue, essentially a waiting list for new validators. Upon reaching the front of the queue, the validator becomes active and is entrusted with fulfilling its duties henceforth. Active validators remain in this state until either their balance falls below 16 ETH due to slashing or they voluntarily exit the system. Rewards accrue from two categories:

- Execution layer rewards (encompassing block rewards, transaction fees, priority fees, and MEV) and Consensus layer rewards (which include attestations, validations and participation in committees when chosen). These rewards are approximately 20% of the total reward package (historically).

- Consensus rewards are distributed every epoch (approximately every 6.4 minutes), while execution rewards are paid when the validator is selected to propose a block. These rewards are approximately 80% of the total reward package (historically).

Execution layer rewards are not predefined, they are wildly variable and also only given if your validator is chosen to propose the next block. Keep in mind that there are currently over 1 million validators, and there is just 1 block per 12 seconds. If you have just one validator, the chance of being selected to propose a block is 0.71% on a daily basis. This means that the average number of days it takes to receive one block proposal is about 140 days. For the VanEck Ethereum ETN, with the current staked percentage, we represent 725 validators. About 5 Ethereum blocks per day are proposed by our validator nodes. Investing in the VanEck Ethereum ETN comes with the additional benefit of actively contributing to Ethereum’s security and decentralization.

Average Staking Rewards (30d)

|

|

APR % |

Rewards per validator (in ETH) |

|

Network total |

3.56% |

+1.139 ETH |

|

Consensus Layer APR % |

2.87% |

+0.918 ETH |

|

Execution Layer APR % |

0.69% |

+0.221 ETH |

Source: Rated.network, Data as of 09/05/2024. Historical performance is no guarantee for future results. Staking rewards are not guaranteed and the staking yield shown is not an indication for future staking yields.

How does Staking work in Practice for the VanEck Ethereum ETN?

Our staking methods are entirely non-custodial, ensuring that the custodian of the ETNs assets retains full control over the staked assets, thus eliminating any lending risks. For investors in the Ethereum ETN, no action is required to receive rewards; they are automatically factored into the coin entitlement of the ETN. Whether an investor acquired the ETN last year or last week, the total staking rewards accrued during the previous timeframe are equally distributed (after deducting staking provider fees and taxes). Staking rewards* are included in the end-of-day NAV on a daily basis, with a cut-off point at 4 pm CET. So, how does staking work in practice for the ETN?

- VanEck utilizes the ETN's collateral for staking by instructing the custodian to deposit ETH into a validator deposit address. While the validator node is owned and maintained by the staking provider, control of the deposited ETH remains with the custodian, securely stored in cold storage.

- Once deposited, the validator node continuously receives consensus layer and execution layer rewards. These rewards are reinvested, and sometimes staked again, into the note on a daily basis, reflecting in the ETN's performance.

- This process is meticulously managed, scaling up or down as needed to ensure the Ethereum ETN remains redeemable on any business day. Rigorous processes and monitoring are in place to effectively manage the liquidity requirements of the ETN.

*Staking Rewards are not guaranteed.

To receive more Digital Assets insights, sign up in our subscription center.

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck Switzerland AG which has been appointed as distributor of VanEck products in Switzerland by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck Switzerland AG’s registered address is at Genferstrasse 21, 8002 Zürich, Switzerland.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Switzerland AG and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: First Independent Fund Services Ltd, Feldeggstrasse 12, 8008 Zurich, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Switzerland AG

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

16 January 2025

27 November 2024

27 November 2024