EM Hiking Cycle – The End Is Nigh?

29 July 2022

Read Time 2 MIN

EM Rate Expectations

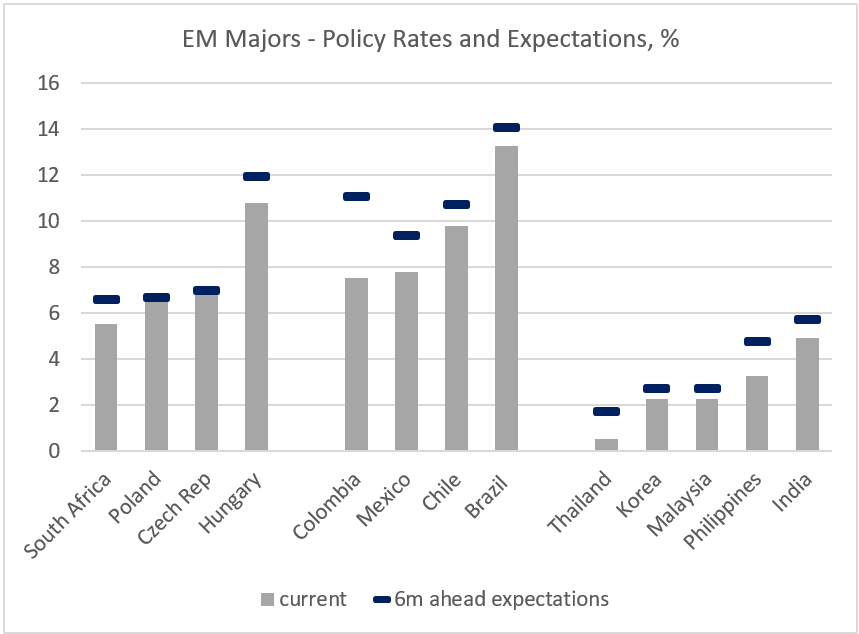

The peak rates chatter refuses to go away – and there are good reasons for that. First, emerging markets (EM) central banks frontloaded a lot of rate hikes, and real policy rates adjusted by expected inflation are now very positive (maybe even contractionary) in quite a few EMs. The recent “super-sized” and off-cycle rate hikes helped to cement this perception, and the market (mostly swap curves) now see no additional tightening in most of Central Europe (Poland, Czech Republic) and relatively small hikes in parts of EM Asia (South Korea, Malaysia – see chart below). Colombia’s expected 150bps rate hike this afternoon will narrow the largest gap between the actual and the expected policy rate among major EMs. And Brazil’s +50bps move in early August will bring it one step closer to the end of the tightening cycle.

Inflation Peaks

The second point is that even though inflation is still extremely high across EM – especially in EMEA and LATAM – it might finally be peaking in some countries. Brazil’s mid-month inflation definitely fits that definition. Poland’s annual headline inflation was unchanged in July (at 15.5%, but a small downside surprise nevertheless). Some commentators pointed out that the sequential momentum in Poland’s core inflation appears to be easing, and that the central bank might use these developments to keep the policy rate on hold in September – which would be a mistake, in our opinion, as the real policy rate is way too negative (however you measure it).

EM Growth Headwinds

Finally, there are lingering concerns about an H2 growth “cliff” in parts of EM. The latest growth/activity prints in some EM were above consensus – including today’s Q2 GDP releases in the Czech Republic and Mexico – but many economists believe that slowdown is already underway in many countries (according to high-frequency indicators), with growth dropping below potential in the coming months. These concerns/observations explain why the next batch of activity surveys (Purchasing Managers Indices, or PMIs) will be closely watched. This would be the first set of PMIs for Q3 – so if we see more “contractionary” PMI prints (<50.0), H2 growth forecasts might be cut even further. Have a great weekend and stay tuned!

Chart at a Glance: How Much Room Left for Rate Hikes in EM?

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.