EM Hawks – Changing of the Guard

08 June 2022

Read Time 2 MIN

EMEA hawks are descending, but EM Asia hawks are now firmly in charge, with India going for a larger than expected rate hike and Thailand’s central bank signaling a near-term liftoff.

Slower Pace of Tightening In EMEA

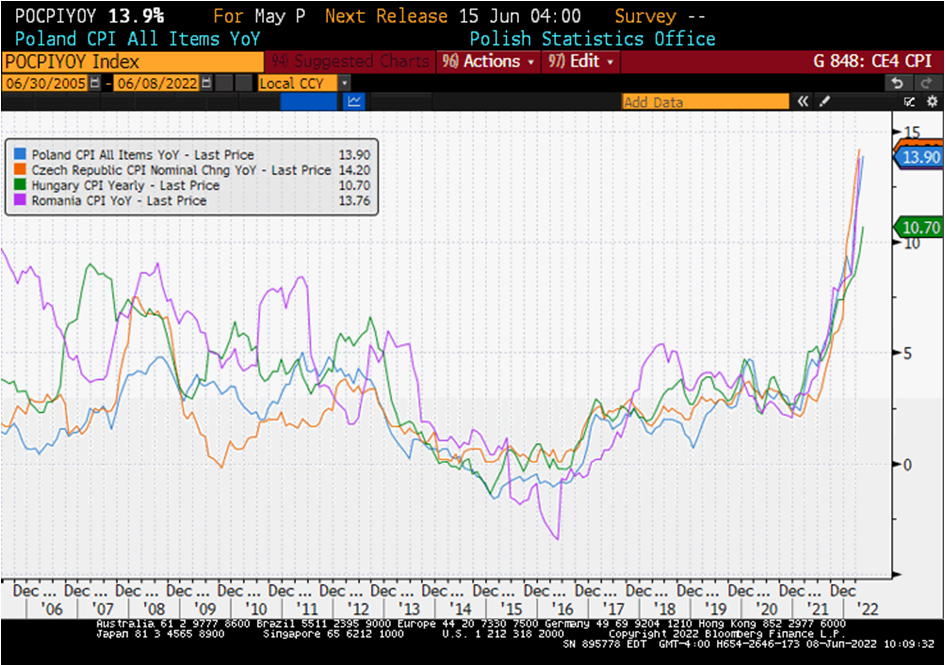

Emerging Markets (EM) Asia’s monetary policy hawks are spreading their wings and getting more confident, but their peers in EMEA are suffering setbacks. And we are not talking about policy outliers such as Russia and Turkey – the latter’s dovish “overdrive” appears to be catching up with the currency, which weakened by more than 200bps vs. U.S. Dollar today (at 9:25am ET, according to Bloomberg LP). Poland delivered the expected 75bps hike today, but President of the Czech Republic Miloš Zeman sounded a bit “Erdogan-ish” in his comments about “other tools to tame inflation”. The Czech National Bank (CNB) is also facing a major board overhaul, with several prominent hawks being replaced by more dovish colleagues. This is the reason why the CNB’s next rate-setting meeting will be closely watched – there is a possibility of a large “goodbye” rate hike from outgoing Governor and his like-minded board members, especially if Czech inflation surprises to the upside this Friday. It’s worth noting that headline inflation in all four Central European countries is now in double digits, after Hungary joined the “club” this morning with an upside surprise (see chart below).

EM Asia Bets on Rate Hikes Frontloading

Going back to EM Asia, hawks are firmly in charge in the Indian central bank – we’ve got a larger than expected 50bps rate hike this morning, which is a nice policy follow-through after the emergency hike in May. “Rate Hikes Frontloading” is the name of the game in India, with at least 125bps more expected in the next six months. Thailand kept the policy rate unchanged today, but it was definitely a hawkish hold. The vote was very close (3 out of 4 members voting for a 25bps hike), and the statement signaled a near-term liftoff, followed by more hikes, because the economy is doing better than expected and the tight labor market is expected to put more pressure on core prices.

Monetary Policy Surprises In LATAM?

Compared to the exciting developments in EMEA and EM Asia, LATAM’s monetary policy landscape looks boring – well, almost. The Chilean central bank exemplifies this steady and orthodox approach, continuing the tightening cycle with the expected 75bps rate hike. This brings the total amount of hikes to 850bps – enough to push the real policy rate based on expected inflation to around 4%, but not enough to turn the inflation tide (headline inflation accelerated to 11.5% year-on-year in May). Elsewhere in LATAM, the consensus sees a smaller 50bps hike in Brazil next week (on the “boring” side as well), but Mexico might surprise with larger policy frontloading (+75bps) at the end of the month if inflation proves higher than expected. Stay tuned!

Chart at a Glance: Central Europe Inflation – Double Digits Reality

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.