VanEck Crypto Monthly Recap for October 2024

05 November 2024

Read Time 10+ MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Bitcoin outperformed all major crypto tokens and asset classes again in October, +11% vs. the S&P 500 and Nasdaq, both -1%, MSCI All Country World Index (ACWI), -2 %, and the Bloomberg Global Bond Aggregate -3.4% which was its worst month in more than 2 years. Investors flooded into Bitcoin ETPs (+$3.3B), sending Bitcoin’s dominance to new highs for the cycle above 60%. Market breadth was poor, as more than 60% of our watch list fell in October, and small caps continued to underperform, down 9%.

- Ethereum Stakeholders Debate Its Future

- Ethereum L2s’ Decentralization Efforts

- How Ethereum Can Restore Confidence

- Solana Sees Dramatic Increase in Usage

- Solana vs. Ethereum: Analyzing Memecoin, NFT, and Wash Trading Revenues

Among the winners, high-throughput Layer 1 smart contract platforms outperformed sharply, with APT (+18%), SOL (+10%), and SUI (+15%). Laggards for the month included Near (-23%), Polygon (-19%), and TON (-15%).

Some may be surprised to see BTC and ETH volatility fall in October (-11%) and (-4.5%) heading into the election to levels not seen since mid-summer. However, this is directly parallel to the 2020 action. As we have detailed in recent notes, we expect volatility to rise on election night.

Price Returns

| October (%) | YTD (%) | |

| MV Global Digital Assets Equity Index | 13 | 29 |

| Bitcoin | 11 | 65 |

| Coinbase | 2 | 4 |

| MarketVector Meme Coin Index | 2 | NA |

| MarketVector Smart Contract Leaders Index | -1 | 3 |

| S&P 500 Index | -1 | 20 |

| Nasdaq Index | -1 | 21 |

| Ethereum | -3 | 9 |

| MarketVector Decentralized Finance Leaders Index | -9 | -18 |

| MarketVector Infrastructure Application Leaders Index | -15 | -28 |

Source: Bloomberg as of 10/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Ethereum Stakeholders Debate Its Future

ETH/BTC Made New Lows in October

Source: Artemis XYZ as of 10/30/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

While Ethereum’s ETH (+3%) performed well this month relative to most Layer 1s, it continues to fall against Bitcoin, with ETH/BTC down (-9.5%) in October to new cycle lows. Amid the sour price action, some members of the Ethereum community, such as Doug Colkitt and Max Resnick, are pushing for a new direction. Principally, they believe Ethereum should focus on bringing more transactions to its L1 to accrue more value. On the flip side, Ethereum’s core development team believes ETH’s long-term value accrual comes from ETH being considered money. This group believes Ethereum’s scaling through L2s will bring in 100s of millions of users who will need ETH to use the chains. Vitalik Buterin, the unofficial leader of Ethereum’s development and strategy, reasserted his roadmap for Ethereum to become a neutral network that can service the world’s financial needs. The waypoints towards his “north star” include:

- Scale Ethereum transaction throughput through trust-minimized L2 blockchains

- Maximize interoperability between L2 blockchains

- Create cheap, abundant blockspace for L2s to settle to Ethereum

- Maintain an extensive network of globally distributed, credibility-neutral validators

- Minimize extractive activities like MEV

- Build an economic system that prevents the centralization of Ethereum infrastructure.

ETH Decentralized Exchange (DEX) Volume Share Hits All-Time Low

Source: Artemis XYZ as of 10/30/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

In the near term, Ethereum’s roadmap has driven much of its financial activity to lower-cost L2s. Though these L2s charge ETH for transactions, Ethereum’s drive to lower fees for these L2s has reduced Ethereum’s overall revenues. This dynamic is reflexive as it causes less demand by users of Ethereum and its L2s to buy ETH. Because ETH is a commodity, its value is derived explicitly from the demand to use it. The above dynamic, along with anemic ETH ETP inflows, have led to ETH’s relative price malaise in 2024.

ETH’s long-term success hinges on attracting substantial L2 activity to use Ethereum’s “blob space” to accelerate demand growth for ETH. The current amount of L2 activity is around 300 transactions per second (TPS), which has proven inadequate for preventing a shift in the economic take rate between ETH and its L2s. This challenge could persist until an Ethereum L2 goes truly viral. A pivot point might occur when Ethereum TPS grows high enough to increase ETH burn (from fees) enough to offset ETH issuance through inflation. Using the well-crafted Ethereum Scenario Analysis page, we find this point to be a sustained TPS of around 600. This assumes blob space of 3/6 - target/max, and transaction size remains around 112.5 bytes.

However, over the next year, Ethereum will likely increase blob space to 4/8 - target/max. At the same time, L2s will add new compression technology to reduce the blob space they use on Ethereum. In fact, on 10/29/2024, Starkware demonstrated a transaction size of just 16 bytes by posting ~176MB for 11M transactions. If we assume that all chains can achieve this feat, combined with the 33% increase in blob space, the target for offsetting ETH issuance through L2s activity will balloon to 3,300 TPS, around 11 times what it is today.

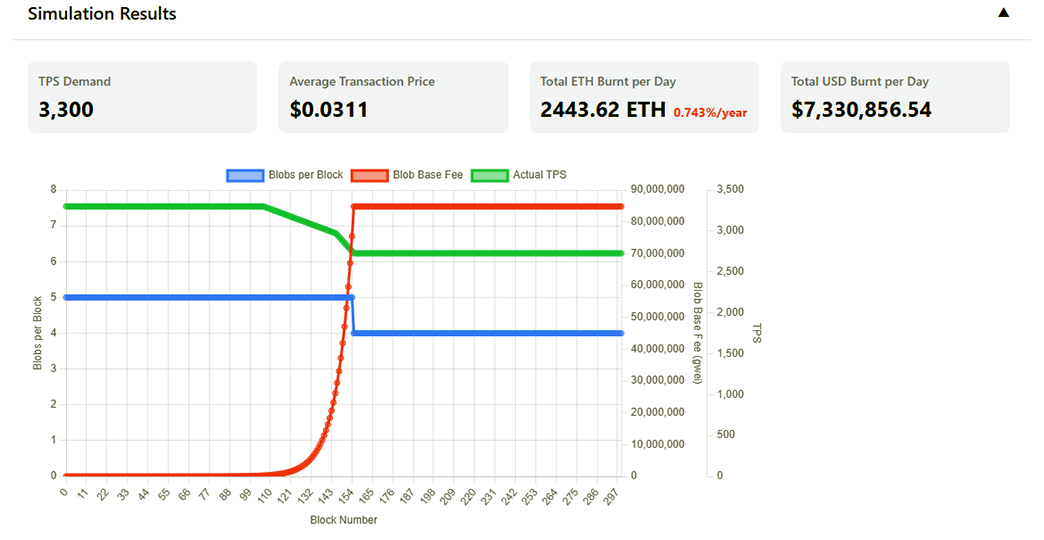

Simulation Results of ETH Burn from L2s

Simulation Inputs: 150 roll-ups, 22 TPS, 4/8 blob, ETH price $3k, transaction (Tx) size 16. Source: Ethereum Blob Simulator as of 10/31/2024.

If we assume Ethereum’s recent TPS growth rate of 250% is sustained, the point where L2s’s blob-driven ETH burn offsets issuance might not be reached until mid-2026. In the meantime, Ethereum is facing strong competition from high throughput blockchains like Solana, Sui, Aptos, and others, which will compete for the users that drive these transactions. All the while, Ethereum’s L2s are looking to push token value accrual for their own tokens (like OP, ARB, and ZK). The bearish argument for ETH would be that the growth rate for users is challenged, Ethereum’s customers are trying to remit less value to Ethereum, and Ethereum is reducing pricing for its blockspace.

There are still many reasons to be bullish about ETH in a longer time frame. Ethereum and the EVM (Ethereum Virtual Machine) ecosystem still command a plurality of developer talent and a strong host of L2s, more than 110, seeking to attract new users and fresh developer talent. Ethereum has by far the most institutional adoption, with mainstream financial institutions such as VanEck and Blackrock building tokenized funds and apps. Ethereum is taking more shots on goal due to the vast number of teams trying to build/attract the killer app. Lastly, for all the talk about L2s, they currently pay less than 1% of total ETH gas fees. Any pickup in ETH Mainnet activity would drive fee generation, burn (ETH buyback), and reflexivity to the asset.

How Ethereum Can Restore Confidence

What are some catalysts that may change the current consensus negativity around ETH? Here are some ideas being floated:

- Forcing roll-ups to hold ETH to access blob space

- Strongly encouraging L2s to back their sequencers with ETH instead of the L2 tokens

- Making Ethereum’s execution layer scale to fit more transactions

Ethereum L2s’ Decentralization Efforts

Stage 1 Rollups Now Dominate L2 Total Value Locked (VL) as Base Introduces Fraud Proofs

Source: Artemis as of 10/29/2024.

While Ethereum continued to debate its future, its L2s had some major announcements. World Coin launched its widely anticipated Mainnet using Optimism’s OP stack, which will connect seamlessly to OP Chains. In another win for Optimism’s tech, US-based crypto exchange Kraken announced plans to create its Ethereum layer-2 blockchain called Ink. Adding to positive news for Optimism’s tech, Ethereum’s largest DEX, Uniswap, announced the creation of its own OP stack chain. Uniswap trading comprises ~70% of Ethereum’s DEX volumes, and if significant portions of that volume moved to Uniswap’s chain, it would be negative for Ethereum. Despite the good news for Optimism’s superchain, the collection of blockchains using the OP stack, OP token waffled in October (-0.5%). This is partly due to questions about the OP token’s value accrual from the superchain. Another Ethereum L2, Scroll, finally released its much-anticipated SCR token by dropping 7% of supply to its users, but its token’s price has sunk (-34%) since its launch on 10/22/2024.

The burgeoning ecosystem of Ethereum L2s also made noteworthy strides toward decentralization in October. While L2 solutions have rapidly gained adoption over the past year due to their ability to provide fast and cost-effective on-chain transactions, they have faced increasing criticism for centralization risks—particularly regarding sequencers and operator control. In September, Ethereum founder Vitalik remarked that starting in 2025, he will only publicly mention L2s that have achieved “Stage 1+” decentralization; that is, L2 rollups governed by smart contracts instead of its operators. According to Kaito AI, as of October 27th, Vitalik holds the #1 spot on CT (“crypto Twitter”) KOL (“key opinion leader”) mindshare for the previous 7 days and 30 days.

According to L2Beat, a research hub dedicated to tracking Ethereum layer 2 technologies, only four rollups have reached Stage 1 decentralization: Arbitrum One, OP Mainnet, dYdX v3, and Zksync Lite. However, dYdX v3 and ZkSync Lite are effectively deprecated, as dYdX has shifted to its Layer 1 on Cosmos (dYdX v4), and zkSync Lite has been largely superseded by zkSync Era, which supports smart contracts and more advanced use cases—but remains a Stage 0 rollup. Unlike Stage 0 rollups, Stage 1 rollups have implemented smart contract governance, fraud-proof systems, and provision for user exits without operator coordination, meaning that users are no longer fully dependent on centralized operators and can remove their funds from the L2 to Ethereum L1 independently. Essentially, Stage 1 rollups reduce the risk of theft, censorship, and other single points of failure, particularly for non-native assets (assets that have been bridged to the rollup). No L2 has yet reached Stage 2, which indicates the full elimination of centralized control by decentralizing the rollup’s sequencers (agents responsible for ordering and bundling L2 transactions before submitting them to the L1) and making its fraud-proof systems (processes defending against malicious transactions) permissionless.

Just in time to heed Vitalik’s urgent call for L2 decentralization, Coinbase’s L2 blockchain Base introduced fault proofs on October 30th, marking a significant step toward Stage 1 decentralization. As Arbitrum, Base, and OP Mainnet lead Ethereum L2s by Total Value Locked (TVL), Base’s fault proofs mean that Stage 1 networks could soon secure the majority of L2 TVL if Base implements its final criterion: a security council. According to Base’s October 30th announcement, the security council—a set of approvers responsible for signing off on Base’s smart contract upgrades—will decentralize beyond the Base and Optimism core teams in the coming months.

As noted above, the ETH L2 Scroll conducted its native SCR token’s first airdrop to decentralize its protocol’s governance. As of October 30th, SCR is trading at a $749 million fully diluted valuation. While still a Stage 0 rollup, Scroll stands out for its plans to decentralize its sequencers and prover infrastructure, similar to Arbitrum’s planned BoLD (“Bounded Liquidity Delay”) upgrade. The BoLD upgrade is a key part of Arbitrum’s Stage 2 rollup roadmap, aiming to unlock permissionless validation and decentralize its sequencers. Permissionless validation enables anyone—not just a centralized entity—to verify transactions, while sequencer decentralization reduces risks stemming from single-party control over transaction ordering, such as MEV (“Maximal Extractable Value”).

Finally, Linea shared its decentralization roadmap this month, outlining plans to introduce on-chain auctions for block proposers and transition to a proof-of-stake model for block validation, allowing any node to participate by staking tokens. By requiring nodes to bid for the right to propose blocks, on-chain block proposer auctions add economic incentives for honest participation, reducing the risks of transaction censorship and MEV. This shift marks Linea’s transition from a centralized protocol to a permissionless system, where proof-of-stake validators participate in a QBFT consensus algorithm to confirm transactions. While these steps advance Linea's decentralization efforts, it remains a Stage 0 rollup due to its continued reliance on centralized sequencers and provers, which must be decentralized to achieve Stage 1.

Solana Sees Dramatic Increase in Usage

In Solana land, SOL’s (+10%) strong performance can be traced to a sizable uptick in chain usage. On Solana, DEX trading in October was up 132% compared to September’s total. Due to this activity, Solana’s blockchain earned its highest monthly revenues from transactions and MEV, which was $150.5M. Part of the run-up in Solana DEX trading stems was spawned by an AI Twitter account promoting a memecoin based on an internet meme from the mid-2000s. This AI account also controls a wallet funded by a donation from the famed Silicon Valley investor Marc Andreessen of the venture capital firm a16z. This AI agent accumulated the memecoin before relentlessly posting about it on X (formerly Twitter). At the time of writing, this “AI Agent” was the first to become a millionaire due to its token holdings in the memecoin. Meanwhile, the AI-promoted memecoin has now peaked at $800M in value.

Solana vs. Ethereum: Analyzing Memecoin, NFT, and Wash Trading Revenues

Solana vs. Ethereum: Share Revenue from Memecoins and NFTs

Source: Artemis, Dune, Flashbots, Jito, VanEck Research as of 10/30/2024.

The continued success of Solana attracting usership and financial activity has rankled some in the crypto community. On the first count, some contend that most of Solana’s documented 111M monthly active wallets, compared to Ethereum’s 5.4M, are mostly Sybil (fake) users. On the second view, detractors of Solana’s success claim that Solana’s on-chain revenue is driven by memecoin trading. It is further supposed that Solana’s memecoin activity mainly comprises wash trading rather than organic volume. The naysayers of Solana extrapolate these assumptions to infer that the token performance of SOL is due to revenues derived from suspicious trading.

Concerning wallets, it is very difficult to untangle activity stemming from one user controlling many wallets versus more organic activity derived from one user controlling one wallet. We do agree that a very large portion of these wallets are not organic. To assess the “FUD” on memecoins, we analyzed recent memecoin activity on Solana and compared it to Ethereum’s activity over the same period. Additionally, we compared current Solana and Ethereum activity to peak memecoin activity on Ethereum in the fall of 2021. To contextualize things further, we added NFT trading to the mix, which many crypto detractors formerly cited as an inorganic driver of blockchain fees.

We find that memecoin activity on Solana is significant, as around 34.3% of Solana’s revenues derive from memecoin and NFT activity. This compares to around 6.6% of Ethereum revenues today and 20.3% of Ethereum Revenues between July and October 2021. We estimate that the wash trading share of memecoin and NFT volume is 41.4% on Solana, compared to 28.9% and 44.4%, respectively, for Ethereum in 2024 and 2021. Wash trading is the practice of buying and selling the same asset to create false market activity, inflating trade volumes without real risk or profit. Putting it together, we assess that 14.2% of Solana revenues come directly from wash trading compared to 2% for Ethereum in 2024 and 9% in mid-2021. One important caveat to this analysis is that it assumes that Solana memecoin wash trading generates MEV in line with normal trading. Without MEV on these trades, our estimates would fall by 50%.

Solana vs. Ethereum: Revenue Share from Wash Trading Estimates

| Share of Revenues due to Memecoins + NFTs (%) | Memecoin Washing Trading Estimate (%) | NFT Washing Trading Estimate (%) | Wash Trading Share of Memecoin + NFT Volume (%) | Total Share of Revenues due to Wash Trading (%) | |

| Solana (last 90 Days) | 34.31 | 41.56 | 9.50 | 41.39 | 14.20 |

| Ethereum (last 90 Days) | 6.61 | 28.95 | 22.30 | 28.92 | 1.91 |

| Ethereum (July - Oct 2021) | 20.32 | 20.32 | 56.27 | 44.44 | 9.03 |

Source: Artemis, Dune, Flashbots, Jito, VanEck Research as of 10/30/2024.

We employed Dune queries of Solana and Ethereum’s blockchain to accumulate memecoin and NFT activity over the specified time ranges to accomplish this analysis and. We then used MEV and transaction fee data from Artemis, Jito, and Flashbots to assess each chain's gas fee revenue and MEV. We triangulated these figures to estimate the portion of total blockchain revenues (fees + MEV) sourced from memecoin and NFT activity. For memecoins, we then pulled the total DEX trading activity for Solana and Ethereum. We filtered that activity for wash trading using a threshold value for the ratio of daily trading volume to a coin’s market capitalization for a day’s trading. If trading volume exceeds that threshold, it is considered to wash trading. We chose 0.05 as the threshold by calculating SOL’s average V/MC over the last three months, ~0.0125, and multiplying it by 4, which is our estimation of memecoin volatility relative to that of SOL’s. See the table below for sensitivity analysis on memecoin trading labeling.

To gauge NFT wash trading on Solana, we used Dune Analyst @tianjinfan’s methodology. For wash trading of NFTs on Ethereum, we used the mighty @hildobby’s methodology.

Solana vs. Ethereum: % of Memecoin Trades from Wash Trading

Memecoin Trading Wash Trading Activity As a Percentage of Memecion Trading

| ETH | ||||||||||

| Theshold V/MC | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 | 0.06 | 0.07 | 0.08 | 0.09 | 0.1 |

| % Trading Wash | 72.85 | 48.69 | 37.79 | 32.72 | 28.95 | 24.47 | 21.26 | 17.59 | 16.35 | 15.24 |

| SOL | ||||||||||

| Theshold V/MC | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 | 0.06 | 0.07 | 0.08 | 0.09 | 0.1 |

| % Trading Wash | 94.08 | 77.34 | 61.52 | 50.63 | 41.56 | 33.28 | 26.69 | 22.77 | 15.32 | 12.96 |

Source: Dune, VanEck Research as of 10/31/2024.

We believe Solana’s greater amount of memecoin trading and wash trading is due to several factors. Solana is a high throughput chain that prices transactions 1/10,000ththat of Ethereum’s transactions. The opportunity cost of wash trading is much cheaper on Solana than on Ethereum. Next, memecoin activity on Solana is more active due to Solana’s vibrant ecosystem of applications like pump.fun that simplify memecoin trading. Furthermore, due to Solana’s low latency architecture, memecoin trading is a better user experience on Solana than on Ethereum. Finally, we assert that Solana’s MEV architecture may drive higher token volumes. This is because Solana’s MEV trading is driven by statistics-driven assessments of landing a transaction through submitting many orders for the same trade. Some of these likely land without capturing MEV, and this may juice trading figures higher than on Ethereum, where block building is done through discrete bidding rather than sending a high volume of orders.

If one contextualizes a potential SOL ETP among comparable investments, looking at companies like Alibaba, DraftKings, and the CME might be instructive. In Alibaba’s case, there was initial skepticism about package volume that may have included ‘empty packages’ to boost metrics, an issue that underwriter research addressed before BABA’s 2014 NYSE IPO. Similarly, DraftKings and the CME derive much of their revenue from speculative trading, with both platforms providing incentives, like reduced fees or rebates, to encourage activity. By contrast, while Solana’s transaction volumes include some wash trading and speculative activity, it doesn’t incentivize users similarly, as its high activity levels are driven by the blockchain’s low-cost, high-throughput design. Solana’s on-chain activity is concentrated mainly in memecoins, making it a hub for speculative assets in the crypto world. However, unlike DraftKings, whose business is limited to gambling, Solana has the potential to expand beyond speculation into impactful use cases such as decentralized physical infrastructure networks (DePIN) and social media applications. While memecoins contribute significantly to Solana’s current revenue, its high valuation—approximately 250x forward revenue—reflects investor expectations for future growth in non-speculative applications.

The analysis of Solana’s revenue sources is important because it brings to light concerns about our proposed SOL ETP. Since there is reason to believe a significant portion of SOL’s revenues are derived from suspicious trading, our ETP prospectus includes significant risk disclosures. That said, we believe this high amount of activity derives from Solana’s high-quality user experience and will become a less important part of Solana’s revenue base as new activity comes to Solana. Ethereum’s transformation should be a guiding light for how Solana’s DEX volumes can mature over time to trading fewer meme-related assets.

Lastly, to the anonymous Twitter account that keeps clogging our bosses’ inboxes and X mentions with complaints and threats on this topic, we would remind him or her that the United States operates under a disclosure-based regulatory regime. The issues above have been addressed throughout the risk factors in our current SOL ETP prospectus. VanEck is indeed taking on issuer liability by proposing to offer the Fund. VanEck and its Legal Department devote significant time and expense to ensure that all material risks are identified in an offering document and no material facts are omitted. Here is the relevant section:

SOL Trading Platforms May Be Exposed to Fraud And Manipulation

“The SEC has identified possible sources of fraud and manipulation in the SOL market generally, including, among others (1) "wash trading"; (2) persons with a dominant position in SOL manipulating SOL pricing; (3) hacking of the SOL network and trading platforms; (4) malicious control of the Solana network; (5) trading based on material, non-public information (for example, plans of market participants to significantly increase or decrease their holdings in SOL, new sources of demand for SOL) or based on the dissemination of false and misleading information; (6) manipulative activity involving purported "stablecoins," including Tether (for more information, see "Risk Factors—Risk Factors Related to Digital Assets—Prices of SOL may be affected due to stablecoins (including Tether and US Dollar Coin ("USDC")), the activities of stablecoin issuers and their regulatory treatment"); and (7) fraud and manipulation at SOL trading platforms. Potential market manipulation, front-running, wash-trading, and other fraudulent or manipulative trading practices may inflate the volumes in the crypto market and/or cause distortions in price, which could adversely affect the Trust or cause losses to Shareholders.

October’s Notable Performer - ApeCoin (+40.1%)

ApeChain Reaches #4 in NFT Trading Volume ~1 Week After Launch

Source: Magiceden.us as of 10.29.2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

ApeCoin (APE) experienced a dramatic rise in October, surging over 130% from its lows after Yuga Labs announced the launch of ApeChain’s mainnet during ApeFest in Lisbon. Despite a subsequent 40% retracement, APE weekly trading volume jumped by over 1,100%, marking a significant increase in market activity. This heightened volatility and engagement reflect optimism and speculative activity surrounding the new chain's potential.

Launched initially as a governance token in March 2022, ApeCoin was designed to decentralize the Bored Ape Yacht Club (BAYC) community's involvement in digital art, gaming, and entertainment. During the 2021-2022 NFT boom, BAYC collections became highly valuable cultural assets, reaching six- and seven-figure price points and gaining celebrity endorsements and brand partnerships. However, as the NFT market waned, APE prices fell sharply alongside the BAYC collection’s value, with both APE and BAYC experiencing drawdowns of over 95%. Despite this decline, ApeCoin DAO maintained its commitment to long-term incentives, distributing millions of APE tokens for staking rewards. As a result, APE’s circulating supply surged from ~292 million to ~753 million tokens, increasing market supply and reducing scarcity. With only ~25% of coins still to be issued, vs. comps averaging 46%, this past context of price depreciation and token oversupply may have the stage for fresh interest spurred by the launch of ApeChain.

~84% of APE’s Unvested Supply Goes Towards the DAO, AIP Carve-Outs, and Founding Teams

Source: Apecoin.com as of 10/29/2024.

ApeChain is built as an Ethereum Layer 3 solution, utilizing Arbitrum’s Orbit technology to create a scalable, high-throughput environment tailored to the BAYC community’s creative and commercial activities. Unlike other Layer 2 networks that rely on Ethereum (ETH) for gas fees, ApeChain requires APE to power its transactions. This design decision directly increases demand for ApeCoin within the ecosystem, creating a value loop that could sustain token interest if ApeChain gains adoption.

With the Banana Bill (AIP-424), ApeCoin DAO has now allocated 100 million APE to commercial agreements and user incentives aimed at over 60 launch partners across gaming, IP, finance, and infrastructure sectors. These incentives are designed to facilitate value-accretive revenue-sharing agreements between the DAO and its commercial partners and to fund dApp user rewards. To enhance user engagement further, ApeChain offers native yield opportunities for APE, ETH, and stablecoins. These yields are funded through the Staking Pool Allocation, Lido’s ETH 2.0 staking, and MakerDAO’s sDAI, creating a ‘sticky’ experience that encourages retention.

In its first week, ApeChain's top five NFT collections on Magic Eden outperformed other Layer 2 platforms like Polygon, Base, and Arbitrum in trading volume, indicating strong early interest. Sustained success will depend on the long-term effectiveness of these partnerships and user incentives.

One of ApeChain’s unique features is its ecosystem-driven approach, particularly through its "Made by Apes" (MBA) program. MBA brings together over 400 brands that leverage BAYC intellectual property in various industries, from restaurants to music, apparel, and beyond. This extensive community involvement is a testament to the strength of BAYC’s brand and network effects. However, the broader crypto market has grown wary of terms like "community" due to overuse during the NFT bubble, meaning ApeCoin DAO will need concrete metrics and examples to validate MBA’s impact on ApeChain's growth.

Looking forward, the success of ApeChain and ApeCoin will hinge on Yuga Labs’ ability to scale the ecosystem and execute its roadmap, including the anticipated launch of the Otherside metaverse. While Otherside has not announced a full platform release date, the game is accessible through a monthly series of events called “Project Dragon,” where select NFT holders can test gameplay being developed by the Otherside Development Kit (“ODK”). The ODK is a suite of creation tools accessible to players who own Otherdeed NFTs (Otherside’s virtual land titles). The ODK enables players to build customized, interoperable user-generated content (“UGC”), making much of the world’s gameplay genuinely player-built and self-sustaining. This design strategy echoes UGC-rich social gaming platforms like Roblox and Fortnite but is distinguished by supporting crypto assets. However, like any UGC platform, its success will require sustained developer and player interest, particularly from outside the existing crypto community.

ApeChain’s unique Layer 3 structure and strategic partnerships may give it a differentiated position within the NFT and social web3 landscape. Nonetheless, risks remain: token inflation could still challenge price stability, and competition from other decentralized networks may limit ApeChain’s growth if its key features fail to resonate with users.

APE Comp Table

| Token | 24h Active Addresses (thousands) | Market Cap (USD millions) |

Circulating Supply (%) |

Fully Diluted Market Cap (USD millions) |

24h Trading Volume (7DMA) (USD millions) |

Liquidity Ratio |

| Flow (FLOW) (%) |

5.0 | 828 | 100 | 828 | 44 | 5 |

| Immutable (IMX) | 111.0 | 2,290 | 82 | 2,810 | 61 | 3 |

| ApeChain (APE) | 50.1 | 801 | 75 | 1,060 | 448 | 56 |

| Uniswap (UNI) | 899.4 | 4,750 | 60 | 7,890 | 269 | 6 |

| Avalanche (AVAX) | 34.5 | 10,840 | 57 | 19,060 | 300 | 3 |

| Mantle (MNT) | 42.4 | 2,030 | 54 | 3,740 | 73 | 4 |

| Arbitrum (ARB) | 701.2 | 2,150 | 40 | 5,420 | 320 | 15 |

| Ronin (RON) | 907.4 | 549 | 35 | 1,550 | 16 | 3 |

| Optimism (OP) | 74.4 | 2,130 | 29 | 7,300 | 324 | 15 |

| Xai (XAI) | 73.3 | 140 | 27 | 520 | 33 | 24 |

| Polygon (POL) | 485.6 | 869 | 26 | 3,330 | 95 | 11 |

| Blast (BLAST) | 21.0 | 177 | 22 | 820 | 12 | 7 |

| Zksync Era (ZK) | 76.3 | 497 | 17 | 2,840 | 103 | 21 |

Source: OKX, Artemis, CoinMarketCap, DappRadar as of 10/29/2024.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

Related Insights

Index Definitions

S&P 500 Index: is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The MarketVector™ Centralized Exchanges Index (MVCEX) is designed to track the performance of assets classified as 'Centralized Exchanges'.

Nasdaq 100 Index: is comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

MarketVector Decentralized Finance Leaders Index: is designed to track the performance of the largest and most liquid decentralized financial assets, and is an investable subset of MarketVector Decentralized Finance Index.

MarketVector Media & Entertainment Leaders Index: is designed to track the performance of the largest and most liquid media & entertainment assets, and is an investable subset of MarketVector Media & Entertainment Index.

MarketVector Smart Contract Leaders Index: designed to track the performance of the largest and most liquid smart contract assets, and is an investable subset of MarketVector Smart Contract Index.

MarketVector Infrastructure Application Leaders Index: is designed to track the performance of the largest and most liquid infrastructure application assets, and is an investable subset of MarketVector Infrastructure Application Index.

MarketVector Digital Assets 100 Large-Cap Index is a market cap-weighted index which tracks the performance of the 20 largest digital assets in The MarketVector Digital Assets 100 Index.

MarketVector Digital Assets 100 Small-Cap Index is a market cap-weighted index which tracks the performance of the 50 smallest digital assets in The MarketVector Digital Assets 100 Index.

Coin Definitions

- Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

- Ethereum (ETH) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

- Solana (SOL) is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake and proof of history. Its internal cryptocurrency is SOL.

- Arbitrum (ARB) is a rollup chain designed to improve the scalability of Ethereum. It achieves this by bundling multiple transactions into a single transaction, thereby reducing the load on the Ethereum network.

- Avalanche (AVAX) is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, scalable ecosystem.

- Ordinals (ODI) is a decentralized finance project that uses blockchain technology to store text, images, and other data on the Bitcoin network.

- Stacks (STX) is a Bitcoin Layer for smart contracts; it enables smart contracts and decentralized applications to use Bitcoin as an asset and settle transactions on the Bitcoin blockchain.

- Uniswap (UNI) is a decentralized exchange built on Ethereum that utilizes an automated market making system rather than a traditional order-book.

- Blur (BLUR) is the native governance token of Blur, a unique non-fungible token (NFT) marketplace and aggregator platform that offers advanced features such as real-time price feeds, portfolio management and multi-marketplace NFT comparisons.

- Polygon (MATIC) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

- Celestia (TIA) is the first modular blockchain network that enables anyone to easily deploy their own blockchain with minimal overhead.

- Immutable (IMX) is a Layer-2 scaling solution for Ethereum that focuses on NFTs and game economies.

- Manta Network (MANTA) is a plug-and-play privacy-preservation protocol built to service the entire DeFi stack.

- Jito Network (JTO) is a major contributor to the Solana ecosystem through its JitoSOL liquid staking pool, and its collection of MEV products.

- Jupiter (JUP) utilizes military grade encryption to secure user data and powers secure dApps on public and private networks.

- Sui (SUI) is a Layer-1 smart contract platform developed by Mysten Labs, which utilizes an object-centric data model intended to scale network throughput.

- Aptos (APT) is a Layer-1 blockchain network focusing on decentralization, speed, and scalability.

- NEAR Protocol (NEAR) is a layer-one blockchain that was designed as a community-run cloud computing platform and that eliminates some of the limitations that have been bogging competing blockchains, such as low transaction speeds, low throughput and poor interoperability.

- Optimism (OP) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups.

- Tether (USDT) is a fiat-collateralized stablecoin platform offering individuals the advantage of transacting on blockchains while mitigating price risk. USDT is their US dollar pegged stablecoin.

- Worldcoin (WLD) is a cryptocurrency project that aims to distribute a global digital currency to every person on Earth. Their vision is to provide equal access to digital assets, making use of blockchain technology for financial inclusion.

- Tron (TRX) is a multi-purpose smart contract platform that enables the creation and deployment of decentralized applications.

- THORChain (RUNE) is an independent blockchain built using the Cosmos SDK that will serve as a cross-chain decentralized exchange (DEX).

- Lido DAO (LDO) is a liquid staking solution for Ethereum and other proof of stake chains.

- Aave (AAVE) is an open-source and non-custodial protocol to earn interest on deposits and borrow assets with a variable or stable interest rate. It also enables ultra-short duration, uncollateralized flash loans designed to be integrated into other products and services.

- Curve (CRV) is a decentralized exchange optimized for low slippage swaps between stablecoins or similar assets that peg to the same value.

- Maker (MKR) is the governance token of the MakerDAO and Maker Protocol — respectively a decentralized organization and a software platform, both based on the Ethereum blockchain — that allows users to issue and manage the DAI stablecoin.

- Axie Infinity (AXS) is a blockchain-based trading and battling game that is partially owned and operated by its players.

- The Sandbox (SAND) is a blockchain-based virtual world allowing users to create, build, buy and sell digital assets in the form of a game. By combining the powers of decentralized autonomous organizations (DAO) and non-fungible tokens (NFTs), the Sandbox creates a decentralized platform for a thriving gaming community.

- Mythos (MYTH) is the interoperable utility token used in these decentralized efforts and provides opportunity for anyone to participate and contribute within the ecosystem - adding governance, and value to game developers, publishers, and content creators.