Rate Cuts and Sanity Checks

19 April 2023

Read Time 2 MIN

Rate Cuts Expectations

Last week in DC, the IMF repeatedly cautioned against premature rate cut communications, but the Hungarian central bank either did not listen carefully, or decided to check what happens anyway. The currency (the Hungarian forint) had a very adverse reaction to an early rate cut suggestion from the deputy governor, weakening the most against the U.S. Dollar compared to emerging markets (EM) peers (as of 10:00am ET, according to Bloomberg LP). We are not saying that the IMF is always right, and we realize that some factors (like the mother of all base effects) argue for faster disinflation in H2. Hungary’s case is also quite extreme – we do not see 20%+ headline and core inflation (vs. 3% inflation target) very often in EM these days. Still, the forint’s reaction was a teachable moment, which hopefully got noticed by various EM central banks. High real rates helped to shield many EMs from this year’s market turbulence – and it is not wise to throw this cushion away while there are plenty of bumps on the disinflation road.

EM Disinflation

In fact, it might be prudent for some EMs to raise their policy rates a bit more. This is what the market currently prices in for South Africa, where headline inflation surprised to the upside in March, re-accelerating to 7.1% year-on-year, and core inflation stayed close to a multi-year high of 5.2% year-on-year. The surprise was mostly due to higher food prices - mega-drought in Argentina, as well as a rising probability of El Nino this year can create headwinds for disinflation not just in South Africa but in wider EM in the coming months.

LATAM Fiscal Outlook

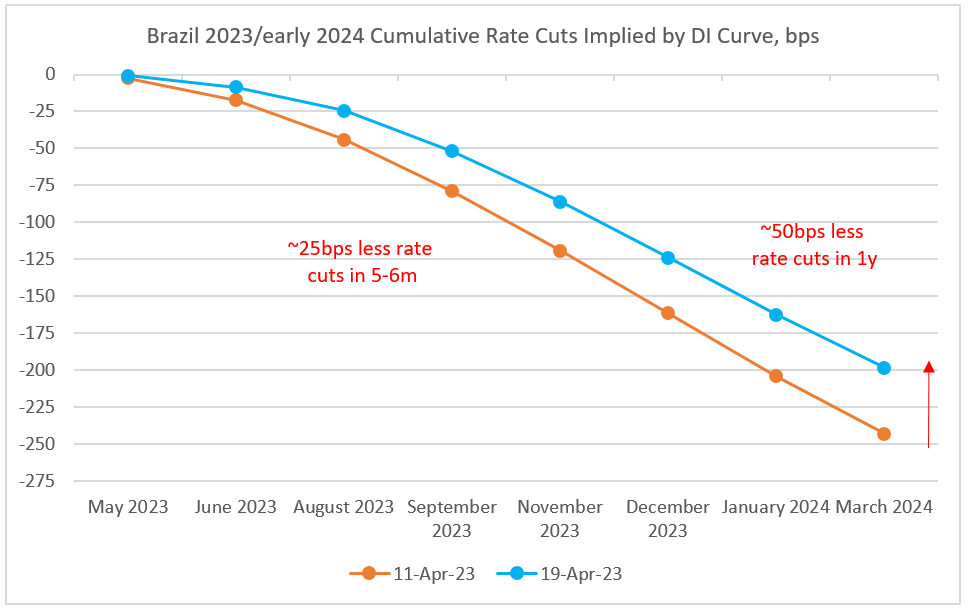

Sanity checks for EM rate cuts can also come from the fiscal side. The market continued to adjust its expectations for policy easing in Brazil in 6-12 months, as it received the final version of the government’s new fiscal framework. Many details of the plan were known before, but the document confirmed that the new framework is more convoluted and less enforceable. There is also a lot of uncertainty about generating additional revenue to meet the primary fiscal targets (which might not necessarily stabilize the debt/GDP ratio). So, even though Brazil’s real policy rate is the highest among major EMs (around 8.7%), the local swap curve priced out about 50bps of implied rate cuts on a 1-year horizon within the past week (see chart below). It is not the end of Brazil’s easing story, but fiscal certainly is key for a big breakthrough. Stay tuned!

Chart at a Glance: Brazil’s Policy Easing Room – Fiscal Certainty Is Key

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.