Education Center

Investment Outlook

18 February 2020

ETF 101: Understanding ETFs In Simple Terms

Investment Outlook

18 February 2020

ETF 102: Why ETFs Layer Up On Liquidity

Investment Outlook

18 February 2020

ETF 103: Does Your ETF Have High Standards?

Investment Outlook

19 February 2020

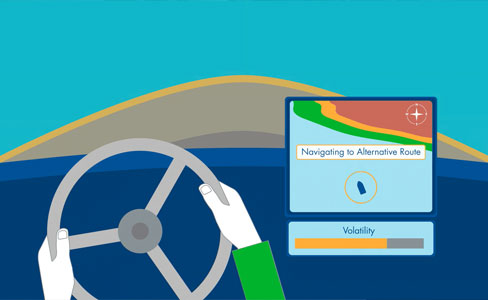

ETF 104: Trade ETFs Intelligently

Investment Outlook

19 February 2020

ETF 105: Wrap Your Fixed Income in an ETF

Investment Outlook

05 March 2021

ETF 106: Debunking Myths About Fixed Income ETFs

Thematic Investing

13 SEPTEMBER 2022

ETF 107: Passive vs. Active ETFs Explained

Thematic Investing

March 21, 2025

Semiconductor Industry Updates: AI Thrills and Geopolitical Spills

AI-driven growth remains strong for the semiconductor industry, led by NVIDIA, Micron, and Intel. However, geopolitical tensions are reshaping supply chains, as seen in TSMC’s Arizona expansion.

Investment Outlook

December 24, 2024

Plan for 2025: Predictions from Our Portfolio Managers

Get your portfolio ready with detailed insights from VanEck’s investment team about the factors driving risk and returns in their respective asset classes.

Income Investing

February 14, 2025

Fallen Angels Take Flight: A Strong Start to 2025

Fallen angels outperformed high yield in January as lower rates/tighter spreads drove gains. Aptiv joined the index, boosting Auto exposure, while Ford’s outlook may signal broader sector headwinds.

Gold Investing

March 6, 2025

Dollar’s Trouble Could Be Gold’s Triumph

Gold continued to make new highs in February; a crisis of confidence in the U.S. dollar may drive gold prices higher than expected.

Moat Investing

February 7, 2025

Moat Stocks Outperform Amid AI Turmoil

Moat stocks thrived in January, dodging AI-driven tech turmoil with gains in health care and mid-cap standouts.

Get More from VanEck

Don’t settle for the conventional. Dare to be different.

Jan van Eck, CEO

Through forward-looking, intelligently designed active and ETF solutions, VanEck offers value-added exposures to emerging industries, asset classes and markets as well as differentiated approaches to traditional strategies. We think beyond the financial markets to identify the trends—including economic, technological, political and social—that we believe will fuel investable opportunities.