Moat Index Review: Value Is In, Facebook Is Out

29 September 2020

Share with a Friend

All fields required where indicated (*)The Morningstar® Wide Moat Focus IndexSM (the “Index”) completed its quarterly review on Friday, 18 September 2020. The first quarter and second quarter reviews saw more significant changes to the index, as its process of identifying attractively priced wide moat companies was more noteworthy during and following the market turbulence of earlier this year. Notable in this quarter’s review is the continuation of several of the key trends of the year. Here are our main takeaways from the latest rebalance.

Unfriended: Facebook Removed from Moat Index

The Index’s shift from big tech formally began in June and took one step further last week as Facebook (FB) was removed from the Index. Facebook’s stock price premium to Morningstar’s assessment of its fair value signaled an opportunity to lock in gains relative to other opportunities in the wide moat universe.

Facebook has notably been an index member off and on since its IPO in May 2012 and has a track record of supporting Index returns during those periods. With the volatility big tech has faced in recent weeks, time will tell if Facebook rejoins the Index in the future. For now, the only big tech names in the Index remain Amazon (AMZN) and Microsoft (MSFT), which together account for just over 2% weighting at present. This compares to a combined weighting of more than 22% in the S&P 500 Index for Facebook, Apple, Amazon, Netflix, Google and Microsoft. The steady increase in stock prices for many of these stocks recently is bringing them at or above fair value, according to Morningstar, and there simply remain too many other attractively valued opportunities in the U.S. wide moat universe.

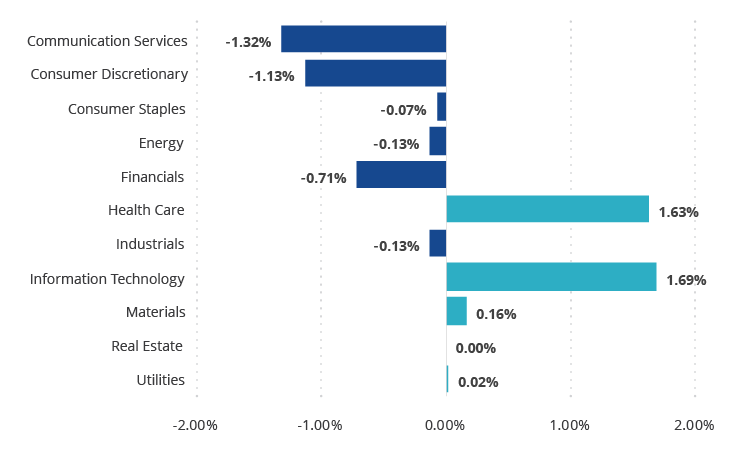

Modest Sector Shifts

Despite the removal of Facebook, the tech sector saw a slight increase in weight following the September review. Health care, a long-time overweight, also saw a slight increase in its exposure, while those gains resulted in similar reductions to communications services, consumer discretionary and financials.

Five Sectors Account for Minor Repositioning of Moat Index

As of 21 September 2020

Source: Morningstar. Changes in sector weightings from 18/9/2020 to 21/9/2020 displayed above.

The decreases in consumer discretionary and communications services are logical to see as they are two of the top performing sectors in the U.S. market in 2020. Tech is far and away the top performing sector in the market this year, yet interestingly, the Index’s tech exposure increased modestly. This is due mainly to an increase in semiconductor exposure, which has underperformed the broader tech sector this year. Applied Materials (AMAT) saw its position increased during the review and new entrant Lam Research Corp. (LRCX) was added following a recent economic moat rating upgrade from narrow to wide moat earlier this year. Cost advantages and intangible assets drive LRCX’s wide economic moat, according to Morningstar. Its research and development cost advantages over smaller peers and intangible assets related to equipment design from service contracts and customer collaboration leave LRCX well-positioned relative to competition in the chip manufacturing industry. It is an industry leader in the dry etch process and a prominent player in the deposition segment. Both of these processes combined are critical to chip fabricating.

Nike (NKE) and Facebook (FB) drove the consumer discretionary and communication services sector weighting lower as they both became too rich to remain in the Index. Over and underweights relative to the S&P 500 Index that have been in place for much of the year remain.

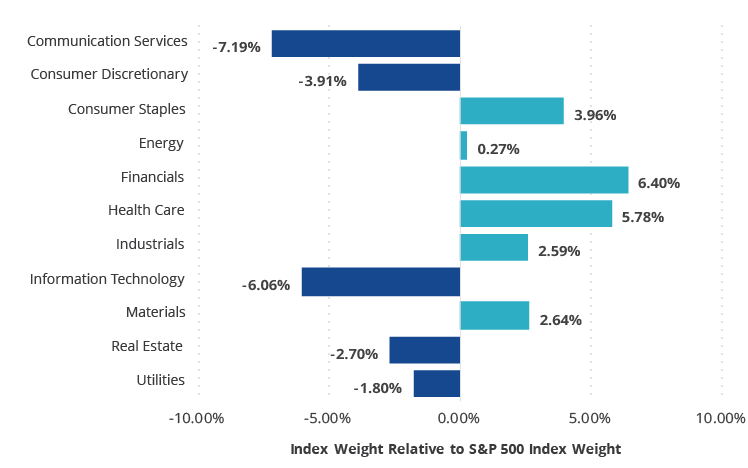

Financials and Health Care Remain Top Overweights in Moat Index

As of 21 September 2020

Source: Morningstar.

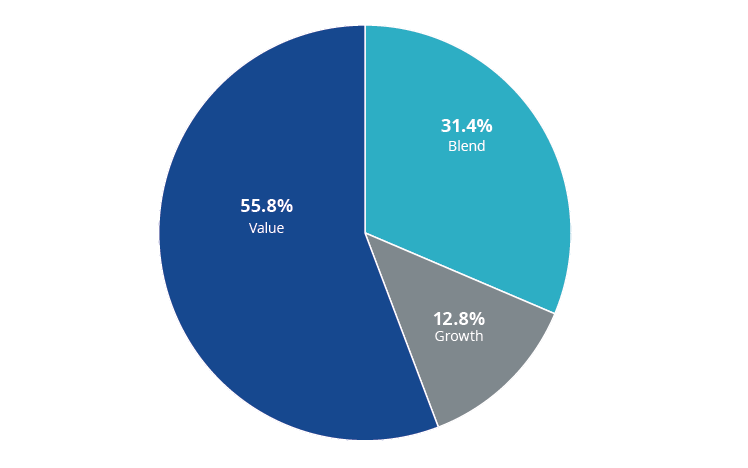

Moat Index Style: Value Over Growth

The Index’s style exposure to growth companies remains low relative to historical averages. At times in the past when growth exposure has decreased, much of that decrease was offset by “core” or “blend” exposure, which are companies that exhibit characteristics of both value and growth. Now the Index is skewed more heavily to value companies and has one of its highest exposures to value historically.

Value Exposure in Moat Index at All Time Highs

Morningstar Wide Moat Focus Index as of 9/21/2020

Source: Morningstar.

The last time the Index had anywhere near this level of exposure to value companies was in mid-2018, shortly before the so-called “tech wreck” that coincided with the breakdown of U.S./China trade negotiations in the fourth quarter and subsequent market selloff led by tech stocks. Prior to 2018, the Index has never had as much as 50% exposure to value companies.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter