Boeing and Constellation: Moat Stocks Rebound After Drawdown

08 June 2020

Share with a Friend

All fields required where indicated (*)Morningstar strategist Andrew Lane recently published a research paper examining the performance of the Morningstar® Wide Moat Focus IndexTM in periods following market drawdowns. I’ve often written of the long-term nature of Morningstar’s moat investing philosophy, and this piece hammers home the potential benefits of the strategy’s systematic focus on valuations. The strategy’s March 2020 index review coincided with one such period, and we’re tracking the dynamics of many of the companies selected for inclusion at that time, including Boeing (BA), Bank of America (BAC) and Constellation Brands Inc (CTZ).

Focus on Valuations Has Driven Outperformance versus Broad Market

Investing in companies with sustainable competitive advantages, or wide economic moats, is a popular investing strategy. So popular, particularly in times of uncertainty, that demand for these companies can drive share prices higher relative to those companies that lack a discernible economic moat. That is what makes valuation research so important. Identifying when these well-positioned companies’ share prices are trading below fair value and then allocating at attractive entry points can make the difference between outperformance and underperformance.

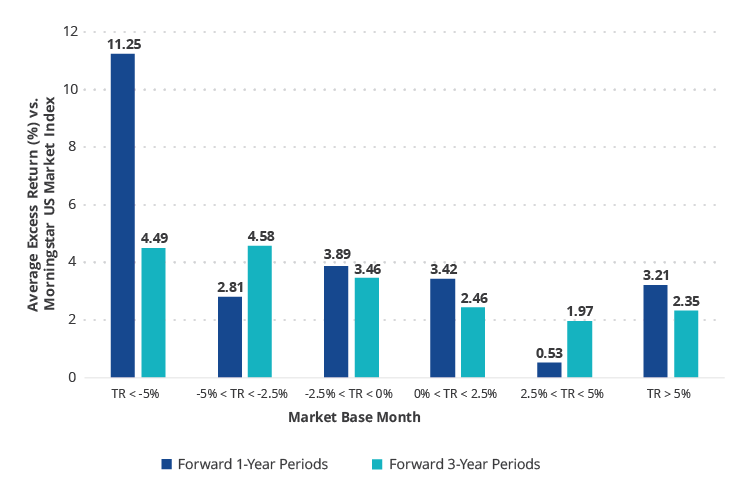

Investing in wide moat companies alone hasn’t always generated excess returns relative to the broad market as measured by the Morningstar US Market Index and has even underperformed the market in some instances. This is where valuations may make a difference. As evidenced by the paper, Morningstar’s regular assessment of valuation dislocations has contributed to the Morningstar Wide Moat Focus Index’s impressive average excess returns relative to the broad market in periods following a month of any market return profile. Even more impressive is that average excess returns relative to the broad market in periods following months in which the market is down more than 5% were even more pronounced. While not every period in the study features outperformance, on average the index has a track record of success.

Sizeable Market Declines Have, on Average, Preceded Excess Returns

28/2/2007 - 31/3/2020

| Number of Occurrences | ||||||

| 1 Year Periods | 15 | 11 | 21 | 51 | 30 | 17 |

| 3 Year Periods | 13 | 9 | 21 | 37 | 26 | 15 |

Source: Morningstar. Data as of 31/3/2020. Morningstar Wide Moat Focus Index vs. Morningstar US Market Index. Performance data quoted represents past performance. Past performance is not a guarantee of future results. Index performance is not illustrative of fund performance. Prior to 16/10/2015, VanEck Morningstar US Wide Moat UCITS ETF had no operating history. For fund performance current to the most recent month-end, visit vaneck.com.

Talk about Timing

Though we didn’t know it at the time, the Morningstar Wide Moat Focus Index rebalanced on the market’s recent bottom, 20 - 23 March. Big name companies trading at big time discounts to Morningstar’s fair value estimate were added.

Boeing (BA) was added to the index for the first time when it was trading at a 70% discount to Morningstar’s fair value. At the end of April, Morningstar reduced Boeing’s fair value estimate approximately 15%, citing its debt burden associated with the continued 737 MAX grounding. Despite this reduction in fair value estimate, Boeing ended the month of May trading at nearly a 50% discount to fair value and has returned 53.51% since being added to the index.

Constellation Brands (STZ) has also posted an impressive 44.94% return in the short time it has been in the index. The beverage company—which derives its moat from its intangible assets, one of Morningstar’s five sources of moat—finished May at a 20% discount to fair value.

Other new entrants have lagged the broad market in that period, such as American Express (AXP, 29.98%), Bank of America (BAC, 22.62%), Corteva (CTVA, 21.89%), Blackbaud (BLKB, 13.63%), and US Bancorp (USB, 10.46%). As mentioned earlier, this strategy is built for the long-term and time will tell how the March 2020 rebalance will impact index performance.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Source of stock returns: Morningstar. All returns quoted from 23/3/2020 through 31/5/2020.

Fair value estimate: the Morningstar analyst's estimate of what a stock is worth.

The Morningstar® Wide Moat Focus IndexTM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Wide Moat Focus IndexTM is a service mark of Morningstar, Inc.

The Morningstar® Wide Moat Focus IndexTM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

The Morningstar® US Market IndexTM represents approximately 97% of the total US stock market cap.

Effective 20 June 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

An investment in the VanEck Morningstar US Wide Moat UCITS ETF (MOAT) may be subject to risks which include, among others, investing in equity securities, consumer discretionary, financials, health care, industrials and information technology sectors, medium-capitalization companies, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter