Boeing and Bank of America Headline March Review

25 March 2020

Share with a Friend

All fields required where indicated (*)Boeing and Bank of America Headline March Review

The Morningstar® Wide Moat Focus IndexTM (the “Index”) completed its quarterly rebalance and reconstitution on Friday, 20 March 2020. The Index has a new look after assessing valuation opportunities among U.S. wide moat companies. The Index’s long-standing health care overweight was pared back while financials now take a more prominent place in the Index following that sector’s outsized participation in the recent market slide. One notable addition to the portfolio last week was Boeing Co. (BA).

Boeing Valuations Hard to Overlook

Boeing finished last week’s trading at just under $100 per share after beginning the year above $300 per share. Its decline leaves the aerospace and defense firm trading at a discount of approximately 70% to Morningstar’s fair value estimate. On 18 March 2020, Morningstar reduced its fair value estimate 5%, to $328 per share, citing lower near-term production and a longer 737 MAX grounding, which Morningstar feels could last into late 2020.

Despite the recently reduced fair value estimate, Boeing’s significant sell-off still puts the company at a discount to fair value far below any level seen since coverage was initiated by Morningstar in 2002. The unique rebalance feature of the Index will allow it to allocate to Boeing at these extreme valuations and, if the market recognizes the current mispricing, participate in its recovery. That is a big “if”, but the Index strategy is built for the long term and some allocations take longer than others to play out.

In an 18 March 2020 update, Morningstar analyst Burkett Huey noted “Ultimately, while we hesitate to recommend that investors catch a falling knife, we think Boeing’s valuation looks attractive at current levels. We remain confident in Boeing’s long-term story of supporting increasing propensity to fly in the emerging market[s] and a developed market[s] replacement cycle.” Further to the long-term story, Morningstar assigns Boeing a wide moat despite its well-documented 737 MAX troubles. Morningstar believes the barriers to entry and the costs and difficulty of switching manufacturers provide Boeing with intangible assets and switching costs that protect its competitive position for years to come.

Banking on Banks

The U.S. Federal Reserve’s (Fed’s) recent cut of the federal funds rate put pressure on financial services firms, in particular, the banking sector. Concerns over net interest income at these rate levels have caused fear for investors. However, in a 15 March 2020 research note, Morningstar analyst Eric Compton provided some perspective: “We remind investors a few bad quarters of earnings are not that important when it comes to the intrinsic value of a firm over its lifetime. When bank stock prices imply that bad times will never end, we think the odds shift in the favor of long-term investors. We believe investors should be seriously watching and considering bank stocks as this plays out.”

To that end, the Index added several financial services firms to its portfolio this quarter including American Express (AXP), US Bancorp (USB) and Bank of America (BAC). The rebalancing process also increased its allocation to Wells Fargo (WFC) and Charles Schwab (SCHW).

Bank of America, last included in the Index in March, 2009, is a compelling addition. It is the second largest money center bank in the U.S. and has undergone a decade-long transformation to streamline its business and cut expenses following its acquisitions of Merrill Lynch, Countrywide Financial and MBNA. Prior to the market impact of the coronavirus, many believed the U.S. banking system to be in strong shape. To witness a bank such as Bank of America trade at current valuations is compelling, to say the least.

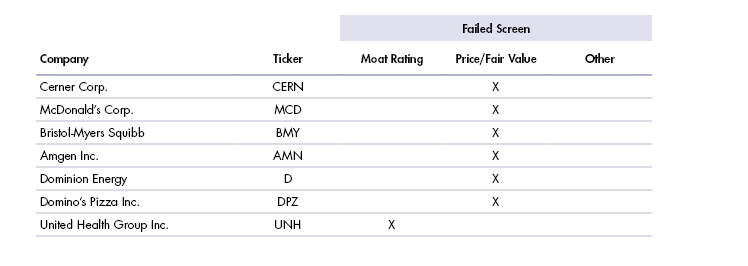

Below is a summary of the stocks added and removed in this quarter’s review.

March 2020 Morningstar® Wide Moat Focus IndexTM Review

Index Additions & Increased Allocations

Index Deletions & Decreased Allocations

Source: Morningstar. Price/fair value data as of 10 March 2020. Past performance is no guarantee of future results. For illustrative purposes only.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter