Moat Stocks: Poised for a Comeback?

12 November 2020

As the markets work through the turmoil that has accompanied this U.S. election season, I’m reminded of a research paper published this spring by Andrew Lane of Morningstar. The paper looked at the Morningstar® Wide Moat Focus IndexSM (the “Index”) and its excess returns relative to the broad equity markets following months with both significant and modest market drawdowns. We highlighted his findings here several months ago. The key takeaway is that the Index has, on average, posted impressive excess returns in the one- and three-year periods following months in which the market had sold-off. However, in looking at the data, they also show that the Index outperforms, on average, following months when the market performed well.

With talk of excess returns, it’s important to address the elephant in the room. Since late June, the Index has underperformed the S&P 500 Index. Underperformance was primarily concentrated in June, July and August, and returns bounced back in line with the S&P 500 in September and October. But, the summer months have certainly left their mark on the Index. Through October, year-to-date total return for the Index was -2.90% versus 2.77% for the S&P 500.

Stock Selection: In Good Times and Bad

Stock selection has historically been the driver of excess returns in good times, and it has also been the driving force behind this short period of underperformance. Though the Index shifted its exposure further away from big tech and into select value opportunities, stock selection within the industrials and information technology sectors—and not the underweight to information technology—contributed the most to the Index’s underperformance through the summer months.

The Index allocated to industrials firm Boeing (BA) in March and June at historically low valuations. As uncertainty around the global pandemic grew, the aerospace and defense firm’s shares slid through the summer months, but Morningstar remains confident that secular forces driving air travel will return in a post-pandemic world. Additionally, regulatory steps have progressed toward receiving an airworthiness directive from the FAA, which Morningstar expects Boeing to receive this quarter. It may take time to realize any potential benefit of the Boeing allocation in the Index, but in the interim Morningstar believes its substantial cash and short-term investment portfolio will allow the firm to weather the storm until the macro environment stabilizes.

Within the tech sector, exposure to Blackbaud (BLKB), Intel (INTC) and Guidewire Software (GWRE) detracted from performance relative the S&P 500.

Blackbaud offers a suite of software solutions for the “social good” community, including nonprofits, foundations, corporations, education institutions, healthcare institutions and individual activists. Morningstar believes Blackbaud is deeply entrenched in the social good community, and its wide economic moat is rooted in high customer switching costs and intangible assets. However, the company remains vulnerable to adverse macroeconomic conditions as its customer base faces continued budget pressure. According to Morningstar, there may be no near-term catalyst, but shares are attractive for patient investors.

Intel reported mixed Q3 results in late October, highlighting several offsetting benefits and detractors brought on by pandemic-accelerated trends. While Intel has benefited from expedited digital transformation boosting cloud and notebook PC demand to support working and learning from home, Morningstar highlights the negative impact to Internet of Things, among other offsetting pressures. With its shares trading at nearly 40% of fair value, Morningstar views the long-term prospects as promising.

Guidewire is a leading software provider for the property and casualty insurance industry that has been transitioning from downloaded software to cloud-based solutions. Its wide economic moat is rooted in customer switching costs as is common in the software industry. Its shift to the software as a service (SaaS) model was driven by the firm’s belief that the pricing opportunity for a SaaS transition is two to three times that of an on-premise installation model, according to Morningstar. Shares remain approximately 15% undervalued relative to Morningstar’s fair value estimate.

Moat Index Outperformance Historically Follows Underperformance

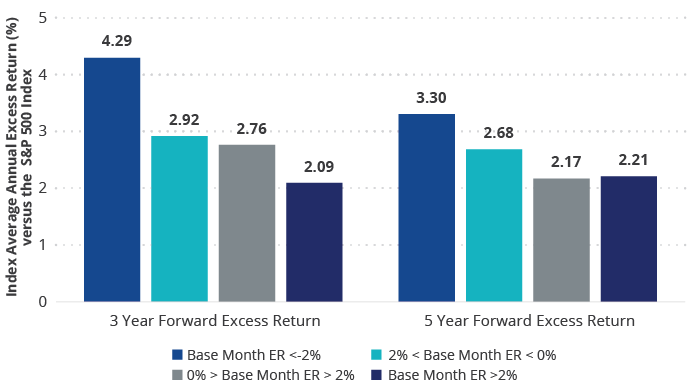

Despite evidence of the Index’s long-term success relative to the S&P 500, periods of underperformance certainly catch one’s attention. Looking at previous periods of underperformance can be informative. The chart below compares the average excess returns of the Index versus the S&P 500 following months in which the Index underperformed and outperformed the S&P 500 to varying degrees. We can see that the Index has generated stronger annualized excess returns, on average, in periods following months of underperformance than outperformance of the S&P 500. The largest average excess returns has come after the Index experienced a month with greater than 2% underperformance. This summer, the Index underperformed the S&P 500 by 1.6% in June, 3.2% in July and 1.1% in August.

Moat Index Outperformance Strongest Following Underperformance

28/2/2007 – 31/10/2020

Source: Morningstar. Data as of 31/10/2020. Chart illustrates the excess returns of the Morningstar Wide Moat Focus Index vs. S&P 500 Index in 3- and 5-year periods following months in which the Morningstar Wide Moat Focus Index underperformed or outperformed the S&P 500 Index to various degrees. Performance data quoted represents past performance. Past performance is not a guarantee of future results. Index performance is not illustrative of fund performance. Prior to 16/10/2015, VanEck Morningstar US Wide Moat UCITS ETF had no operating history. For fund performance current to the most recent month-end, visit vaneck.com.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter