From 0 to over 300M$ Market cap in a Year: Tokenized Real-World Assets

21 September 2023

I discussed how regulation will advance the development and market opportunity of the cryptocurrency market in one of my most recent columns. But how and under what circumstances will this occur? So what if cryptocurrency is regulated? Crypto natives, who have long chosen the path of self-regulation over allowing traditional financial regulators to play a key role, are undoubtedly not interested in it. The tokenization of real-world assets is a significant development that has already begun to take shape and even amass a sizable market cap. We will examine the distinctions between digitally native tokenized assets and real-world tokenized assets in this article, as well as the benefits of tokenizing real-world assets and the main difficulties that issuers must face.

Digitally Native Tokenized Assets vs. Real-World Tokenized Assets

Digitally native tokenized assets are entirely digital, existing solely on blockchain platforms. Examples include cryptocurrencies like Bitcoin or Ethereum but you could also say NFTs are entirely digital tokenized assets if the NFT represents ownership of an image or gives access to an exclusive online community. They derive their value from their inherent scarcity, demand, and utility within the blockchain ecosystem.

On the other hand, real-world tokenized assets are representations of physical assets (e.g., real estate, art, commodities) on a blockchain. These tokens are backed by tangible assets, and ownership is recorded on a blockchain, ensuring transparency and security. Real-world assets are tokenized to enhance accessibility, liquidity, and efficiency in traditional asset markets.

It's important to emphasize the differences in the tokenization's justification. While tokenizing real-world assets is done from the standpoint of efficiency, access to liquidity, and reducing trust and intermediaries, tokenizing natively digital assets is primarily done to promote self-custody, ownership of the user's personal data, and promote decentralization.

Benefits of Tokenized Real-World Assets

Accessibility and liquidity are improved because tokenization removes long-standing obstacles to asset ownership. Investment opportunities that were previously inaccessible are now available to investors thanks to fractional ownership, which enables them to own a portion of valuable assets. Tokens can also be traded round-the-clock on digital exchanges, increasing liquidity.

Global Reach and Interoperability: Assets that have been tokenized are not restricted by geographical boundaries. A global marketplace is created by the participation of investors from all over the world. Additionally, these tokens may be traded between various blockchain platforms, promoting interoperability.

Reduced Intermediaries and Costs: Transaction costs for traditional asset transfers are higher because there are frequently many intermediaries involved. Tokenization gets rid of a lot of these middlemen, which lowers costs and boosts productivity.

Security and Transparency: The immutability and transparency of blockchains are guaranteed by their very nature. A public ledger keeps track of ownership and transaction information, which lowers the possibility of fraud and offers a safe environment for transactions.

Challenges for Issuers

Regulation Compliance: Issuers must juggle a dense web of regulations and compliance requirements since the regulatory environment for tokenized assets is still developing. It is crucial for issuers to maintain legal clarity because different jurisdictions could have different requirements. In the world of regulated securities, for instance, a CSD maintains the records and displays a golden state of truth, but a decentralized ledger is not under the authority of a single party; how can you guarantee that the state of the ledger is always accurate? Token ownership would also require legal recognition in order to be equivalent to asset ownership.

How do you identify the user's wallet for KYC/AML purposes? A straightforward solution would be for the user to demonstrate ownership of the address by sending a message using the related private key and presenting official identification from the neighborhood. The counterparty may then provide the user a KYC NFT passport or store this information in their own local, centralized database. On-chain identity has some unresolved problems and risks, particularly when one loses access to their wallet or the private key is stolen.

Asset Appraisal & Valuation: Accurately estimating the value of real-world assets is essential for tokenization. To provide fairness and openness for investors, this procedure necessitates trustworthy valuation techniques. For instance, Oracle networks like Chainlink could be a crucial data provider for manual pricing or indexes.

Although blockchain technology is fundamentally secure, there are security threats that could arise from trades or smart contract flaws. Issuers must put strong security measures in place to protect against fraud or hacking. One significant distinction is that once implemented, smart contracts are immutable, making it nearly impossible to undo any damage if the issuer loses access for whatever reason. Regular audits and other security precautions could assist in resolving the problem.

Impact on Investors and Native Currency

The network, its investors, and the native currency of the smart contract platform are all significantly impacted by the tokenization of real-world assets:

greater usage (demand for blockspace) = greater transaction fees paid to network validators (network revenue), which is not difficult to understand. As the use of tokenized assets spreads, there may be a rise in demand for the platform's native currency, such as Ethereum's Ether. The value of the local currency may rise as a result of this increased demand. Investors should be aware of the dangers associated with investing in digital assets, such as the dangers of severe volatility and catastrophic loss.

Market Innovation and Efficiency: The tokenization of physical assets encourages market innovation and efficiency, potentially resulting in a more open and accessible global financial ecosystem. This is a presumption that hasn't been proven in practice.

Real Yield Opportunities for DeFi: Financial solutions based on yield- or dividend-bearing real-world assets could provide DeFi with the much-needed boost it requires in the current context of high interest rates. Investors should be aware that this may prevent sustainable or steady yields or returns from digital assets.

State of Tokenized Real-World Assets

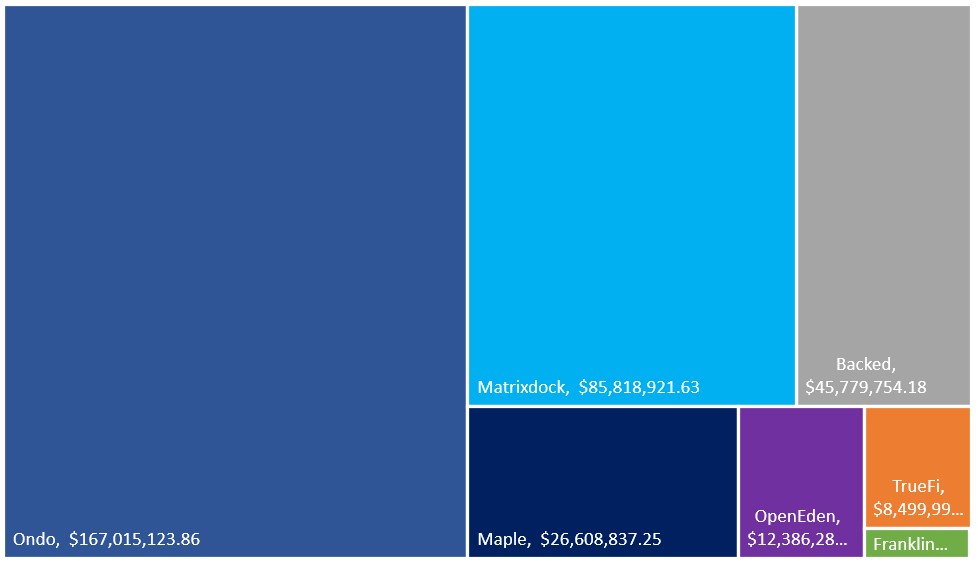

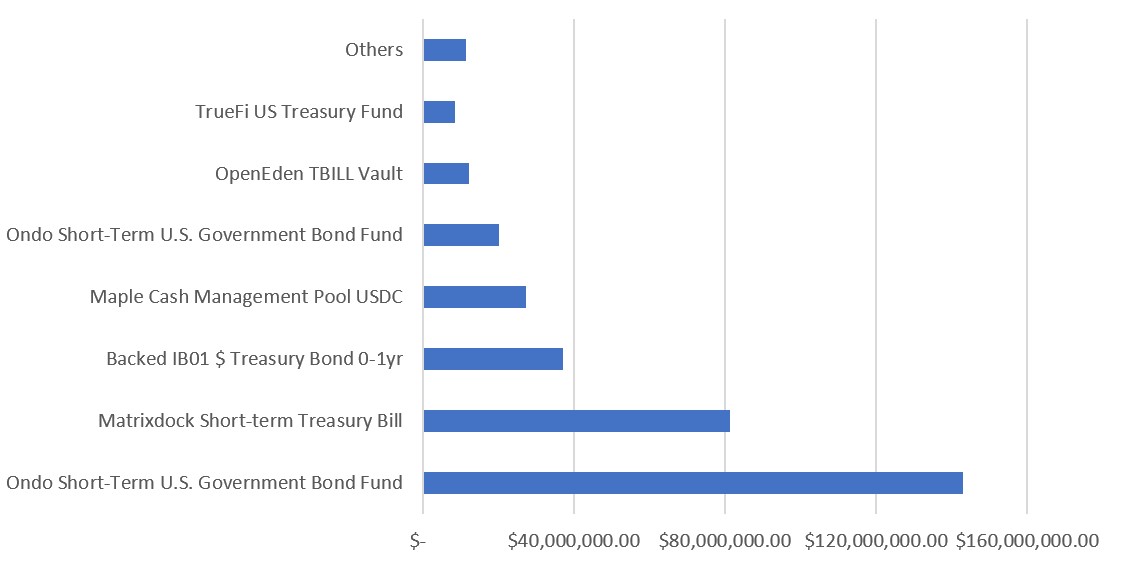

Tokenization of RWAs in numbers, starting with market cap growth.

Market Growth (Total Market Capitalization of RWA's)

Source: Messari, VanEck Research, Data as of 31/08/2023. Historic performance is no guarantee for future results.

Source: Messari, VanEck Research, Data as of 31/08/2023. Historic performance is no guarantee for future results.

Platform of Choice

Source: VanEck Research, Data as of 31/08/2023. This should not be understood as financial advice for any particular network or its native currency.

Source: VanEck Research, Data as of 31/08/2023. Historic performance is no guarantee for future results. This should not be understood as financial advice for any particular network or its native currency.

Type of Tokenized Assets:

Source: VanEck Research, Data as of 31/08/2023. This should not be understood as financial advice for any particular asset type.

Conclusion

Tokenized real-world assets represent a significant evolution in the world of finance, offering a myriad of benefits to investors and issuers alike. While challenges persist, the potential for increased accessibility, liquidity, and transparency in asset markets is substantial. As the space continues to mature, the impact on investors and native currencies of smart contract platforms is likely to be even more pronounced, reshaping the way we think about traditional assets and investments. It is not just the assets themselves that are changing, but also the asset managers, issuers, data providers and all other intermediaries that will need to rethink their entire business model. For a while, we will be stuck in a hybrid world (both off-chain and on-chain), much like the theoretical concept of gradient descent, I believe we will slowly tend towards the global optimum of fully on-chain assets and minimize the number of intermediaries.

To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

16 January 2025

27 November 2024

11 October 2024

11 October 2024