VanEck Morningstar US SMID Moat UCITS ETF

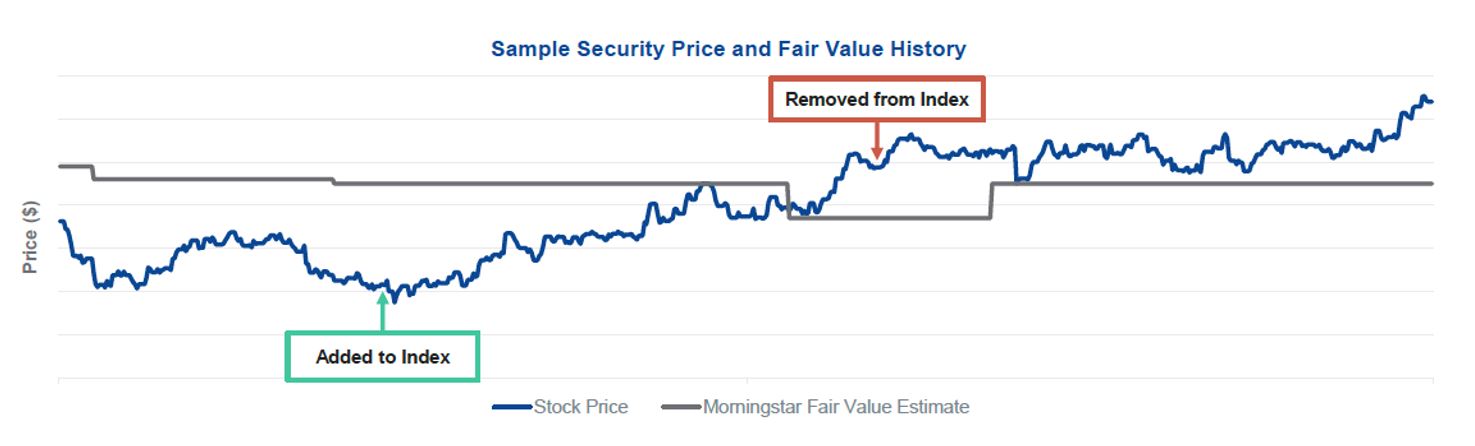

- Potential for outperformance over time

- Diversifies risks in your portfolio

- Invests in the United States, with the largest universe of small and mid-cap equities

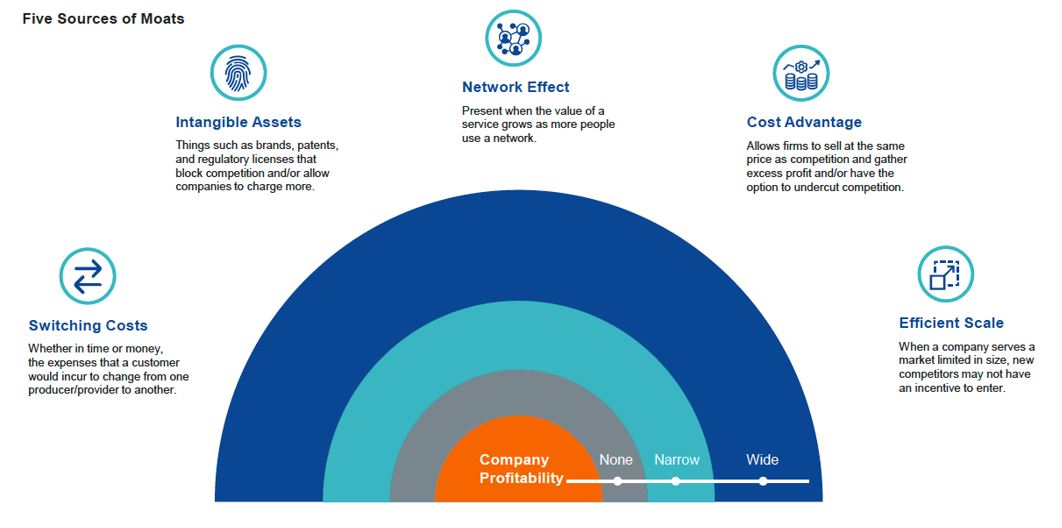

- Targets quality companies with reasonable valuations

- Main Risk Factors: Equity market risk, risk of investing in smaller companies