ETF Academy ETF risks

Video: ETF Risks

Ahmet Dagli

As it happens for all financial products there is also a number of ETF risks. Before starting to invest in them, one should be well aware of them.

1. Volatility as the first of the ETF risks

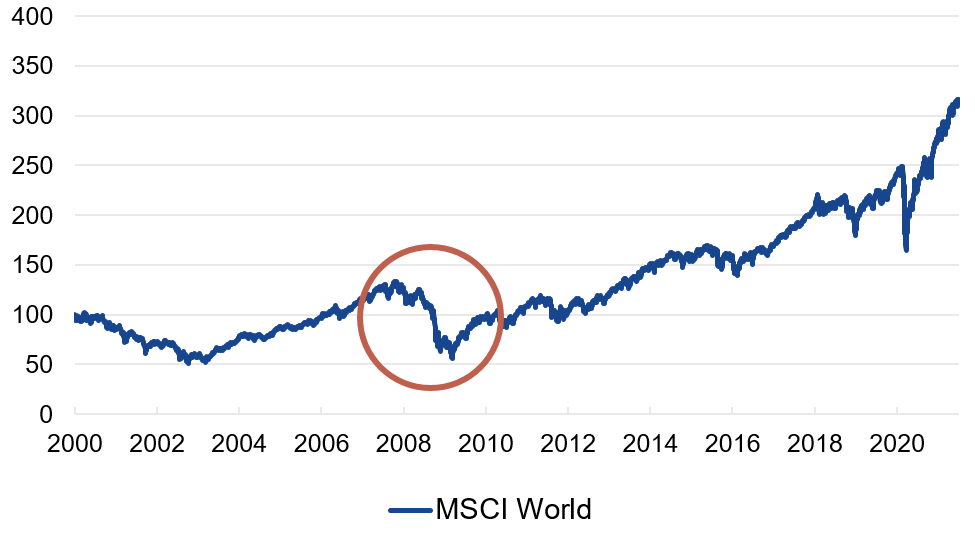

Volatility refers to the fluctuations of investments, which can vary. The more volatile an ETF is, the higher an ETF risk is. Broadly speaking, shares are more volatile than bonds. The following graph shows the volatility of the MSCI World index (Net Total Return) during 2008’s financial crisis – an exceptionally difficult time for the global economy. From peak to trough, it fell 58%! Would you have the nerves to remain invested? If so, your investments would have recovered by 2013, going on to make gains. When investing, patience is a virtue.

Volatility during a financial crisis

Equity prices can drop significantly during crises

Past performance is not a reliable indicator of future performance. Source: VanEck, Bloomberg. Data as of 1/1/2000 - 30/6/2021.

2. Market risk

Market risk belongs as well to the group of ETF risks and it refers to the risk of the general price movements in a market, such as a stock market. All stocks, bonds or ETFs are influenced by the general market movements – if the whole market goes down, or up, your investment may react as well.

3. Concentration risk

Concentration risk often is underestimated by retail investors. It means that your portfolio’s volatility will increase if it’s invested in only a few stocks. Even if you invest in multiple stocks, you can suffer significant concentration risk if these stocks come from just a few sectors, countries, currencies or investment styles.

4. Synthetic ETFs belong to the group of ETF risks

Roughly two types of ETFs exist:

- Synthetic ETFs: These can replicate the performance of an index, without actually investing in the underlying stocks or bonds via derivatives. Many investors do not realise that such ETFs carry hidden risks: if the issuer of the synthetic ETF went bankrupt you might incur significant losses. While synthetic ETFs typically are backed-up by so called collateral investments, they’re still connected to the creditworthiness of the ETF manager issuing them. That's why synthetic ETFs figure among the ETF risks we chose to highlight.

- Physical ETFs: These ETFs buy the underlying stocks or bonds. Thus they do not carry the hidden risk of synthetic ETFs. Note that VanEck Europe only offers physical ETFs.

5. Securities lending as another risk of ETFs

Securities lending is another often overlooked element belonging to the broader category of ETF risks. Some ETF managers lend out the stocks or bonds in the ETF to other parties. These other parties might be hedge funds which speculate on the stock price falling. While there’s a profit for you, the investor, from securities lending, there’s equally a small risk of loss if the borrowing party were to go bankrupt. In some cases the lending split is often more advantageous for the issuer.

VanEck Europe does not engage in security lending.

Conclusion on ETF risks

In summary, by building a diversified portfolio, avoiding synthetic ETFs or ETFs which engage in security lending and remaining invested over a long period one can construct a portfolio that seeks to minimize these risks.