2025 Semiconductor Outlook: Investor Roadmap

27 January 2025

Read Time 5 MIN

The semiconductor industry is poised for another transformative year in 2025. Following a year of record-breaking growth in AI-related semiconductors and notable struggles in legacy sectors, the landscape is set for both challenges and opportunities. For investors and financial advisors, understanding these dynamics is crucial to navigating the road ahead.

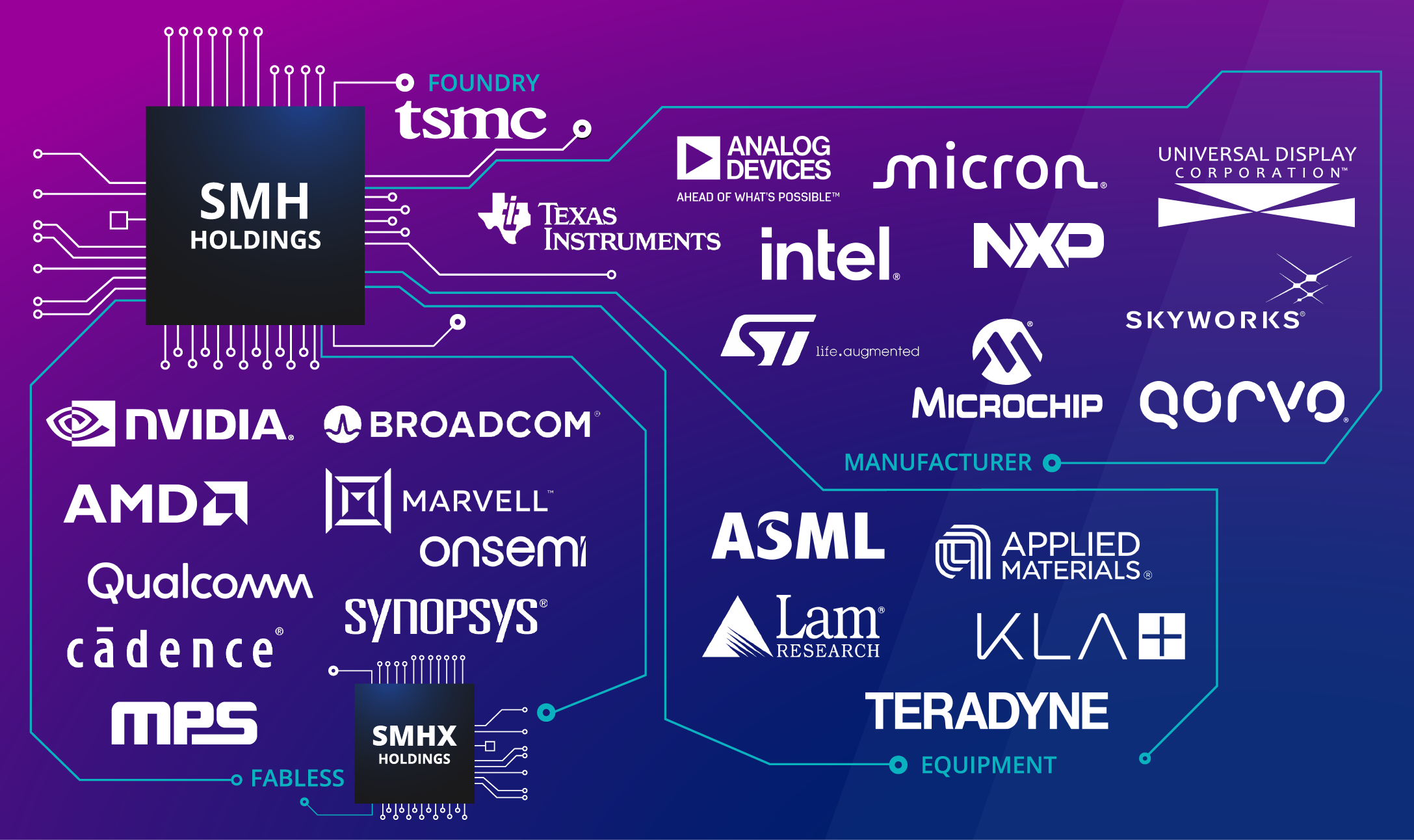

The VanEck Semiconductor ETF (SMH) Holds Nvidia, Broadcom, TSMC, and Other Key Players

Source: VanEck. Not intended as a recommendation to buy or to sell any of the securities mentioned herein.

AI Continues to Lead the Way

Artificial intelligence remains the driving force behind the semiconductor market. Companies like Nvidia, Broadcom, TSMC, and Marvell continue to dominate, benefiting from AI’s seemingly insatiable demand. Nvidia has cemented its role as the gold standard for AI semiconductors, though growth rates may moderate compared to its exceptional performance in 2023 and 2024. Meanwhile, Marvell’s positions it as a major beneficiary in this space, particularly as it aligns its solutions with AI-driven trends and hyperscaler demand.

Strong AI Chip Market Revenues Expected to Continue in 2025 (2023-2025)

Source: Gartner as of 2024. For illustrative purposes only. Past performance is no guarantee of future results. Not intended as a forecast or prediction of future results.* Projected numbers.

The rise of hyperscalers like Amazon and Google developing their own AI solutions (e.g., Tranium and Tensor chips) marks a shift in the competitive landscape. Broadcom and AMD are also playing significant roles as this unbundling introduces viable alternatives that could reshape the market. While Nvidia’s solutions remain vital for specialist workloads, this diversification highlights a growing ecosystem of players vying for AI market share. Additionally, TSMC’s dominant position as the leading-edge fab player ensures it remains a critical component of AI’s continued expansion into 2025 and beyond.

Challenges and Opportunities for Legacy Sectors

Not all segments shared AI’s meteoric rise. Automotive, analog, and smartphone chips faced significant hurdles in 2024 with oversupply impacting profitability and growth. However, 2025 brings the potential for recovery as these sectors stabilize and benefit from cyclical rebounds. Automotive chips are poised to gain traction as the electric vehicle (EV) market grows and demand for advanced driver-assistance systems (ADAS) accelerates.

Analog and IoT-focused semiconductors also present recovery potential, with stabilization in key end markets driving renewed investor interest. Companies like Texas Instruments and Analog Devices may see improvement as market dynamics in these areas recover. For smartphones, the recovery may be slower, but the rollout of next-generation devices and a focus on efficiency improvements could create selective opportunities.

Various Sectors are Poised to Gain Traction from Semiconductor Growth

Semiconductor Market Revenue Worldwide 2020-2025, by Segment

Source: Statista as of 2024. For illustrative purposes only. Past performance is no guarantee of future results. For illustrative purposes only. Not intended as a forecast or prediction of future results.* Projected numbers.

Undervalued Players Emerging

While market leaders grab headlines, undervalued players in memory chips and semiconductor equipment offer attractive opportunities for strategic positioning. Companies like SK Hynix and Micron are poised for growth as the memory market stabilizes, driven by stronger customer relationships and a shift toward contract-based demand. SK Hynix is positioned to benefit from demand for high-bandwidth memory (HBM), which is increasingly vital for AI applications. Western Digital, though less concentrated in HBM, also offers a potential upside as the market stabilizes.

On the equipment side, Applied Materials and Lam Research stand out as key beneficiaries of industry demand cycles, offering compelling value. With improving fundamentals and strategic alignment with future technology trends, these companies represent critical enablers of the semiconductor ecosystem. Emerging players like Onto Innovation and ACMR Technologies also present intriguing growth stories as their innovative solutions gain traction in the broader market.

The Balancing Act: Optimism and Caution

While the trajectory for AI semiconductors remains positive, history reminds us that this is a cyclical industry. Inventory builds and extended growth cycles could introduce volatility. Companies that successfully manage AI’s high fixed and marginal costs will likely emerge as long-term leaders. Additionally, as hyperscalers continue to explore alternatives to Nvidia’s dominance, the AI ecosystem may experience further fragmentation, with Broadcom and AMD increasingly shaping the competitive dynamics.

For investors, balancing exposure to high-growth areas with diversification across undervalued sectors is key. Semiconductors are integral to nearly every aspect of modern technology, making thoughtful portfolio allocation critical in capturing long-term value.

Key Takeaways for the Semiconductor Market in 2025

- Stay Aligned with AI: Market leaders like Nvidia, Marvell, and TSMC are set to remain at the forefront of AI growth. Keep an eye on developments in hyperscaler-driven chip alternatives, including Broadcom and AMD.

- Watch for Recovery: Automotive, IoT, and analog sectors may rebound, offering potential upside for diversified portfolios. Companies like Texas Instruments and Analog Devices could see improvement in these segments.

- Explore Hidden Value: Memory chips (SK Hynix, Micron, Western Digital) and semiconductor equipment (Applied Materials, Lam Research, Onto Innovation) represent undervalued opportunities.

- Monitor Fragmentation Risks: The increasing diversity in AI solutions could create competitive pressures but also open doors for new players and technologies.

- Stay Vigilant: Inventory challenges and cyclical risks require careful monitoring, even as growth prospects remain strong.

A Roadmap for Semiconductor Investors

For those investing in the semiconductor space, 2025 is a year to remain forward-looking yet cautious. The industry’s evolution, driven by AI and emerging technologies, creates a fertile ground for growth while demanding strategic positioning. ETFs like the VanEck Semiconductor ETF (SMH) offer diversified exposure to both leading innovators and emerging players, making them valuable tools for navigating this dynamic sector.

As we move through 2025, staying informed and adaptable will be key to capitalizing on the opportunities this pivotal industry presents. The semiconductor story is far from over—and this year may be one of its most exciting chapters yet.

Related Insights

Related Insights

28 January 2025

24 December 2024

26 September 2024