Who’s Afraid of High Interest Rates?

19 October 2022

Read Time 2 MIN

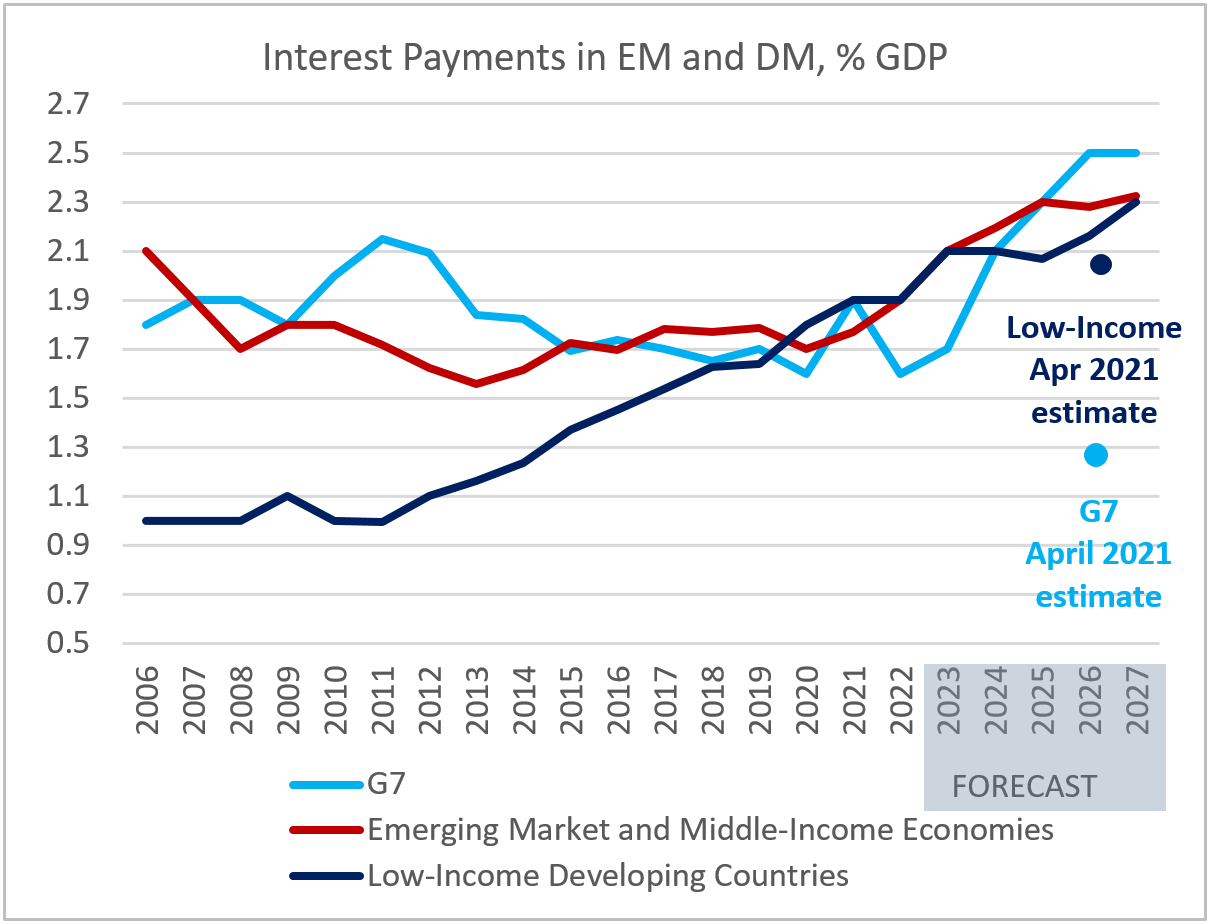

Global Debt Service Costs

There are still no signs of China’s “delayed” activity indicators and foreign trade numbers this morning, and this gives us more time to study the latest batch of the IMF’s research reports – which contain not only updated growth forecasts, but also a lot of interesting stuff on global interest rates. Rising developed markets (DM) interest rates – the 10-year U.S. Treasury yields reached another post-2008 high this morning – mean that net interest payments in that part of the world can almost double in the next few years, compared to estimates made a year and a half ago (see chart below). This is not a DM debt sustainability crisis (yet) – nominal GDP growth is still well above nominal rates. However, DMs might no longer be “exceptional” in their ability to borrow without immediate consequences, which was the predominant view 1.5 years ago.

EM Inflation and Rate Hikes

The increase in the debt service costs in emerging markets (EM) – even though less surprising than in G7 – should also be monitored very closely. South Africa is among the countries where the IMF expects net interest payments to exceed 5% of GDP starting in 2023 (potentially reaching 6% of GDP and more from 2025 onwards). The government’s ability to control inflation and the central bank’s policy response are, therefore, of utmost importance. Today’s headline inflation surprised slightly to the downside, easing to 7.5% year-on-year. However, the underlying price pressures appear sticky, with core inflation accelerating to 4.7% year-on-year. This is one of the reasons why the market continues to price in a fair amount of tightening over 12 months (+183bps), but there is a chance that the central bank will proceed at a more moderate pace after two “oversized” 75bps hikes in a row.

EM Debt Restructuring

The continuing rise in the debt service costs in low-income economies is also concerning, especially in such regions as Sub-Saharan Africa, where sovereign yields widened to 14%+ (J.P. Morgan EMBIG Diversified Africa Index,1 Blended Yield) and countries might be expected to spend close to 3% of GDP on interest payments (on average) going forward. These levels might be prohibitively high, which explains another push towards debt restructuring for poorer nations (including the G20 common framework), as well as creating new facilities and programs to fight poverty and hunger. Stay tuned!

Chart at a Glance: Rising Debt Service Costs

Source: VanEck Research; IMF Fiscal Monitor (October 2022).

1 J.P. Morgan EMBIG Diversified Africa Index tracks total returns for traded external debt instruments issued by emerging market countries in Africa that meet specific liquidity and structural requirements.Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.