Old Policies Might Backfire

16 May 2022

Read Time 2 MIN

China’s domestic slowdown questions the policy stimulus direction.

China Growth Slowdown, Policy Response

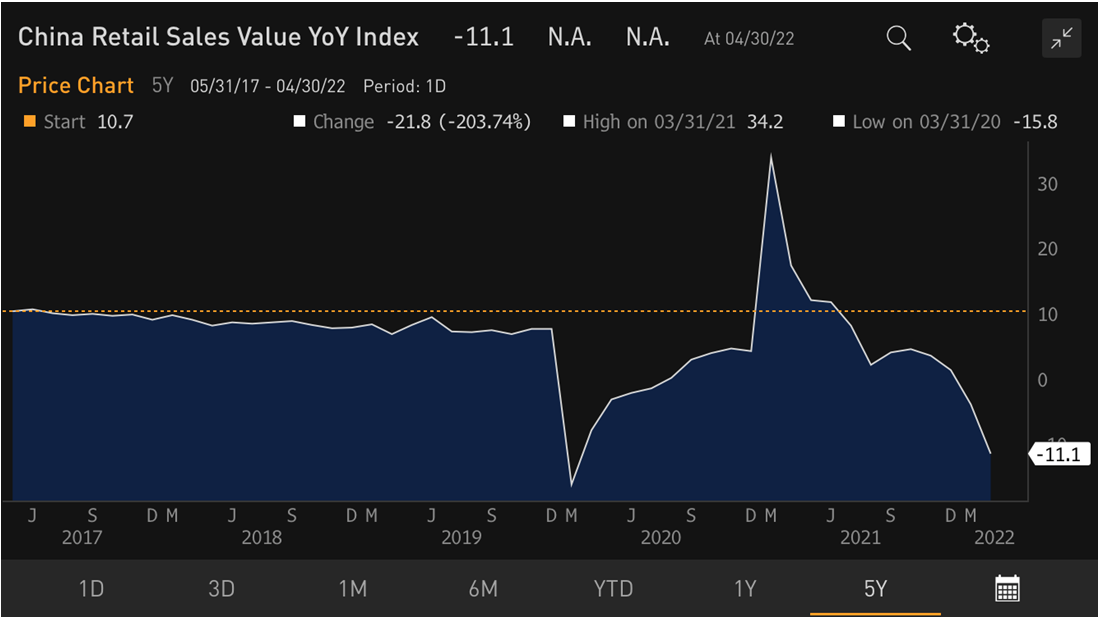

China’s latest domestic activity indicators suggest that the near-term growth headwinds might be stronger than previously thought. April’s slowdown was broad-based, with the services and retail sales hit particularly hard by the zero-COVID policy (down by respective 6.1% and 11.1% year-on-year – see chart below). It is fair to assume that the situation should improve once the virus outbreak is over, but the longer it lasts, the wider the gap between the 2022 GDP growth (currently expected at 4.8%) and the official growth target (about 5.5%). Authorities continue to announce “drip” stimulus measures to boost activity – like cutting the mortgage rate floor for first-time home buyers by 20bps. However, the “big-picture” emphasis is still on supply-side measures, such as infrastructure investments. This approach served China well during the 2020 pandemic wave, but there are growing concerns that subdued consumption and the imbalanced recovery can lead to more lasting damage to China’s growth potential.

Central Europe’s Inflation Challenge

Another region where investors question a “more of the same” approach is Central Europe. Poland’s upside core inflation surprise (7.7% year-on-year in April) comes on the heels of an even bigger overshoot in headline inflation. Still, the central bank insists that its policies can only affect a small portion of inflation pressures, which are linked to domestic factors. Today’s core inflation print, however, suggests that global shocks are already having the secondary impact on domestic prices, and that it is too early to think about a slower pace of rate hikes.

Turkey’s Exchange Rate and External Deficits

Turkey also exemplifies policy prescriptions that prove counterproductive. The president’s fixation on a “stable” exchange rate – while freezing the policy rate at 14% despite annual inflation nearing 70% – blocks the adjustment of external imbalances. It is true that the widening of Turkey’s current account deficit (USD5.55B in March) is in part driven by global shocks – the country is among the most exposed to energy spillovers from the Russia/Ukraine war. However, multiple internal factors (including cheap government-sponsored credit) make the situation worse, creating a negative feedback loop that weights on the currency, which is now getting closer to the end-2021 lows against the U.S. dollar. Stay tuned!

China Retail Sales Testing COVID Lows

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.