Judgement Day… Or Not?

27 July 2022

Read Time 2 MIN

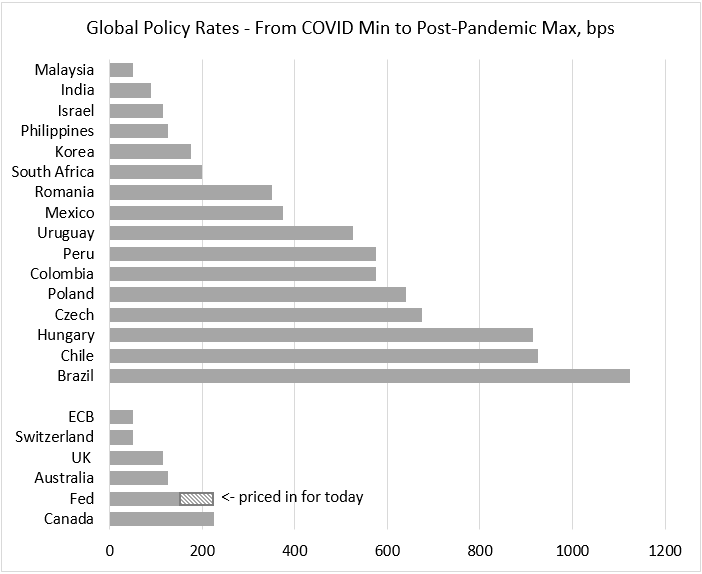

U.S. Fed Hikes

The focus of the world today is on the U.S. Federal Reserve (Fed). The Fed Funds Futures price in a solid +75bps, albeit there are some very small tails on both sides of the consensus distribution (+50bps and +100bps). There were no major data releases in major emerging markets (EM) today, so we spent the morning thinking about the future (strictly in the monetary policy sense), and putting together a table that shows who did what in the world’s “tightening club” during the post-pandemic period. We often use EM/DM aggregate policy rate chart(s) to illustrate just how unusual the current global tightening cycle is. EM are leading the way this time around, with earlier and more aggressive rate hikes than the Fed or any other central bank in developed markets (DM). But these aggregates do not show the extent of divergence within the EM block – EM is not a monolith, and it has an impact on investment outcomes.

EM Rate Hikes Frontloading

The most aggressive EM frontloaders are Brazil, Chile and Hungary (after yesterday’s 100bps rate hike). Brazil is currently in the blackout period before the next rate-setting meeting, and the local swap curve prices in a smaller 50bps rate hike, followed by +25bps more in September. Brazil might become the first major EM to exit the tightening cycle – that is unless the Czech National Bank’s doves go on a hiking “strike” after the departing hawks delivered a super-sized “goodbye” rate hike in June. As regards the overall amount of monetary tightening, the Czech National Bank does not look bad on the chart below – except that headline inflation is in the high-teens (17.2% year-on-year), and the ex-post real policy rate is very negative. So, putting an end to rate hikes right now would be a mistake.

Pace of Policy Normalization in EM

Asian central bank dominate the opposite end of the spectrum – catching up with their EM peers, but with a couple of important countries absent from the chart below. Indonesia’s central bank opted to stay on hold again this month, justifying the decision by the deteriorating global growth outlook. Thailand is an even more interesting case – headline inflation is now 3.4 standard deviations (!) higher than the 5-year average, but the central bank is yet to start policy normalization. Would today’s rate hike in the U.S. force the Bank of Thailand finally make a move on August 10? Stay tuned!

Chart at a Glance: Global Tightening Club – Results So Far

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.