EM Hawks – Talons Still Out

29 March 2023

Read Time 2 MIN

Global Disinflation

A concept of “transitory disinflation” is creating some buzz, and we are wondering whether such fears keep emerging markets (EM) central banks on the cautious side, despite obvious progress in disinflation. The mother of all base effects will continue to push inflation down in the coming months, but would this be enough to bring inflation back to targets over the forecast horizons, and, importantly, make sure that inflation stays close to the target for a considerable period of time? Brazil is an important testing ground here – especially against the backdrop of raging fiscal debates. But some smaller “EM Graduates” like the Czech Republic or Thailand – which are closer to DM structurally and institutionally - are in this group as well.

EM Policy Rates

Thailand’s central bank opted for another measured rate hike today (+25bps), and signaled more tightening as the economy continues to rebound. The Czech National Bank stayed on hold, as expected, and Governor Aleš Michl – who was considered a dove until recently – warned the market against “premature” bets on rate cuts, and said that the peak rate might not be behind us yet. Other EM central banks also signal that the bar for easing is high. Core price pressures are often more sticky than headline inflation, inflation expectations sometimes grind higher even when disinflation is well underway, and there is a lot of uncertainty about the global growth outlook. This was today’s message from the Malaysian central bank (“not out of the woods on inflation”), and these are the reasons why central banks in Mexico, Colombia, and South Africa are likely to tighten more this week (albeit at a slower pace) before considering a pause.

Market Turbulence and EM

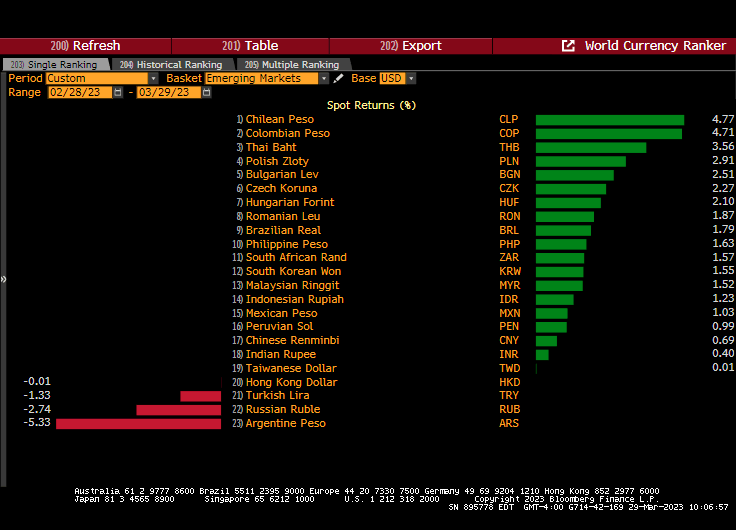

EM FX certainly does not seem to mind that real rates are high, as this could be a nice safety cushion in times of market turbulence. The chart below shows major EM currencies’ performance against the U.S. Dollar in the past month – we suspect we were not the only ones who was humming R.E.M.’s song “It’s the End of the World as We Know It (And I Feel Fine)” when looking at it. Stay tuned!

Chart at a Glance: EM FX – Crisis? What Crisis?

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.