Democratizing Game Development Through AI and Edge Computing

June 09, 2023

Read Time 2 MIN

The world of video gaming is experiencing an unprecedented transformation. The catalysts? Cutting-edge technologies like artificial intelligence (AI) and edge computing. These technologies are not just revolutionizing the gaming experience but also how games are developed, offering a democratizing effect that's set to reshape the industry landscape.

Handheld Power Redefined

Edge computing, which brings computation closer to data sources for real-time interaction and responsiveness, holds massive upside for the gaming industry. Gamers could enjoy faster load times, near-zero latency, and an overall improved gaming experience. But perhaps even more exciting is the possibility of players creating their own games in real time. This potential shift towards player-creators could redefine the boundaries of creativity and player agency, signaling a future where anyone could become a game developer. An example of this is Legend of Zelda: Tears of the Kingdom which leverages user-generated content (UGC) to foster creativity and engage its community. This freedom of creativity coupled with the tangible impact of players’ actions on the game world has boosted sales, driven engagement and created a viral wave on social media.

Free Guy is Paid Guy IRL

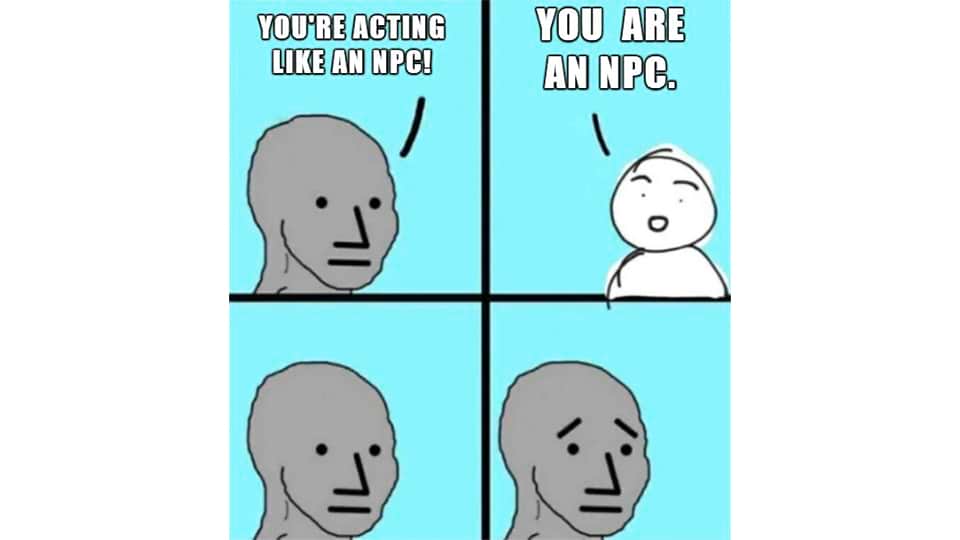

Simultaneously, AI advancements are opening innovative avenues in game development. Machine learning and natural language processing are breathing new life into Non-Playable Characters (NPCs), creating advanced AI NPCs that can conversate more naturally and make intelligent decisions. This level of immersion is clearly in high demand, with a recent study revealing that 99% of gamers believe advanced AI NPCs would enhance gameplay.

While these advanced AI NPCs can enrich gameplay, they also present a valuable revenue opportunity for publishers. The same study found that 81% of gamers were willing to pay more for games with advanced AI NPCs, suggesting additional untapped income streams for these features. For aspiring publishers and indie developers, this is an opportunity to meet the growing demand for immersive experiences while driving additional revenue.

Source: Reddit.

Pac-Man Growth Strategy

Though AI and edge computing could diversify game development, they also have the potential to influence M&A activity in the gaming industry. As more non-traditional developers use these technologies to create innovative games, bigger publishers could start focusing their growth strategies on acquiring emerging new titles. This might lead to a surge in M&A activity in the medium to long term, fueling industry growth while also nurturing innovation.

As we continue into this exciting future, it's clear that the boundaries between players and creators are set to blur, paving the way for an industry that is more innovative, inclusive, and dynamic than ever before.

One way for investors to access the space in a diversified way and to capture the future potential of the industry is through the VanEck Video Gaming and eSports ETF (ESPO). ESPO is a passive product that tracks the MVIS Global Video Gaming and eSports Index. The index targets the 25 largest most liquid companies in the industry that drive 50% or more of their revenue from said industry.

To receive more Thematic Investing insights, sign up in our subscription center.

Related Topics

Related Insights

April 10, 2024

March 25, 2024

March 01, 2024

February 16, 2024

January 31, 2024

Disclosures

Source: Forbes, "How The Games Industry Can Leverage Advances In AI To Revolutionize NPCs".

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

An investment in the VanEck Video Gaming and eSports ETF (ESPO) may be subject to risks which include, among others, risks related to investing in video gaming and eSports companies, software industry, internet software & services industry, semiconductor industry, equity securities, communication services sector, information technology sector, depositary receipts, small- and medium-capitalization companies, issuer-specific changes, special risk considerations of investing in Asian, Chinese and Japanese issuers, emerging markets issuers, foreign securities, foreign currency, market, operational, cash transactions, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and industry concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com/etfs. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

Disclosures

Source: Forbes, "How The Games Industry Can Leverage Advances In AI To Revolutionize NPCs".

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

An investment in the VanEck Video Gaming and eSports ETF (ESPO) may be subject to risks which include, among others, risks related to investing in video gaming and eSports companies, software industry, internet software & services industry, semiconductor industry, equity securities, communication services sector, information technology sector, depositary receipts, small- and medium-capitalization companies, issuer-specific changes, special risk considerations of investing in Asian, Chinese and Japanese issuers, emerging markets issuers, foreign securities, foreign currency, market, operational, cash transactions, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and industry concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com/etfs. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.