What are Smart Contracts?

March 01, 2023

Read Time 3 MIN

Please note that VanEck has exposure to Bitcoin and holds a position in Ethereum.

Smart contracts were first introduced in the 1990s by Nick Szabo. He described a smart contract back then as a device that formalizes and secures computer networks by fusing user interfaces with protocols. Szabo talked about the possible applications of smart contracts in a number of industries that deal with contractual agreements, including payment processing, content rights management, and credit systems.

A smart contract in the context of cryptocurrencies is a blockchain-based application or program. They often function as a digital contract that is upheld by a certain set of guidelines. All network nodes reproduce and execute computer code that contains these established rules.

Smart contracts on the blockchain make it possible to design trustless protocols. This implies that two parties can enter into agreements using blockchain without having any prior acquaintance or confidence. They can be confident that the contract won't be carried out if the requirements aren't met. In addition, the implementation of smart contracts can eliminate the need for middlemen, substantially lowering operating expenses.

Smart contracts have been supported by the Bitcoin protocol for a long time, but Vitalik Buterin, who is also the co-founder of Ethereum, is credited for popularizing them. It's important to keep in mind, though, that each blockchain may offer a unique way to create smart contracts.

How Do Smart Contracts Work?

A smart contract functions like a deterministic program. It performs a certain task when and if a set of requirements are met.

As a result, "if... then..." expressions are frequently used in smart contract systems. Contrary to popular belief, smart contracts are neither contracts that are legally binding nor intelligent. They are merely code that is running on a distributed system (blockchain).

The blockchain actions that happen when users (addresses) connect with one another on the Ethereum network are executed and managed by smart contracts. A smart contract-free address is referred to as an externally held account (EOA). EOAs are governed by users, whereas smart contracts are controlled by computer code.

Ethereum smart contracts are made of a contract code and two public keys. The first public key is the one provided by the creator of the contract. The other key represents the contract itself, acting as a digital identifier that is unique to each smart contract.

The deployment of any smart contract is made through a blockchain transaction and can only be activated when called by an EOA (or by other smart contracts). However, the first trigger is always caused by an EOA (user).

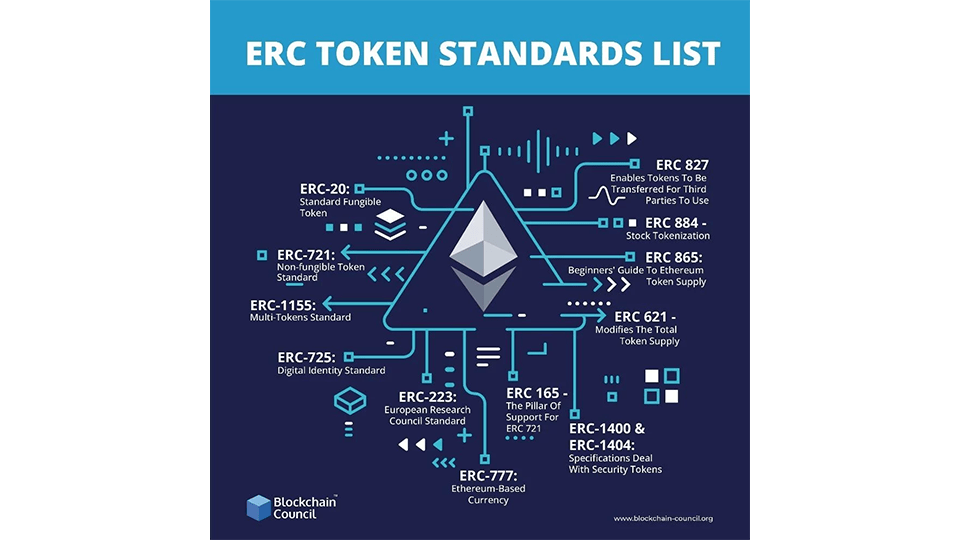

Smart Contracts and Token Standards

Tokens created on the Ethereum network generally adhere to the ERC-20 standard. The fundamental features of all tokens based on Ethereum are described in the standard. As a result, these digital assets are sometimes referred to as ERC-20 tokens, and they account for a sizable fraction of all currently traded cryptocurrencies.

Smart contracts were used by a lot of blockchain firms and businesses to launch digital tokens on the Ethereum network. The bulk of these businesses distributed their ERC-20 tokens through Initial Coin Offering (ICO) occasions after the issuance. Most of the time, the implementation of smart contracts made it possible to trade money and distribute tokens in an effective and trustless manner.

Source: Blockchain Council.

Smart Contract Use Cases

Smart contracts are programmable code that may be built in a variety of ways and offer a wide range of services and solutions.

Smart contracts, which are autonomous decentralized programs, might boost accountability and lower expenses. They may also improve efficiency and cut back on administrative costs, depending on how they are implemented.

Smart contracts are very helpful when money is being transferred between two or more parties or exchanged between them.

Smart contracts can therefore be created for a wide range of use cases. Tokenized assets, voting processes, digital wallets, decentralized exchanges, games, and mobile apps are a few examples. They could also be used in conjunction with other blockchain-based solutions tackling the areas of governance, decentralized finance (DeFi), supply chain, healthcare, and philanthropy.

To receive more Digital Assets insights, sign up in our subscription center.

Related Topics

Related Insights

DISCLOSURES

Definitions

Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Beta of rig price is a measure of the price volatility of a mining rig compared to Bitcoin’s price.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included in this communication.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the cryptocurrencies mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© 2023 Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

DISCLOSURES

Definitions

Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Beta of rig price is a measure of the price volatility of a mining rig compared to Bitcoin’s price.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included in this communication.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the cryptocurrencies mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© 2023 Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.