The ENS Airdrop and the Future of DAOs

November 17, 2021

Read Time 4 MIN

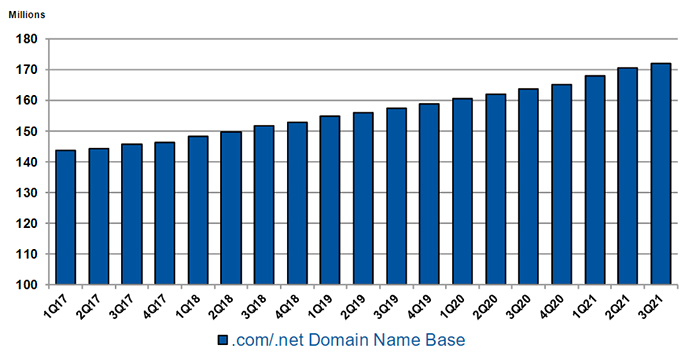

There are 200M active websites in the world right now and one U.S. company—Verisign—maintains 172M of them.1 Verisign has a long-term, no-bid contract with an unelected international body (ICANN), which has been repeatedly renewed at the request of the U.S. government, who considers the service crucial infrastructure.

On revenues above $1B, Verisign hasn't spent more than $100M in capex since it jettisoned its cryptographic hash business ("issuer of digital certificates") to Symantec to focus on the monopoly registry business in 2011, meanwhile growing its topline at an astounding 18% CAGR since 1998. Verisign's 63% operating margins and the stock's 21% 10-year CAGR are further proof of privilege.2

And yet like so many Web 2.0 platforms, Verisign now faces potential disruption from an open, interoperable, community-owned protocol that lets small business operators not only own their own domain name, but also potentially collect a financial reward from the growth of Web3. Such is the promise of the Ethereum Name Service (ENS), a distributed, open and extensible system based on the Ethereum blockchain.

The Ethereum Name Service's job is to map human-readable names like Sigel.eth to machine-readable identifiers such as Ethereum addresses, other cryptocurrency addresses, content hashes and metadata. Registering a name costs $5/year for 5+ character names, $160/year for 4 character names, and 3 character names at $640/year, plus the cost to mint the address as an NFT, which can run around $100 at current gas prices.3 ENS users can use the NFT to store all of their crypto addresses, and to receive any cryptocurrency or NFTs to their ENS smart contract. Decentralized website developers can then upload their website files to IPFS (a distributed file storage network) and save the hash to their ENS name. Voila! Decentralized commerce, no Verisign!

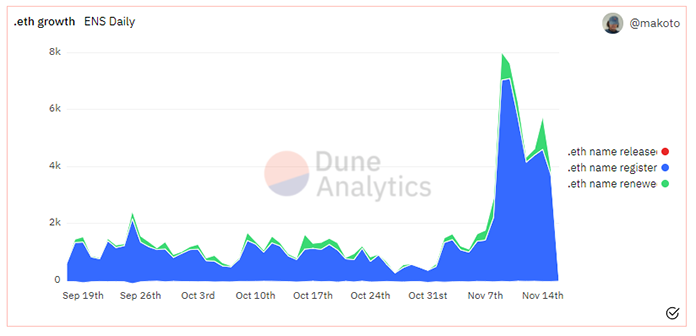

I had a vague idea of the utility last month when I set up my .eth address. It wasn't so much I was afraid my name would be taken by a squatter (as VanEck's was), as much as an appreciation that Sigel.eth might someday form the basis of a new social media presence or family business, and $25 for 5 years was good value given that Budweiser had paid $95,000 for beer.eth. I had no expectation that the developers behind ENS would transform their "multisignature" leadership into a decentralized autonomous organization (DAO) and launch a token, which was then airdropped to all users (now 178,000) based on how long they've owned their ENS names and for how long they are registered.

Claimants then ratified a "Constitution" outlining governance responsibilities, which include control over how ENS funds are to be allocated. Could the ENS model include distributing some portion of registration fees or resales to ENS token-holders going forward? For the DAO's part, Brantley Millegan, ENS' director of operations, told Cointelegraph that “there is no profit sharing motive” but that the token-based DAO system “allows for a large amount of flexibility.”4

NFT platform OpenSea already supports secondary ENS transactions, reporting 7-day ENS domain volume of $1.7M.5 At the peak token price of $83 last week, my 122 ENS tokens were worth more than $10,000 on a $25 investment, obviously reflecting market expectations of further monetization.6 Indeed according to IRS law, the ENS airdrop is a taxable event despite the fact I and many others bought our addresses with no expectation of profit. I expect we'll see the Supreme Court rule on airdrops this decade. By then, ENS' market cap of $800M may have taken another bite from Verisign's $26B monopoly.

Number of New ENS Addresses Registered Daily (Total = 449k)

Source: Dune Analytics, as of 11/15/2021.

Number of .com & .net Domains Administered by Verisign

Source: Verisign, as of Q3 2021.

As a final comment, the ENS DAO provides a roadmap for other user-created networks. On November 18, Sotheby’s will host an auction for a historic first printing of the U.S. constitution (the only one of 13 still in private hands).7 A crypto group called ConstitutionDao has launched a crowdfunding platform aiming to purchase the document. In three days the DAO has collected $13.1M out of its $20M target from anonymous contributors.8

If successful, donors would receive a governance token that allows DAO members to advise on where the Constitution should be displayed, how it should be exhibited and the mission and values of the DAO. That participants will own the governance and not the item may temporarily shield the project from security registration requirements. As we saw from the ENS airdrop, however, the free market may have other ideas when it comes to valuing these intangible governance assets. One idea is to register the name ConstitutionDao.sol (still available!) via Bonfida’s Solana Naming Service9, which is currently accepting bids but has not announced a token. Perhaps the lucky winner will have two airdrops to report.

Related Topics

Related Insights

DISCLOSURES

Important Information Regarding Cryptocurrencies

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

- Siteefy.com, Verisign

- Bloomberg, Verisign; as of Q3 2021

- Ethereum Name Service, VanEck research

- Cointelegraph interview, 11/10/2021

- OpenSea

- CoinMarketCap.com, Metamask

- WSJ, “Crypto investors want to buy rare copy of U.S. constitution.” 11/16/2021

- ConstitutionDAO

- https://naming.bonfida.org/#/

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

Important Information Regarding Cryptocurrencies

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

- Siteefy.com, Verisign

- Bloomberg, Verisign; as of Q3 2021

- Ethereum Name Service, VanEck research

- Cointelegraph interview, 11/10/2021

- OpenSea

- CoinMarketCap.com, Metamask

- WSJ, “Crypto investors want to buy rare copy of U.S. constitution.” 11/16/2021

- ConstitutionDAO

- https://naming.bonfida.org/#/

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.