The Investment Case for Bitcoin

26 June 2023

Share with a Friend

All fields required where indicated (*)We would like to provide you with insights into Bitcoin, a potential digital asset for value storage. Please note that the information provided here is based on estimates and should not be considered as price predictions or guarantees of asset performance. Additionally, we have ensured that for every benefit mentioned, the corresponding risks are highlighted.

Bitcoin's Characteristics:

Limited Supply: Bitcoin has a maximum supply of 21 million coins, creating scarcity in the market. This scarcity could potentially contribute to an increase in price as adoption grows. However, it's important to understand that market factors and regulatory changes may impact the value of Bitcoin negatively. Investing in Bitcoin involves risks, including volatility and market fluctuations.

Increasing Adoption: Bitcoin has gained acceptance by merchants as a form of payment. In 2021, El Salvador recognized Bitcoin as legal tender, providing an interesting case study. However, it's crucial to recognize that the acceptance of Bitcoin by merchants may vary, and regulatory developments can influence its usage. Risks associated with Bitcoin adoption should be carefully evaluated.

Potential Hedge against Inflation: Bitcoin is often considered as a potential hedge against inflation due to its limited supply. Unlike traditional currencies, Bitcoin is not subject to the same inflationary manipulation. However, it's vital to acknowledge that Bitcoin's value can be influenced by various market factors and its own inherent volatility. Investors should carefully consider the risks associated with Bitcoin.

Portfolio Diversification Benefits: Bitcoin is commonly regarded as an uncorrelated asset, meaning it may not move in tandem with traditional financial markets. Including Bitcoin in a diversified portfolio can potentially provide diversification benefits. However, the volatility and uncertainties associated with Bitcoin should be carefully evaluated before making investment decisions. Diversification does not guarantee profit and may not protect against losses.

Distinguishing Factors of Bitcoin

Unlike gold, Bitcoin offers certain unique characteristics

Divisibility: Bitcoin is divisible, allowing for smaller units to be transacted. This divisibility enhances its potential for usage in day-to-day transactions. Nevertheless, it's important to be aware that Bitcoin's divisibility does not eliminate the risks associated with its volatility and market fluctuations. Investors should be cautious of the potential risks involved.

Transparency: Bitcoin transactions are transparent and recorded on a public ledger called the blockchain. This transparency brings accountability to transactions, reducing the risk of fraud and enhancing trust within the network. However, it's essential to note that while transactions are transparent, the identities of the individuals involved are typically pseudonymous. Investors should be aware of the limitations of transparency in the Bitcoin network.

Bitcoin's Limited Supply and Its Potential Value over Time

Bitcoin's supply is capped at 21 million coins, and halvings are programmed into its protocol. Halvings, which occur approximately every four years, reduce the block reward for Bitcoin miners, ultimately slowing down the introduction of new coins into circulation. This built-in scarcity and limited supply differentiate Bitcoin from fiat currencies that are subject to inflationary pressures imposed by central banks. Nonetheless, it's important to recognize that Bitcoin's value is still influenced by various factors, including market demand, regulatory developments, and technological advancements. Investors should carefully evaluate the potential risks associated with Bitcoin's value over time.

Continued Bitcoin Adoption

Bitcoin adoption has expanded significantly since its early years when it was primarily used by a small group of tech enthusiasts. Today, more merchants and businesses accept Bitcoin as a form of payment, and user-friendly wallets, exchanges, and marketplaces have improved accessibility. It's worth noting that while Bitcoin's adoption is increasing, it remains important to consider the potential risks and uncertainties associated with the cryptocurrency market. Investors should be aware of the risks involved in adopting Bitcoin.

Furthermore, institutional investors, such as hedge funds, asset management firms, and endowments, have shown growing interest in Bitcoin as a potential store of value and portfolio diversifier. However, it's essential to remember that investing in Bitcoin involves risks, including its volatility, regulatory uncertainties, and the potential for losses. Professional guidance should be sought before making investment decisions.

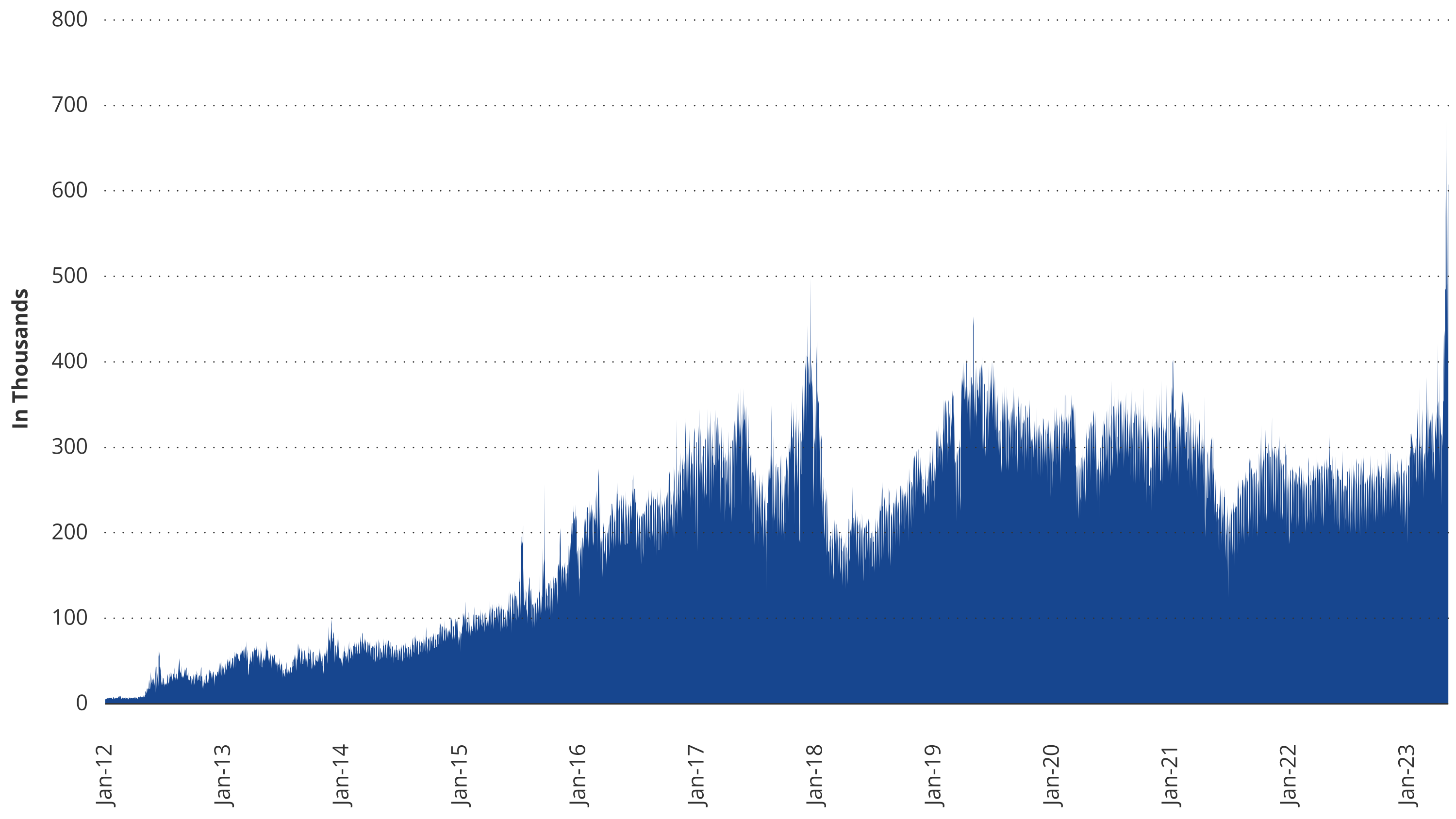

Bitcoin's network value is demonstrated by the significant number of daily transactions, exceeding 570,000 permission-less transactions per day. It's crucial to understand that network value does not guarantee future performance or eliminate the risks associated with investing in Bitcoin.

Daily Bitcoin (BTC) Transactions (12/1/2012 - 5/8/2023)

Source: Y-Charts as of 5/8/2023. Past performance is not a guarantee of future results.

Layer 2 solutions, such as Liquid by Blockstream, have the potential to drive Bitcoin adoption by addressing scalability and allowing for customizations while preserving the security properties of Bitcoin. The Lightning Network, built on top of the Bitcoin blockchain, further enhances Bitcoin's payment capabilities with lower costs and faster transaction speeds.

An upcoming layer 2 development called RGB holds significance as it enables the creation and management of digital assets on the Bitcoin blockchain. This development adds a new layer of functionality, allowing assets like stocks, bonds, real estate, or other cryptocurrencies to be issued and traded on top of the Bitcoin network. The RGB protocol is designed to be scalable and resource-efficient, making it easier for developers and users to integrate digital assets without extensive changes to the underlying Bitcoin network. This expansion of use cases makes Bitcoin a more versatile and valuable platform, fostering opportunities for innovation and growth within the ecosystem.

Bitcoin's Potential Hedge Against Inflation:

The global increase in money supply due to the COVID-19 pandemic has resulted in widespread inflation, eroding the purchasing power of established fiat currencies. Bitcoin's potential as a hedge against inflation has gained attention in investment decision-making. Its limited supply and decentralized nature form the basis of this idea. Unlike fiat currencies, which can be printed by governments and central banks, Bitcoin has a fixed supply that reduces by 50% every four years through halving events. This characteristic makes Bitcoin resilient to inflationary pressures caused by fiat money supply growth. Consequently, investors concerned about the impact of inflation on their portfolios and purchasing power find Bitcoin an attractive option.

Bitcoin's decentralized nature also shields it from geopolitical events and economic policies that can lead to currency devaluation, such as quantitative easing (QE) or excessive government spending.

Bitcoin's Role in an Investment Portfolio:

As Bitcoin gains recognition as an asset with monetary value, its potential role within an investment portfolio comes into question. Bitcoin may enhance portfolio diversification due to its low correlation with traditional asset classes, including broad market equity indices, bonds, and gold.

|

Asset Class Correlation (2/1/2012 – 3/31/2023) |

|||||||

|

|

S&P 500 |

U.S. |

Bitcoin |

Gold |

U.S. |

Oil |

Emerging Market |

|

S&P 500 |

- |

0.27 |

0.19 |

0.11 |

0.71 |

0.44 |

0.47 |

|

U.S. Bonds |

0.27 |

- |

0.06 |

0.43 |

0.46 |

-0.10 |

0.48 |

|

Bitcoin |

0.19 |

0.06 |

- |

-0.05 |

0.04 |

0.07 |

0.01 |

|

Gold |

0.11 |

0.43 |

-0.05 |

- |

0.16 |

0.05 |

0.47 |

|

U.S. Real Estate |

0.71 |

0.46 |

0.04 |

0.16 |

- |

0.25 |

0.46 |

|

Oil |

0.44 |

-0.10 |

0.07 |

0.05 |

0.25 |

- |

0.27 |

|

Emerging Market Currencies |

0.47 |

0.48 |

0.01 |

0.47 |

0.46 |

0.27 |

- |

Source: Morningstar. Data as of 3/31/2023. S&P 500 is measured by the S&P 500 Index; US Bonds is measured by the Bloomberg Barclays US Aggregate Index; Bitcoin is measured by the MarketVector Bitcoin Benchmark Rate Index; Gold is measured by the S&P GSCI Gold Spot Index; US Real Estate is measured by the MSCI US REIT Index; Oil is measured by the Brent Crude Oil Spot Price Index, Emerging Market Currencies is measured by the Bloomberg Barclays EM Local Currency Government Index. Indices are not securities in which investments can be made. Correlation is defined as a statistic that measures the degree to which two or more securities move in relation to each other.

Please see important disclosures and index descriptions at the end of this presentation. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities mentioned herein, to adopt any investment strategy, or as any call to action. Index performance is not representative of fund performance. It is not possible to invest directly in an index.

An allocation to Bitcoin may also enhance the risk-return profile of institutional investment portfolios. As shown in the chart below, a small allocation to Bitcoin significantly enhanced the cumulative return of a traditional 60% equity and 40% bond portfolio allocation mix while only minimally impacting overall portfolio volatility.

Improved Portfolio Upside From a Small Bitcoin Allocation (2/1/2012 - 3/31/2023)

Source: Morningstar. Data as of 03/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities mentioned herein, to adopt any investment strategy, or as any call to action. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Please see important disclosures at the end of this commentary regarding hypothetical performance.

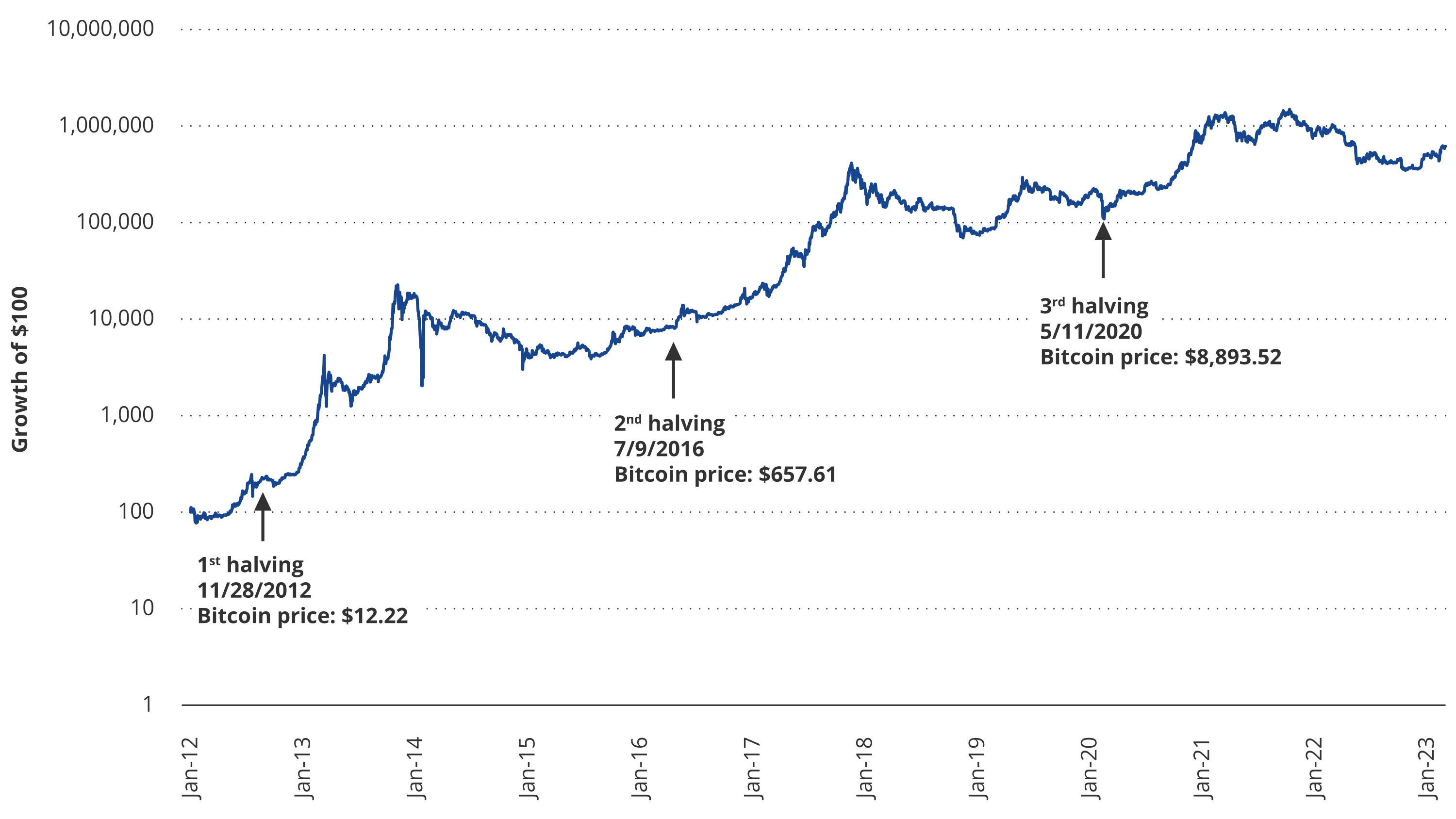

Bitcoin Growth of $100 (2/1/2012 - 3/31/2023)

Source: Morningstar. Data as of 03/31/2023. Past performance is no guarantee of future results.

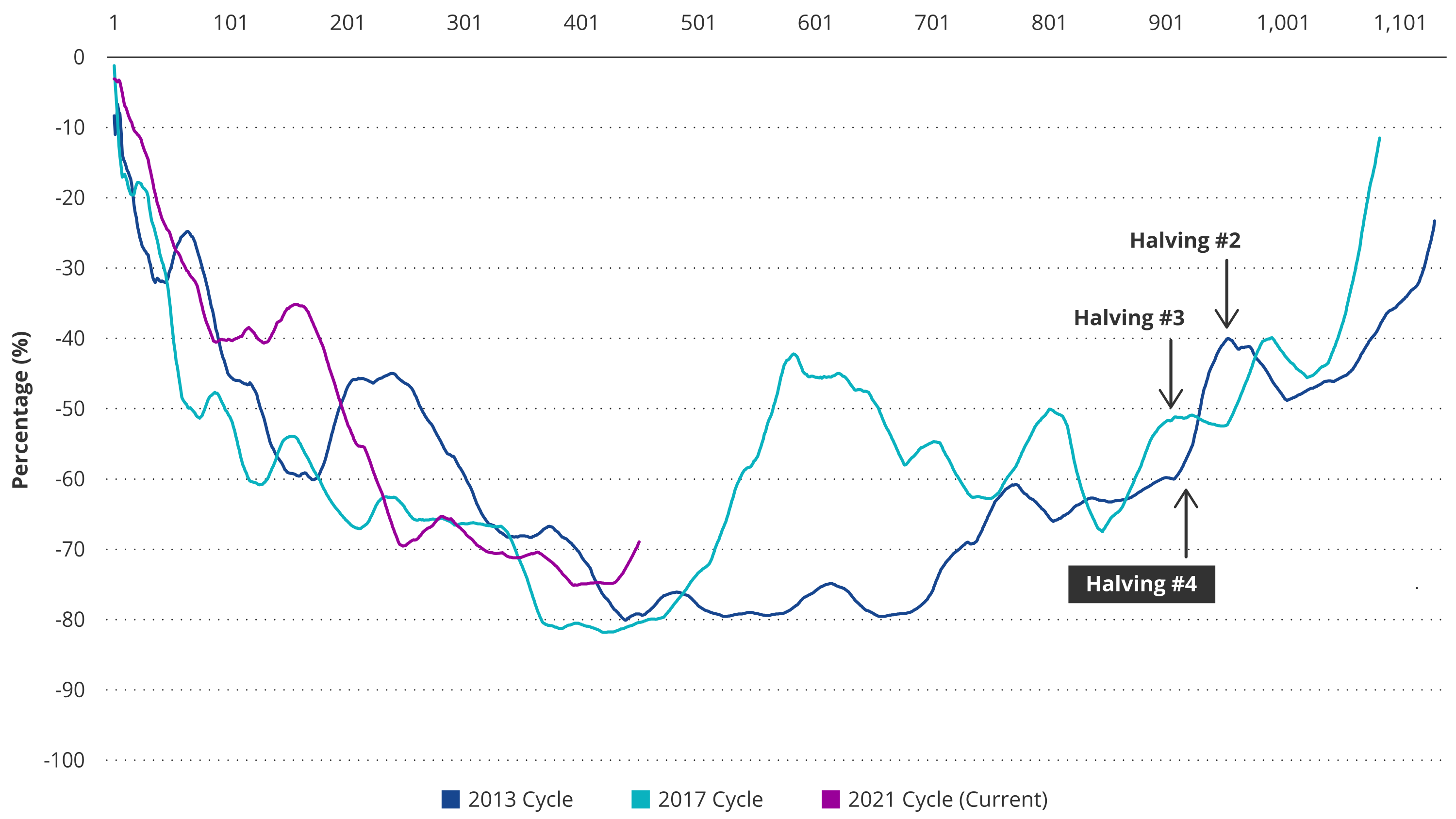

Previous Cycles Suggest That Bitcoin Could Rally Prior to and After the Next Halving

Source: Arcana. Data as of 2/4/2023. Past performance is not indicative of future results. Not a recommendation to buy or sell any of the names mentioned herein.

How Might Bitcoin Shine Brighter Than Gold?

While both gold and bitcoin share some characteristics, there are notable differences that potentially make bitcoin superior. Here are the reasons:- Divisibility: Gold is a physical asset that has limitations when it comes to division for smaller transactions. In contrast, bitcoin is highly divisible, allowing it to be used for microtransactions. With bitcoin, transactions can occur even at the smallest unit called Satoshis, which makes it more practical for day-to-day usage.

- Transparency: Bitcoin transactions are recorded on the public blockchain, providing a high level of transparency. This transparency makes it difficult to manipulate or counterfeit bitcoin, enhancing trust in the network. On the other hand, gold lacks the same level of transparency. When gold is traded, the transaction details, such as buyer, seller, and price, are often not publicly available. This lack of transparency may increase the risk of fraud and manipulation in the gold market.

Please note that the information provided here is for informational purposes only and should not be considered as financial advice. It's recommended to consult with a qualified financial professional before making any investment decisions.

Important Information

We publish this newsletter to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

ETN Disclaimer

Important information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

22 April 2024

20 April 2024

26 February 2024

26 February 2024