Government Bonds ETF

VanEck iBoxx EUR Sovereign Capped AAA-AA 1-5 UCITS ETF

Government Bonds ETF

VanEck iBoxx EUR Sovereign Capped AAA-AA 1-5 UCITS ETF

Fund Description

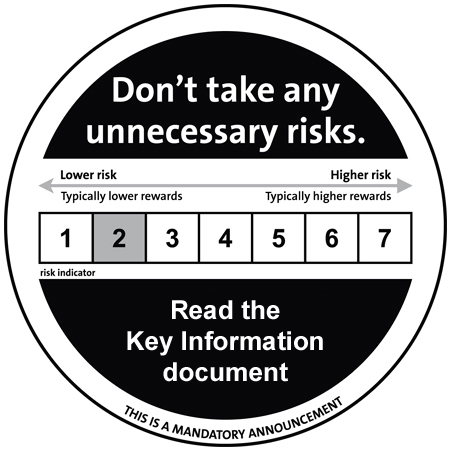

Cushion your portfolio against unforeseen risks. Our ETF follows 15 government bonds with investment-grade ratings and relatively short maturities, which limits their volatility still further.

-

NAV€18.62

as of 08 May 2024 -

YTD RETURNS-1.11%

as of 08 May 2024 -

Total Net Assets€58.5 million

as of 08 May 2024 -

Total Expense Ratio0.15%

-

Inception Date26 Nov 2012

-

SFDR ClassificationArticle 6

Overview

Fund Description

Cushion your portfolio against unforeseen risks. Our ETF follows 15 government bonds with investment-grade ratings and relatively short maturities, which limits their volatility still further.

- Targeted exposure to euro-denominated government bonds with a rating of AA or higher

- Remaining maturities of one to five years

- Maximum weighting of 30% per country

Underlying Index

Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index (IBXXS15T Index)

Fund Highlights

- Targeted exposure to euro-denominated government bonds with a rating of AA or higher

- Remaining maturities of one to five years

- Maximum weighting of 30% per country

Underlying Index

Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index (IBXXS15T Index)

Performance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index is composed of 15 liquid investment grade government bonds. It only consists of AAA or AA rated bonds. All bonds are denominated in Euro. The outstanding amount is at least EUR 2 billion. The weight per country is capped at 30%.

Underlying Index

Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index(IBXXS15T Index)

The index has the followings specifications:

- It is a weighted index based on free float-adjusted market capitalisation.

- The Markit iBoxx EUR Liquid Sovereigns Capped AAA-AA 1-5 Index consists of the approximately 15 largest and most liquid euro denominated government bonds with a remaining maturity of 1.25 to 5.5 years. The index only consists of AAA or AA rated bonds with an outstanding amount of at least 2 billion euro.

- The weight per country is capped at 30%.

- The ETF aims, insofar as possible and practicable, to invest in bonds that form part of the index and meet the credit rating criteria (AA). If the bonds are downrated, the ETF may continue to hold such bonds until they are no longer part of the index and it is practicable to sell them.

- The index may be reviewed quarterly on the last trading day of February, May, August and November.

- The universe of the underlying index consists of all euro denominated bonds.

Index Provider

Markit Group Limited